6 latest cryptomarket Rollercoaster : Record DEX Volumes, Policy Shifts, and Bitcoin’s Sentiment Fluctuations

December 2024 latest marked a pivotal moment in the cryptomarket, showcasing dramatic shifts, record-breaking achievements, and forward-looking policy changes. Decentralized exchanges (DEXs) hit unprecedented heights with $462 billion in monthly volume, underscoring the growing dominance of DeFi platforms. Meanwhile, the U.S. and Hong Kong unveiled bold plans, with President-elect Trump promising a crypto-friendly administration and Hong Kong proposing Bitcoin as part of its national reserves. Amidst these highlights, market sentiment took a turn as Bitcoin’s price faced corrections, accompanied by a dip in the Fear & Greed Index. Ethereum stood out with a surge in long-term holders, reflecting growing confidence in its ecosystem, while Bitcoin investors opted for profit-taking, leading to contrasting trends for the two leading assets. This period encapsulated the dynamism of the crypto industry, setting the stage for an eventful 2025. 1. DEXs Hit Record $462 Billion Monthly Volume In December 2024, decentralized exchanges (DEXs) recorded their highest-ever monthly trading volume, reaching $462 billion. This milestone surpassed the previous high of $374 billion set in November, reflecting the growing popularity of decentralized finance (DeFi). Platforms like Uniswap, PancakeSwap, and Raydium led this surge, with $106 billion, $96 billion, and $58 billion in respective volumes. The rise in DEX activity underscores a shift toward decentralized platforms, offering transparency and user control over assets. Interestingly, while DEX volumes flourished, the memecoin market faced a sharp correction, with market capitalization dropping from $137 billion to $92 billion in December. This shift suggests traders are pivoting toward established protocols and away from speculative assets, further solidifying DeFi’s growth trajectory in the crypto ecosystem. 2. Donald Trump’s Pro-Crypto Stance Signals Market Transformation President-elect Donald Trump has vowed to make the U.S. the “crypto capital of the planet,” promising a favorable regulatory environment for cryptocurrencies. His administration plans to appoint crypto-friendly officials, including David Sacks as “AI & Crypto Czar,” aiming to attract institutional investment and foster innovation. Analysts predict this could drive Bitcoin prices near $200,000 and bolster the cryptocurrency market in 2025. However, concerns about increased market volatility remain. While Trump’s agenda may accelerate adoption, it could also intensify speculative activity. Still, his supportive stance is expected to pave the way for significant advancements in blockchain technologies and heightened investor confidence. 3. Hong Kong Proposes Bitcoin as a National Reserve Hong Kong legislator Wu Jiezhuang has proposed adding Bitcoin to the region’s national reserves to strengthen financial security and stability. Inspired by El Salvador and Bhutan, Wu believes such a move could attract global talent and investment while positioning Hong Kong as a digital asset leader. Wu advocates for an incremental approach, starting with Bitcoin ETFs before expanding holdings. This proposal aligns with Hong Kong’s broader strategy of creating a secure and innovative digital asset framework. As the region embraces Bitcoin’s potential as “digital gold,” it aims to enhance its status as a forward-thinking financial hub. 4. Bitcoin’s Fear & Greed Index Falls Amidst Year-End Decline In late December, Bitcoin’s price dropped by 13.7%, landing around $93,000. This correction coincided with a decline in the Crypto Fear & Greed Index to a two-month low of 65, marking a significant shift in market sentiment from extreme greed to caution. Despite short-term volatility, Bitcoin remains the best-performing asset of 2024, with a 129% return compared to traditional investments like gold. cryptomarket analysts are divided on what’s next. While some foresee increased volatility, others maintain a bullish outlook for Bitcoin, citing strong fundamentals and institutional support. As the market digests these fluctuations, the long-term trajectory of Bitcoin remains optimistic. 