Recent data indicates that Bitcoin is consolidating just below the critical $110,000 level, maintaining a robust position with the potential for a breakout. After several consecutive weeks of upward momentum, Bitcoin is currently encountering a significant resistance zone that could determine the trajectory of its next bullish cycle. Despite ongoing global macroeconomic uncertainties—including trade tensions and anticipated shifts in interest rates—Bitcoin appears to be thriving in this challenging environment. Demand for digital assets like Bitcoin is notably increasing, even as traditional markets exhibit signs of strain.

On-chain analytics further reveal sustained investor confidence. According to a report by CryptoQuant, the 30-day moving average of the Short-Term Holder Spent Output Profit Ratio (STH SOPR) recently reached a local peak, reflecting a marked increase in short-term holders securing profits. This behavior suggests that recent buyers are realizing gains, which is typically indicative of an underlying bullish trend. Importantly, the profit-taking has not yet reached levels typically associated with market tops, implying that this healthy profit realization is not undermining the broader bullish market structure.

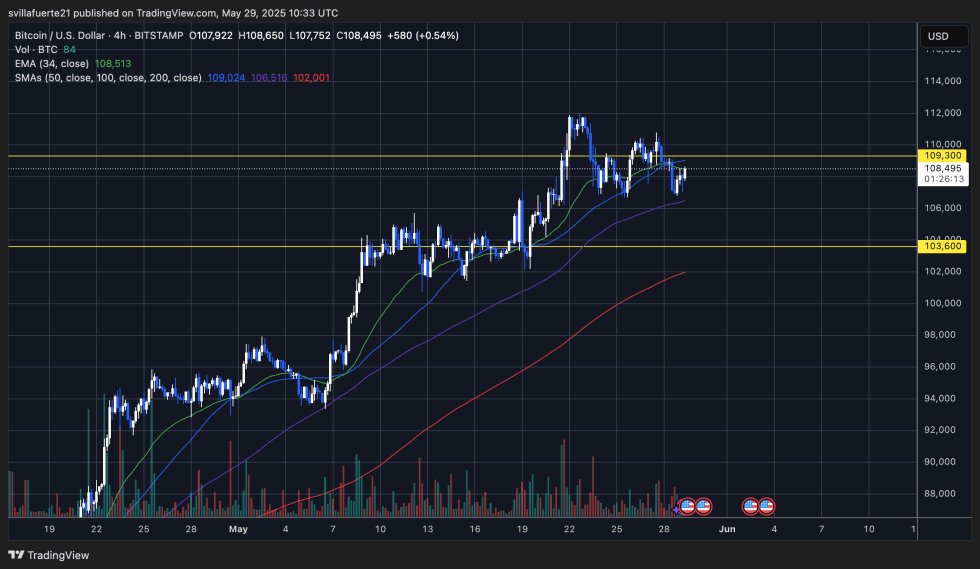

Adding to the complex backdrop, a recent federal court ruling in the United States invalidated presidential trade tariffs, injecting additional uncertainty into the global trade landscape. Nevertheless, Bitcoin and other major cryptocurrencies have demonstrated resilience amid these developments. From a technical standpoint, Bitcoin’s near-term support and resistance levels indicate that surpassing the $109,300 threshold could propel the price toward $112,000. Strong buying pressure and solid support at key moving averages underpin the sustained upward momentum, suggesting that Bitcoin’s bullish trend remains intact and primed for a potential breakout.

Overall, the current profit-taking activity within Bitcoin’s market appears balanced and healthy, reinforcing the strength of the prevailing bullish trend. These factors collectively point to a positive outlook for Bitcoin’s next significant advance.

Source: bitcoinist