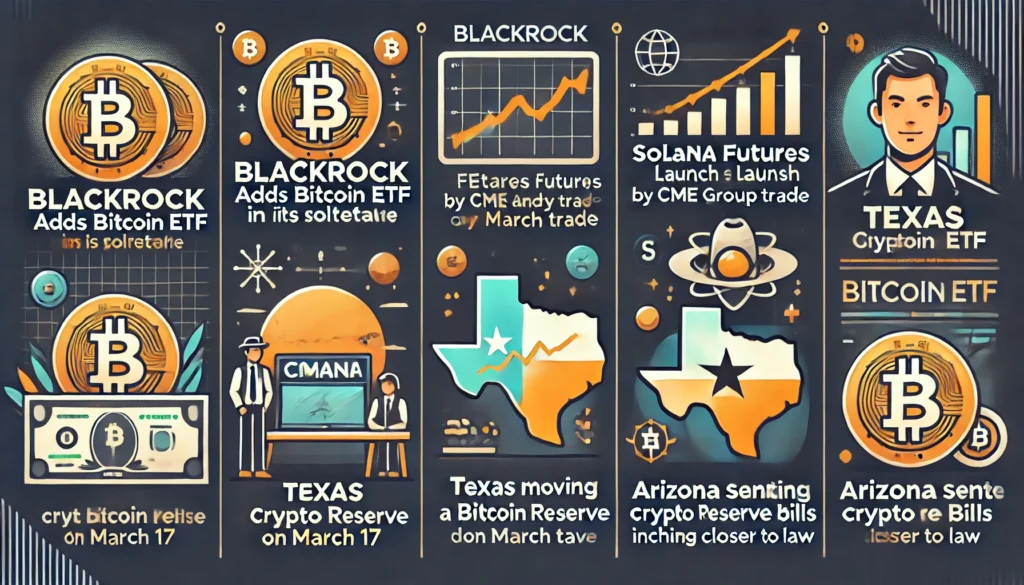

5 Important Crypto News : BlackRock Bitcoin ETF, Solana Futures, Bitcoin Crash, Texas & Arizona Crypto Reserves – Botslash Daily Crypto News Analysis

The crypto market is witnessing major institutional movements that could reshape the future of digital assets. From BlackRock’s Bitcoin ETF integration to Solana futures on CME, and states like Texas and Arizona moving forward with crypto reserves, these developments highlight a growing trend toward crypto adoption and regulation. Meanwhile, Bitcoin’s price volatility continues to stir concerns, as seen with recent market crashes and the erosion of ETF-based trades. These key moments mark important milestones that could influence market sentiment and shape future regulatory frameworks. BlackRock Adds Its iBIT Bitcoin ETF to Alternative Asset Model Portfolio BlackRock’s decision to add its iBIT Bitcoin ETF to its alternative asset model portfolio reflects a growing acceptance of Bitcoin among traditional financial institutions. The iBIT Bitcoin ETF, launched by the world’s largest asset manager, aims to provide institutional investors with a regulated pathway to Bitcoin exposure. By adding this ETF to its portfolio, BlackRock recognizes Bitcoin’s place within a diversified investment strategy, enhancing its legitimacy in the eyes of both retail and institutional investors. This move aligns with the broader trend of institutional adoption of cryptocurrency, further indicating that Bitcoin is becoming a mainstream asset class. While Bitcoin ETFs remain relatively new in the market, BlackRock’s participation lends credibility to the idea of digital assets being part of long-term investment strategies. This integration is expected to increase Bitcoin’s accessibility, particularly for institutions looking to gain exposure without directly purchasing or managing the digital asset. The choice to include Bitcoin in the alternative assets model portfolio is a sign that traditional investment vehicles are gradually expanding their scope to accommodate digital currencies. Market Impact: The addition of the iBIT Bitcoin ETF to BlackRock’s model portfolio signals a positive step forward for Bitcoin’s institutional adoption. It shows that major asset managers are acknowledging Bitcoin’s growing relevance in diversified investment strategies, which is likely to encourage other institutions to follow suit. In the longer term, this move may support Bitcoin’s price, potentially driving demand from institutional investors who seek to balance portfolios with alternative assets. This move could lead to more mainstream recognition of Bitcoin as a credible asset class. Solana Futures Launch Date: CME Group to Roll Out SOL Futures on March 17 CME Group’s announcement of launching Solana (SOL) futures trading on March 17 is an important development in the cryptocurrency market. Solana, known for its high throughput and low fees, has gained significant attention as a leading competitor to Ethereum. By introducing Solana futures, CME Group opens up an opportunity for institutional investors to hedge, trade, or speculate on Solana’s price movement in a regulated environment. Futures contracts provide a more secure means for institutions to gain exposure to Solana without directly holding the token, which is particularly valuable given the volatility in the cryptocurrency market. The introduction of Solana futures also marks a key moment for the Solana ecosystem, as it elevates the network’s profile within the broader financial market. Futures contracts often lead to greater liquidity and price discovery, helping to stabilize the market over time. Additionally, it could pave the way for other major cryptocurrencies to see futures contracts listed on regulated exchanges like CME Group, contributing to the overall maturation of the digital asset space. Market Impact: The launch of Solana futures is likely to have a positive impact on the Solana market. As a regulated financial product, it is expected to attract institutional investors who have been hesitant to invest directly in the cryptocurrency due to concerns about volatility and regulatory uncertainty. This could lead to an influx of capital into the Solana ecosystem, potentially increasing liquidity and supporting the long-term price of SOL. The futures market also increases transparency, which can help reduce price manipulation and foster a more stable trading environment for Solana. Bitcoin Crash Triggered by Erosion of ETF Cash-and-Carry Trade — Analyst This article highlights the significant role played by hedge funds using a cash-and-carry trade strategy involving Bitcoin ETFs and CME futures in the recent price crash. The trade, which had been a reliable low-risk way to generate