5. Ethereum Long-Term Holders Surge as Bitcoin Investors Take Profits Throughout 2024, Ethereum (ETH) witnessed a significant rise in long-term holders, climbing from 59% to 75%. This trend contrasts with Bitcoin, where long-term holders decreased from 70% to 62%, likely due to profit-taking during Bitcoin’s recent price rally. Ethereum’s increased adoption is further highlighted by doubling ETF inflows, which reached $2.1 billion in December. The data reflects growing confidence in Ethereum’s ecosystem, driven by advancements in DeFi, scalability, and institutional adoption. Meanwhile, Bitcoin’s correction suggests a natural market adjustment, as investors rebalance portfolios after substantial gains. 6. Bitcoin Dips Below $94,000, Bears Take Charge? Bitcoin’s price slipped below $94,000 on December 29, raising concerns about bearish market control. The Taker-Buy-Sell Ratio fell below 1, signaling heightened selling pressure. Additionally, the rising dominance of Tether (USDT) indicates a flight to stability among investors. Despite bearish signals, some traders remain optimistic, as Bitcoin’s funding rates for perpetual contracts stay positive, showing confidence in long positions. Moreover, Bitcoin continues to hold above its 200-day exponential moving average (EMA), hinting at underlying support. While the market braces for potential short-term volatility, Bitcoin’s long-term bullish case remains strong. Key Insights 1. DEXs Break Records While Memecoins Decline Decentralized exchanges achieved a record $462 billion in trading volume, led by platforms like Uniswap and PancakeSwap. This growth underscores the increasing shift toward decentralized platforms for transparency and control. Memecoins, however, saw a sharp decline, losing 20% of their market capitalization in December. Key Insight: The DeFi sector continues to gain momentum, while speculative assets face a reality check. 2. Trump’s Crypto Push Sets Bullish Expectations President-elect Trump’s pro-crypto stance aims to make the U.S. a global crypto leader. Policies include appointing crypto-friendly officials and fostering institutional investment. Analysts predict these moves could drive Bitcoin toward $200,000 in 2025 but warn of potential market bubbles. Key Insight: U.S. policy shifts could catalyze adoption but introduce volatility risks. 3. Hong Kong’s Bitcoin Reserve Proposal Highlights Regional Ambitions Hong Kong explores adding Bitcoin to national reserves, inspired by El Salvador’s example. Legislators propose starting with ETFs before direct integration into reserves. This move could solidify Hong Kong’s reputation as a forward-thinking financial hub. Key Insight: Regional players are increasingly leveraging Bitcoin as a strategic asset. 4. Bitcoin Sentiment Weakens as Fear & Greed Index Drops Bitcoin fell to $93,000 amid a market sentiment shift from extreme greed to caution. Despite short-term corrections, Bitcoin outperformed other assets in

Exchanges: A Beginner’s Guide to Cryptocurrency Trading

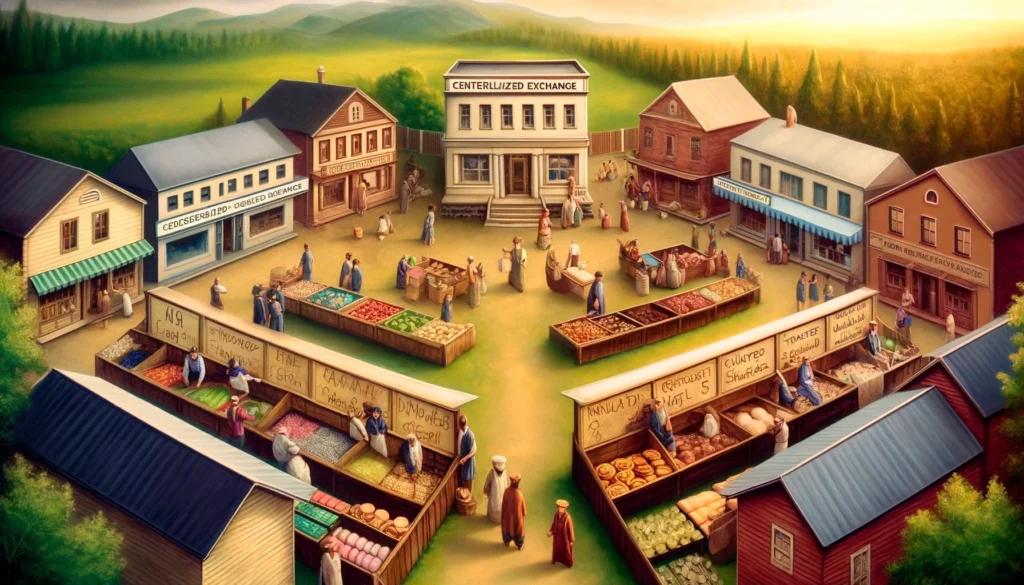

