The latest developments in the crypto industry highlight key shifts in institutional adoption, regulatory advancements, and market sentiment. MoonPay has expanded its reach with a significant acquisition, reinforcing the growing role of stablecoins in enterprise payments. Meanwhile, the upcoming FOMC meeting could shape the financial landscape, impacting risk assets, including cryptocurrencies. VanEck’s move to launch an AVAX ETF signals increasing institutional interest in Layer 1 blockchain investments. However, despite these promising developments, Bitcoin is facing a decline in demand, triggering concerns about short-term market stability. These events collectively reflect the evolving dynamics of the crypto sector and its interconnectedness with macroeconomic trends.

MoonPay Acquires API-Focused Stablecoin Infrastructure Company Iron in a 9-Figure Deal

MoonPay’s acquisition of Iron represents a major strategic move in the stablecoin and digital payments space. Iron’s API-driven stablecoin infrastructure will allow MoonPay to offer enterprises advanced solutions for cross-border payments, treasury management, and yield generation. Stablecoins have increasingly become a critical component of digital finance, with major companies and fintech platforms integrating them for faster, cheaper transactions. By acquiring Iron, MoonPay is positioning itself as a leader in enterprise-grade stablecoin solutions, enhancing its competitive edge against traditional financial institutions and crypto-native payment providers.

The integration of Iron’s technology into MoonPay’s ecosystem will likely streamline financial operations for businesses by reducing the reliance on slow bank transfers. This move also aligns with MoonPay’s recent acquisition of Helio, a Solana-based payments provider, signaling an aggressive push to dominate the Web3 payment sector. The deal indicates that stablecoin adoption is growing beyond retail and crypto-native platforms, now appealing to fintech companies and traditional financial institutions seeking efficient cross-border transactions.

Given the rising scrutiny of stablecoins by global regulators, MoonPay’s entry into this space also highlights the growing need for compliant, regulated solutions. The company’s ability to navigate these challenges while offering a seamless payment experience will determine the long-term success of this acquisition. If executed well, this move could set a new standard for stablecoin integration into mainstream financial infrastructure.

Market Impact:

This acquisition strengthens MoonPay’s position as a key player in crypto payments, potentially boosting the adoption of stablecoins in mainstream finance. The broader stablecoin market could see increased institutional interest, particularly from fintech companies looking to integrate digital assets into their payment ecosystems.

FOMC Meeting 2025: Date, Time, What to Expect from Federal Reserve Interest Rates

The Federal Open Market Committee (FOMC) meeting scheduled for March 18-19, 2025, will be a crucial event for financial markets, including cryptocurrencies. The Federal Reserve’s stance on interest rates will directly influence market liquidity and investor sentiment. If the Fed decides to maintain current rates, markets might experience stability, while a potential rate hike could lead to a sell-off in risk assets, including cryptocurrencies. The Fed’s decision will be based on economic indicators such as inflation, employment, and GDP growth, making this meeting a key moment for macroeconomic analysis.

Historically, the crypto market has shown a strong correlation with Fed policies. Higher interest rates tend to drive investors toward safer assets like bonds and cash, reducing liquidity in riskier markets like crypto. Conversely, rate cuts or dovish signals from the Fed often lead to bullish momentum in digital assets. With Bitcoin and other cryptocurrencies already facing a downturn, a hawkish Fed stance could exacerbate the decline. On the other hand, a softer policy approach might provide relief to struggling markets.

Investors should pay close attention to Federal Reserve Chair Jerome Powell’s post-meeting press conference, as any hints about future policy shifts could impact both traditional and digital asset markets. The crypto market’s reaction to these developments will be closely watched, particularly in light of recent volatility and declining Bitcoin demand.

Market Impact:

The FOMC’s decision could trigger volatility across all asset classes, including cryptocurrencies. A hawkish stance may push Bitcoin and altcoins lower, while dovish signals could provide a short-term recovery. Traders should be prepared for market fluctuations based on the Fed’s outlook.

VanEck Files S-1 Registration Statement with SEC for Launch of First AVAX ETF

VanEck’s filing for an Avalanche (AVAX) ETF marks another step in the growing acceptance of crypto-based exchange-traded funds. If approved, this ETF would allow traditional investors to gain exposure to AVAX without directly holding the cryptocurrency. The move signals increased institutional interest in Layer 1 blockchain projects beyond Bitcoin and Ethereum, which have historically dominated crypto investment products. Avalanche’s high-speed transactions and low fees make it an attractive blockchain for various applications, and an ETF could further boost its adoption.

VanEck has been a pioneer in crypto ETFs, with past filings for Bitcoin and Ethereum ETFs. However, approval is not guaranteed, as the SEC has historically been cautious about approving spot crypto ETFs. The regulator has raised concerns about market manipulation, liquidity, and investor protection, which could delay or impact the approval process. The fate of this AVAX ETF will be closely watched by investors looking for diversified exposure to the crypto market.

