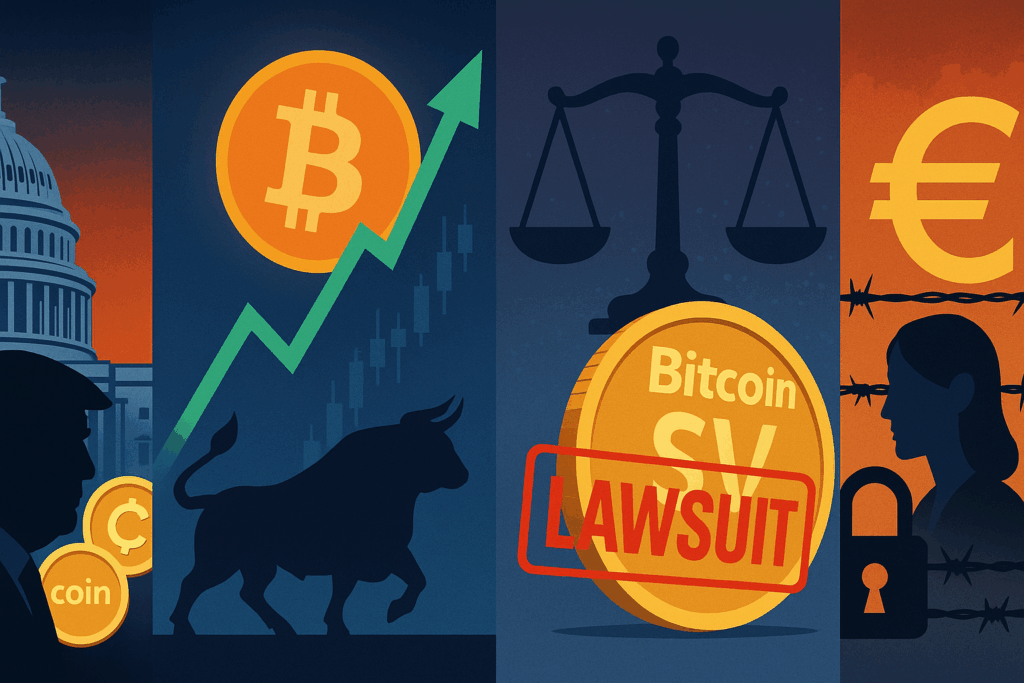

5 Important Crypto News: Stablecoin Bill Stalls, Bullish Bitcoin Indicator, $13.3B Binance Case, & EU Capital Controls: BotSlash Daily Crypto News Analysis

Political scrutiny, legal disputes, and macroeconomic policy shifts are converging with Crypto momentum and institutional behavior to shape the current crypto narrative. While the U.S. Senate battles controversy over the stablecoin framework, Europe tightens monetary policy in the shadow of its digital euro ambitions. Meanwhile, bullish market indicators and whale activity are hinting at renewed optimism in Bitcoin’s trajectory, all while Binance faces a resurrected multibillion-dollar lawsuit from discontented Bitcoin SV investors. 1. Senate Stablecoin Bill Stalls Amid Political Controversy The U.S. Senate’s attempt to pass the GENIUS Act, aimed at establishing a federal regulatory framework for stablecoins, has hit a roadblock. Despite earlier bipartisan support, the bill failed a procedural vote, largely due to concerns over former President Donald Trump’s involvement in cryptocurrency ventures. Democrats expressed apprehension about potential conflicts of interest, citing Trump’s launch of a meme coin and connections to a stablecoin project receiving significant foreign investment. The legislation’s future remains uncertain, with ongoing negotiations attempting to address issues related to money laundering, foreign issuers, and accountability. Senator Mark Warner has indicated a commitment to refining the bill to garner broader support. The crypto industry, which has invested heavily in lobbying for regulatory clarity, views the bill’s failure as a significant setback. The situation underscores the complexities of crafting legislation in a rapidly evolving financial landscape, especially when political interests intersect with regulatory efforts. 2. Bitcoin Bull-Bear Cycle Indicator Signals Potential Uptrend CryptoQuant’s Bull-Bear Market Cycle Indicator has flashed its first bullish signal since February, suggesting a possible shift in Bitcoin’s market dynamics. The indicator, which had consistently signaled bearish conditions, now points to a trend reversal as Bitcoin consolidates around the $103,000 mark. Analysts interpret this development as a sign of renewed investor confidence, with the potential for Bitcoin to challenge its all-time high of $109,000. The current market behavior indicates accumulation, often a precursor to significant price movements. While the bullish signal is promising, market participants remain cautious, acknowledging the need for sustained momentum and external factors that could influence the trajectory. 3. Bitcoin SV Investors Revive $13.3 Billion Claim Against Binance Investors in Bitcoin SV (BSV) are seeking to reinstate a “loss of chance” claim in a UK lawsuit against Binance, alleging that the exchange’s delisting of BSV led to significant financial losses. The claim, valued at approximately $13.3 billion, centers on the argument that Binance’s actions deprived investors of potential gains. A judge previously highlighted a discrepancy in the claimed damages, noting a substantial overstatement. Despite this, the investors are pushing to have their case reconsidered, emphasizing the impact of Binance’s decision on their investment opportunities. The outcome of this legal battle could set a precedent for how exchanges handle token listings and the responsibilities they bear toward investors. 