yield by exploiting the price difference between spot and futures markets, became unprofitable when Bitcoin’s price fell. As a result, large outflows from Bitcoin ETFs followed, accelerating the crash. The major losses were particularly concentrated among recent buyers who entered the market in the past month, with over 74% of realized losses coming from those new investors. The erosion of the cash-and-carry trade underscores the risks that institutional investors face when relying on market arbitrage strategies, especially in volatile markets like cryptocurrency. The sharp drop in Bitcoin’s price serves as a reminder that even traditionally less volatile assets, such as ETFs, can experience sharp declines in extreme market conditions. While this might trigger temporary pain, analysts believe that such market shakeouts can ultimately lead to more mature and stable market behavior in the long term. Market Impact: This news has a negative impact on the Bitcoin market, as it underscores the vulnerability of ETF-based strategies to sharp market movements. The erosion of the cash-and-carry trade may cause short-term instability and loss of investor confidence, particularly among those reliant on leveraged and arbitrage strategies. However, the market might eventually stabilize as weaker hands exit, leaving behind more resilient holders. The price drop may also encourage future regulation to address these kinds of market risks, potentially leading to improved market stability over time. Texas Proceeds with Bitcoin Reserve Despite Price Fluctuations Texas is moving ahead with its Bitcoin reserve project, despite the volatile nature of Bitcoin prices. The state is focused on securing its position in the evolving world of digital assets, aiming to build a reserve that will protect the value of state funds over the long term. Bitcoin’s price volatility presents a challenge, but Texas believes the asset has long-term potential, especially as part of a diversified investment portfolio. The decision to continue with the reserve project, even amid market fluctuations, highlights the state’s commitment to using cryptocurrency for innovative financial strategies. By proceeding

Crypto Daily News Analysis: Bitcoin Reserves, ETFs, AI Trading, and Institutional Adoption : 10 latest news analysis

As Bitcoin adoption accelerates, governments and financial institutions are making bold moves in the crypto space. U.S. states like Kentucky and Maryland are proposing Bitcoin reserves to diversify assets, while major banks, including PNC, are revealing significant Bitcoin ETF investments. Meanwhile, the SEC remains cautious, delaying its decision on BlackRock’s Ethereum ETF options. In a groundbreaking development, AI agents are now autonomously trading intellectual property rights and earning cryptocurrency, reshaping digital ownership. Despite Bitcoin’s continued volatility, retail investor confidence is rising, signaling bullish sentiment. El Salvador remains committed to Bitcoin despite IMF-driven policy adjustments, further reinforcing the global shift toward digital assets. These developments paint a picture of an evolving financial landscape where crypto is becoming an integral part of national and institutional strategies. 1. VanEck CEO Advocates for U.S. Bitcoin Reserve VanEck CEO Jan van Eck has proposed that the United States establish a Bitcoin reserve as a means to maintain economic supremacy. According to him, Bitcoin, similar to gold, can act as a hedge against inflation and currency devaluation, providing financial security in uncertain economic times. This perspective aligns with growing institutional and governmental interest in digital assets, as countries explore ways to incorporate blockchain technology and decentralized assets into their economic policies. The concept of a national Bitcoin reserve is gaining traction, especially with the Trump administration signaling openness to crypto-friendly regulations. If the U.S. were to adopt Bitcoin as part of its reserves, it could create a ripple effect, prompting other nations to follow suit. This could significantly boost Bitcoin’s global adoption and legitimacy as a reserve asset. However, critics argue that Bitcoin’s volatility could pose risks to national financial stability. Unlike gold, Bitcoin’s price is highly unpredictable, and integrating it into a country’s reserve system may introduce unnecessary risks. Nonetheless, if successfully implemented, this initiative could strengthen the U.S.’s leadership in financial innovation while reinforcing Bitcoin’s position as “digital gold.” Impact on Market: If the U.S. seriously considers a Bitcoin reserve, it could trigger a bullish trend, with institutional investors following suit. This would likely increase demand, drive up prices, and further cement Bitcoin’s role in the financial ecosystem. 