If approved, the AVAX ETF could open doors for similar products based on other blockchain ecosystems, such as Solana, Polkadot, or Cardano. Institutional interest in Layer 1 blockchain projects has been growing, and an ETF would provide a regulated investment vehicle for risk-averse investors. However, the crypto market’s overall sentiment and regulatory climate will play a key role in determining whether the SEC greenlights this initiative.

Market Impact:

The filing reflects growing institutional interest in alternative blockchain networks. Approval could drive demand for AVAX and set a precedent for other Layer 1 blockchain ETFs. However, regulatory hurdles remain a significant challenge.

Bitcoin Demand Hits Lowest Point in 2025

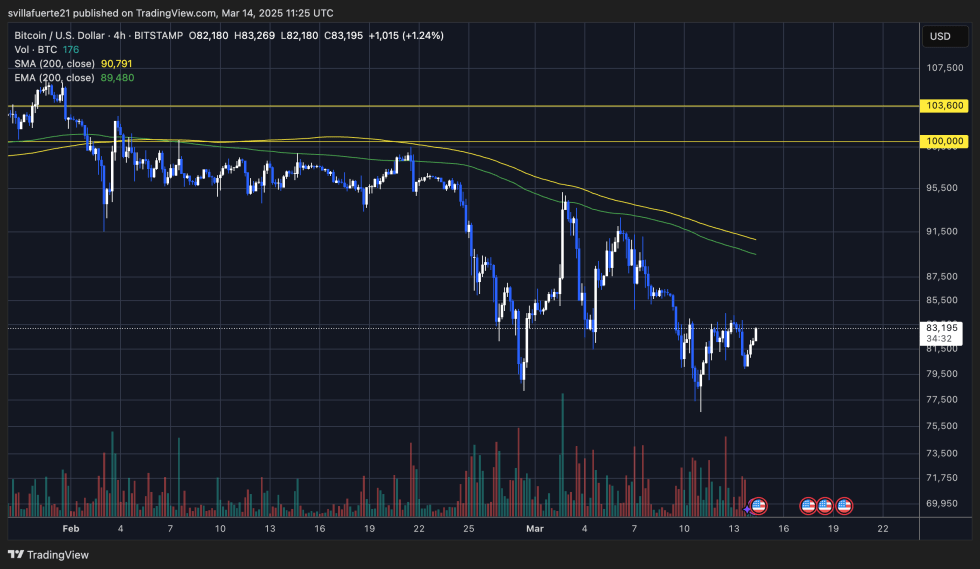

Bitcoin’s demand has reached its lowest point in 2025, with CryptoQuant data showing negative demand growth. This decline indicates a reduced number of active buyers, suggesting that investors are either exiting positions or holding off on new purchases due to macroeconomic uncertainty. Bitcoin’s price has fallen over 22% from its January highs, signaling a bearish phase. This downturn is partly attributed to broader economic concerns, including high inflation, rising interest rates, and geopolitical tensions.

The drop in demand is further reflected in outflows from Bitcoin ETFs, with institutional investors withdrawing $4.75 billion over the past month. This suggests a shift away from Bitcoin as a risk asset, at least in the short term. Market sentiment remains weak, and without renewed buying interest, Bitcoin could face further downside pressure. Analysts have identified key support levels at $74,000 and $69,000, with a crucial resistance level at $89,000. A break above this level could confirm a bottom and signal a recovery.

Despite the current decline, some investors see this as a buying opportunity, particularly those with a long-term perspective. Bitcoin has historically recovered from downturns, and many expect renewed institutional interest once macroeconomic conditions stabilize. However, in the immediate future, Bitcoin’s performance will depend on market liquidity, investor confidence, and external economic factors.

Market Impact:

Bitcoin’s declining demand could signal further downside risks in the short term. If selling pressure continues, the broader crypto market could experience additional losses. However, long-term investors may view this dip as a strategic accumulation opportunity.

Key Takeaways:

- MoonPay’s acquisition of Iron strengthens its position in stablecoin payments, offering enterprise-grade solutions for instant cross-border transactions and treasury management.

- The Federal Reserve’s upcoming FOMC meeting is expected to impact investor sentiment in the crypto market, with potential volatility depending on interest rate decisions.

- VanEck’s filing for an AVAX ETF represents a major step toward institutional adoption of Avalanche, though SEC approval remains uncertain.

- Bitcoin demand has fallen to its lowest point in 2025, with declining ETF inflows and cautious investor sentiment weighing on price action.

- Stablecoin adoption is expanding, with fintechs and enterprises integrating digital assets for seamless global transactions.

- Regulatory uncertainty continues to play a key role, affecting both ETF approvals and institutional involvement in the crypto space.