4. Europe Faces Capital Controls Amid Digital Euro Concerns European nations are implementing capital controls in response to growing apprehensions about the digital euro initiative. Critics argue that the central bank digital currency could lead to increased surveillance and reduced financial privacy. Concerns include the potential for the digital euro to limit cash availability and grant authorities greater control over individual spending habits. The European Central Bank maintains that the digital euro aims to modernize the financial system, but public skepticism persists. The debate highlights the challenges central banks face in balancing innovation with privacy and autonomy in the digital age. 5. Institutional Bitcoin Holdings Surge by 41,300 BTC Institutional investors have significantly increased their Bitcoin holdings, with a reported addition of 41,300 BTC. This surge reflects a growing institutional interest in Bitcoin as a hedge against economic uncertainty and a store of value. Analysts attribute this trend to factors such as global economic instability and the search for alternative assets. The accumulation by large-scale investors suggests confidence in Bitcoin’s long-term prospects. This development could influence market dynamics, potentially leading to increased price stability and further adoption of Bitcoin in institutional portfolios. Key Takeaways 1. Senate Stablecoin Bill Stalls Amid Political Controversy The GENIUS Act failed to pass due to political disputes tied to Trump’s crypto involvement. Key issues include foreign issuer oversight, anti-money laundering, and governance structures. A major regulatory setback for stablecoin clarity and institutional crypto expansion in the U.S. 2. Bitcoin Bull-Bear Cycle Indicator Signals Potential Uptrend CryptoQuant’s indicator flipped bullish for the first time since February. Bitcoin hovers around $103K with renewed institutional and retail accumulation signals. A potential trend shift could lead BTC toward retesting its all-time high of $109K. 3. Bitcoin SV Investors Revive $13.3 Billion Claim Against Binance Investors allege Binance’s delisting of BSV caused lost opportunities. The case highlights exchange accountability and risks tied to token removals. A judicial precedent could emerge affecting future token listing decisions globally. 4. Europe Faces Capital Controls Amid Digital Euro Concerns EU capital restrictions raise alarms over surveillance and cash access. Public distrust grows around CBDCs despite ECB’s assurances. The development adds friction to the broader push toward digital financial systems. 5. Institutional Bitcoin Holdings Surge by 41,300 BTC Bitcoin whale wallets saw a sharp spike in holdings, signaling institutional confidence. Motivated by macroeconomic concerns and long-term value positioning. May fuel price stability and boost institutional adoption.