2. Long-Term Bitcoin Holders Increase Accumulation, Signaling Potential Rally Analysis: Data suggests that Bitcoin holders, particularly those who keep their assets for extended periods (six months or more), have been significantly increasing their accumulation. With approximately 75% of Bitcoin’s supply now held in dormant wallets, analysts believe this signals a potential rally. Historically, when long-term holders accumulate, it reduces available supply, leading to upward price pressure when demand rises. This trend is further supported by macroeconomic factors, including institutional adoption, favorable regulations, and the increasing view of Bitcoin as a hedge against inflation. With financial uncertainty looming due to global economic conditions, investors are turning to decentralized assets. Additionally, the Trump administration’s pro-Bitcoin stance has increased confidence in Bitcoin’s long-term potential. However, while long-term accumulation is a bullish signal, the market still faces risks. External factors such as regulatory crackdowns, macroeconomic downturns, or unforeseen events could lead to sudden price corrections. Investors should be cautious and consider potential volatility despite the positive sentiment. Impact on Market: A continued accumulation trend could drive a supply shock, causing Bitcoin’s price to rise sharply. If demand surges alongside this trend, Bitcoin could experience a major rally, making 2024-2025 a crucial period for long-term investors. 3. AI Agents Now Trading IP Rights and Earning Crypto for Owners A new trend is emerging where AI agents are autonomously trading intellectual property (IP) rights and generating cryptocurrency revenue for their owners. These AI systems use blockchain-based smart contracts to facilitate transactions, ensuring security, transparency, and automation. This development represents a fusion of AI and decentralized finance (DeFi), creating new opportunities for digital ownership and asset monetization. One notable example is Truth Terminal, an AI that successfully gathered a substantial crypto fortune through social media interactions and community-driven support. This demonstrates how AI-driven economic activity is becoming more prevalent, with implications for digital property rights, automated financial transactions, and even potential regulatory challenges. While this innovation presents numerous opportunities, it also raises ethical and legal questions. How will regulatory authorities address AI-driven transactions? What happens when AI agents make financial decisions that impact human users? Governments and regulatory bodies will need to catch up quickly to establish legal frameworks that ensure fair and responsible AI-driven financial activity. Impact on Market: The integration of AI in blockchain and DeFi could drive demand for cryptocurrencies supporting smart contracts, such as Ethereum and Solana. However, regulatory uncertainty could lead to temporary volatility as policymakers navigate this new technological landscape. 4. Bitcoin Address Activity Drops as Holding Strategy Dominates Data indicates that Bitcoin’s address activity has shifted into a downward trend, as more investors are choosing to hold onto their assets rather than trade. This pattern has persisted for nearly two years, suggesting a strong belief in Bitcoin’s future price appreciation. Historically, when large portions of Bitcoin remain inactive, it creates supply constraints that could lead to higher prices in the long term. This shift also correlates with Bitcoin’s broader adoption as a store of value, much like gold. Long-term holding strategies have been amplified by institutional players, high-net-worth individuals, and even some governmental entities considering Bitcoin reserves. As a result, Bitcoin is increasingly viewed as a hedge against inflation and fiat currency devaluation. However, reduced address activity could also indicate lower overall liquidity in the market. While this may support price increases, it can also contribute to higher volatility when large trades occur. Investors must be prepared for potential market swings if sudden shifts in sentiment lead to sell-offs or increased accumulation. Impact on Market: If the holding trend continues, Bitcoin could experience a supply shock, leading to higher prices. However, if selling pressure emerges, low liquidity could exacerbate price volatility, causing sharp market fluctuations. 5. Kentucky Proposes Bitcoin Reserve Bill Following National Trend Kentucky has joined the growing list of U.S. states considering Bitcoin reserves, introducing a bill aimed at incorporating Bitcoin into state