Imagine you live in a small town where everyone loves to trade goods. In this town, there are two main marketplaces: one is a big, organized store run by a group of managers, and the other is an open field where people trade freely with each other. These two marketplaces represent centralized and decentralized exchanges in the world of cryptocurrency. Centralized Exchanges: The Organized Store Centralized exchanges (CEX) are like the big, organized store. In this store, a team of managers oversees everything. They set the rules, ensure security, and help you find what you need. When you want to trade, you give your goods (or money) to the store, and they handle the trade for you. How It Works: Account Creation: Just like you’d sign up for a membership at the store, you create an account on a centralized exchange, like Binance, OKex, Kucoin, Bitget, Bybit and MEXC etc. You can create account on Binance here. Depositing Funds: You deposit your money or cryptocurrency into the exchange’s account, similar to how you might put your money in the store’s safe deposit box. Trading: The exchange matches buyers and sellers. If you want to buy some cryptocurrency, the exchange finds someone who wants to sell and completes the trade for you. Withdrawal: Once you’re done trading, you can withdraw your funds back to your personal account. Advantages: User-Friendly: Centralized exchanges are usually very easy to use. They offer customer support, clear interfaces, and help with transactions. Security and Trust: These exchanges invest heavily in security to protect users’ funds and have insurance in case something goes wrong. Liquidity: There are often many people trading on these platforms, making it easier to buy or sell quickly. Disadvantages: Control: You don’t have complete control over your funds because they are held by the exchange. Privacy: You often need to provide personal information to use these platforms. Risk of Hacking: Even with strong security, centralized exchanges can be targets for hackers. Decentralized Exchanges: The Open Field Decentralized exchanges (DEX) are like the open field where people trade directly with each other. There are no managers or middlemen; you handle everything yourself. Some examples are uniswap, 1inch and pancakeswap. How It Works: No Account Needed: You don’t need to create an account. All you need is a digital wallet where you store your cryptocurrency, like trust wallet, exodus etc. Direct Trading: You trade directly with other people. Using smart contracts, which are self-executing agreements coded into the blockchain, trades are done automatically and securely. Maintaining Control: Your funds stay in your wallet until you decide to trade, so you have full control over your assets. Advantages: Control: You always control your funds and don’t have to trust a third party. Privacy: You don’t need to provide personal information to trade. Security: Since your funds aren’t stored on a central server, they are less vulnerable to large-scale hacks. Disadvantages: Complexity: Decentralized exchanges can be harder to use, especially for beginners. Liquidity Issues: There may be fewer people trading, which can make it harder to buy or sell quickly. Lack of Customer Support: If something goes wrong, there’s no customer service to help you. Blockchain relation: You can only trade on provided blockchains. If a token is on Ethereum you can not directly change it to BTC. Summary: Choosing Your Marketplace Both centralized and decentralized exchanges have their strengths and weaknesses. If you prefer ease of use, strong security measures, and customer support, centralized exchanges might be the way to go. Many people use CEX only. If you value privacy, control over your funds, and are comfortable with a bit more complexity, decentralized exchanges could be more appealing. In the end, the choice depends on your personal preferences and comfort level with handling digital assets. By understanding the differences between these two types of exchanges, you can make informed decisions about how to trade and manage your cryptocurrency. Happy trading!