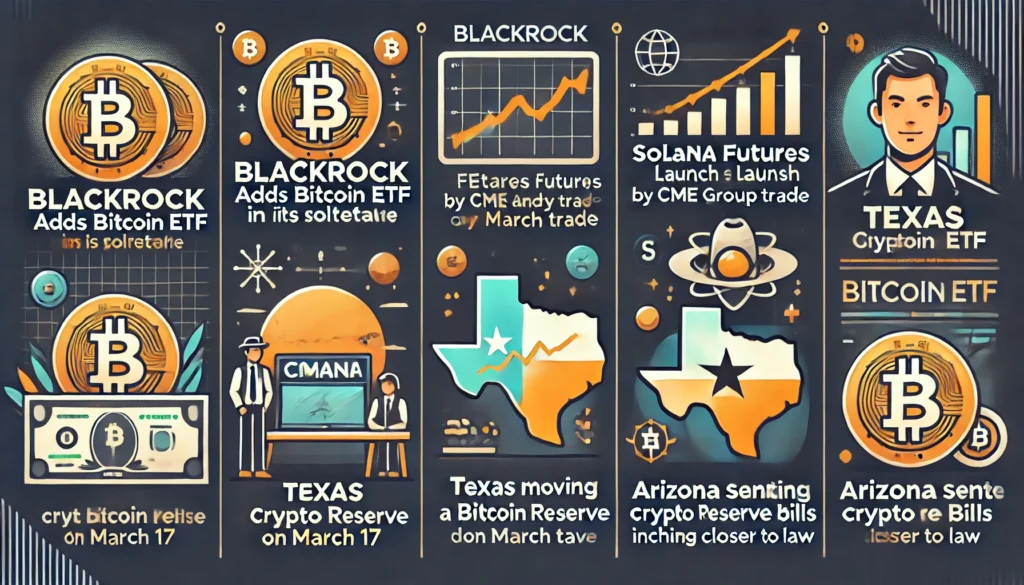

5 Important Crypto News : BlackRock Bitcoin ETF, Solana Futures, Bitcoin Crash, Texas & Arizona Crypto Reserves – Botslash Daily Crypto News Analysis

The crypto market is witnessing major institutional movements that could reshape the future of digital assets. From BlackRock’s Bitcoin ETF integration to Solana futures on CME, and states like Texas and Arizona moving forward with crypto reserves, these developments highlight a growing trend toward crypto adoption and regulation. Meanwhile, Bitcoin’s price volatility continues to stir concerns, as seen with recent market crashes and the erosion of ETF-based trades. These key moments mark important milestones that could influence market sentiment and shape future regulatory frameworks. BlackRock Adds Its iBIT Bitcoin ETF to Alternative Asset Model Portfolio BlackRock’s decision to add its iBIT Bitcoin ETF to its alternative asset model portfolio reflects a growing acceptance of Bitcoin among traditional financial institutions. The iBIT Bitcoin ETF, launched by the world’s largest asset manager, aims to provide institutional investors with a regulated pathway to Bitcoin exposure. By adding this ETF to its portfolio, BlackRock recognizes Bitcoin’s place within a diversified investment strategy, enhancing its legitimacy in the eyes of both retail and institutional investors. This move aligns with the broader trend of institutional adoption of cryptocurrency, further indicating that Bitcoin is becoming a mainstream asset class. While Bitcoin ETFs remain relatively new in the market, BlackRock’s participation lends credibility to the idea of digital assets being part of long-term investment strategies. This integration is expected to increase Bitcoin’s accessibility, particularly for institutions looking to gain exposure without directly purchasing or managing the digital asset. The choice to include Bitcoin in the alternative assets model portfolio is a sign that traditional investment vehicles are gradually expanding their scope to accommodate digital currencies. Market Impact: The addition of the iBIT Bitcoin ETF to BlackRock’s model portfolio signals a positive step forward for Bitcoin’s institutional adoption. It shows that major asset managers are acknowledging Bitcoin’s growing relevance in diversified investment strategies, which is likely to encourage other institutions to follow suit. In the longer term, this move may support Bitcoin’s price, potentially driving demand from institutional investors who seek to balance portfolios with alternative assets. This move could lead to more mainstream recognition of Bitcoin as a credible asset class. Solana Futures Launch Date: CME Group to Roll Out SOL Futures on March 17 CME Group’s announcement of launching Solana (SOL) futures trading on March 17 is an important development in the cryptocurrency market. Solana, known for its high throughput and low fees, has gained significant attention as a leading competitor to Ethereum. By introducing Solana futures, CME Group opens up an opportunity for institutional investors to hedge, trade, or speculate on Solana’s price movement in a regulated environment. Futures contracts provide a more secure means for institutions to gain exposure to Solana without directly holding the token, which is particularly valuable given the volatility in the cryptocurrency market. The introduction of Solana futures also marks a key moment for the Solana ecosystem, as it elevates the network’s profile within the broader financial market. Futures contracts often lead to greater liquidity and price discovery, helping to stabilize the market over time. Additionally, it could pave the way for other major cryptocurrencies to see futures contracts listed on regulated exchanges like CME Group, contributing to the overall maturation of the digital asset space. Market Impact: The launch of Solana futures is likely to have a positive impact on the Solana market. As a regulated financial product, it is expected to attract institutional investors who have been hesitant to invest directly in the cryptocurrency due to concerns about volatility and regulatory uncertainty. This could lead to an influx of capital into the Solana ecosystem, potentially increasing liquidity and supporting the long-term price of SOL. The futures market also increases transparency, which can help reduce price manipulation and foster a more stable trading environment for Solana. Bitcoin Crash Triggered by Erosion of ETF Cash-and-Carry Trade — Analyst This article highlights the significant role played by hedge funds using a cash-and-carry trade strategy involving Bitcoin ETFs and CME futures in the recent price crash. The trade, which had been a reliable low-risk way to generate yield by exploiting the price difference between spot and futures markets, became unprofitable when Bitcoin’s price fell. As a result, large outflows from Bitcoin ETFs followed, accelerating the crash. The major losses were particularly concentrated among recent buyers who entered the market in the past month, with over 74% of realized losses coming from those new investors. The erosion of the cash-and-carry trade underscores the risks that institutional investors face when relying on market arbitrage strategies, especially in volatile markets like cryptocurrency. The sharp drop in Bitcoin’s price serves as a reminder that even traditionally less volatile assets, such as ETFs, can experience sharp declines in extreme market conditions. While this might trigger temporary pain, analysts believe that such market shakeouts can ultimately lead to more mature and stable market behavior in the long term. Market Impact: This news has a negative impact on the Bitcoin market, as it underscores the vulnerability of ETF-based strategies to sharp market movements. The erosion of the cash-and-carry trade may cause short-term instability and loss of investor confidence, particularly among those reliant on leveraged and arbitrage strategies. However, the market might eventually stabilize as weaker hands exit, leaving behind more resilient holders. The price drop may also encourage future regulation to address these kinds of market risks, potentially leading to improved market stability over time. Texas Proceeds with Bitcoin Reserve Despite Price Fluctuations Texas is moving ahead with its Bitcoin reserve project, despite the volatile nature of Bitcoin prices. The state is focused on securing its position in the evolving world of digital assets, aiming to build a reserve that will protect the value of state funds over the long term. Bitcoin’s price volatility presents a challenge, but Texas believes the asset has long-term potential, especially as part of a diversified investment portfolio. The decision to continue with the reserve project, even amid market fluctuations, highlights the state’s commitment to using cryptocurrency for innovative financial strategies. By proceeding