7 Important Crypto News: Bitcoin’s Key Levels, U.S. Economic Signals, Institutional Buying, and Regulatory Moves — BotSlash Daily Crypto News Analysis

A mix of bullish accumulation trends, macroeconomic indicators, institutional adoption, and regulatory pressure is shaping the current crypto landscape. Bitcoin continues to defend its crucial support levels while eyeing major resistance thresholds, backed by steady long-term holder accumulation. Meanwhile, fresh U.S. economic data releases are set to influence market sentiment, with GDP and consumer confidence readings on deck. On the adoption front, more publicly traded firms are adding Bitcoin to their balance sheets, strengthening the asset’s institutional profile. At the same time, South Korea is cracking down on unregistered crypto exchanges in a move that aligns with global regulatory tightening. Each of these developments paints a layered picture of where the market may head next, blending technical, strategic, and policy dimensions. Bitcoin Holds Critical Support at $83,444 as Bulls Target Key Resistance Bitcoin is currently holding a critical support level at $83,444, underscoring its strength amidst recent volatility. This level, identified through the Unspent Transaction Output (UTXO) Realized Price Distribution (URPD) metric, signals substantial investor activity at this price point. The UTXO data reveals that a significant volume of transactions has occurred near this level, effectively creating a psychological and technical support zone. As long as Bitcoin maintains this threshold, it signals that bullish sentiment is intact, even as the market attempts to find direction. Resistance looms overhead at $84,400 and then significantly at $97,532—levels which are also clustered with a large volume of unspent UTXOs. These resistance points will be critical to watch in the coming days, as failure to surpass them could stall upward momentum and result in sideways movement or a pullback. If bulls can breach $84,400 decisively, the next leg up may target $87,000 and potentially even approach $90,000. Conversely, failure to maintain the $83,444 support could see Bitcoin revisiting lower supports around $82,000 or even $77,000. Technical indicators remain mixed, with some showing strength in accumulation while others indicate cautious optimism. However, long-term holders continue to exhibit confidence, which is a bullish sign for the asset’s resilience. The interplay between resistance breakouts and support holds will define Bitcoin’s short-term trajectory, making these levels key zones for traders to watch. Market Impact: A decisive breakout above $84,400 could inject bullish energy into the broader crypto market, lifting altcoins and improving investor sentiment. However, a failure to breach this level or a breakdown below $83,444 may spark near-term selling pressure, especially among leveraged traders. Key U.S. Economic Data Releases Scheduled for Next Week A busy week of economic indicators from the U.S. is likely to influence both traditional and crypto markets. The most significant among these is the Conference Board’s Consumer Confidence Index due on March 25. This gauge offers a snapshot of consumer sentiment and spending tendencies—critical data, especially in an environment where inflation and interest rate policy remain hot topics. Consumer confidence impacts retail spending and economic momentum, and any notable deviation from expectations could ripple through markets. Also on deck is the second GDP estimate for Q4 2024, scheduled for release on March 27. While not as headline-grabbing as the initial reading, revisions can influence market narratives around growth, inflationary pressures, and potential Federal Reserve actions. Additionally, the U.S. Census Bureau will report new home sales data on March 25, which could provide insight into the housing sector’s health—a key sector for both labor markets and broader economic sentiment. For crypto investors, these macro indicators act as indirect but impactful signals. Positive economic readings could stoke risk-on sentiment, benefiting Bitcoin and altcoins, especially if investors believe the Fed will maintain current rates or move to easing. Conversely, disappointing data may heighten recession fears or signal prolonged high interest rates, pressuring speculative assets including cryptocurrencies. Market Impact: If consumer confidence and GDP data beat expectations, crypto markets could experience bullish spillover as risk appetite returns. Poor results, however, could trigger a flight to safety, with digital assets facing temporary outflows as traders reassess portfolio risk. Beyond Strategy: 11 More Publicly Traded Companies Stockpiling Bitcoin A fresh wave of Bitcoin adoption is unfolding among publicly traded companies, with 11 new firms reportedly stockpiling the asset on their balance sheets. This comes amid growing belief that Bitcoin is not only a speculative vehicle but a strategic store of value. With pioneers like MicroStrategy leading the way, other firms are beginning to follow suit, recognizing Bitcoin’s potential to act as a hedge against fiat devaluation, inflation, and economic uncertainty. What’s particularly notable is the diversity among these companies, spanning industries from tech to financial services. This broadening interest signifies a maturation of sentiment around Bitcoin, as its reputation transitions from high-risk asset to credible financial tool. As Bitcoin becomes embedded in corporate treasuries, it may also reduce its perceived volatility over time, as a growing portion of the supply becomes locked up by institutions with long-term outlooks. This shift also introduces a new layer of influence on Bitcoin’s price. With more entities holding substantial positions, their actions—whether accumulation or liquidation—can have outsized effects on liquidity and volatility. Moreover, these corporate moves may pressure regulatory agencies to provide clearer frameworks, as the financial exposure of public firms brings more mainstream scrutiny to the crypto sector. Market Impact: Continued corporate accumulation could solidify Bitcoin’s role as a strategic asset, boosting institutional confidence and encouraging further inflows. The trend adds upward pressure on long-term prices, and each new public disclosure can act as a catalyst for broader market enthusiasm. Bitcoin’s Long-Term Holders Increase Accumulation Amid Market Fluctuations Amid the usual ups and downs of the crypto market, one cohort remains undeterred: long-term Bitcoin holders. Recent on-chain data confirms that these investors are accumulating more BTC despite price fluctuations, reinforcing a recurring theme of confidence in the asset’s long-term potential. This behavior often marks the early stages of a bullish macro phase, where foundational support is built from persistent accumulation by seasoned investors. According to data, long-term holders have added over $21 billion in BTC since February, pushing their total holdings from 13.1 million to over 13.3 million BTC. This quiet