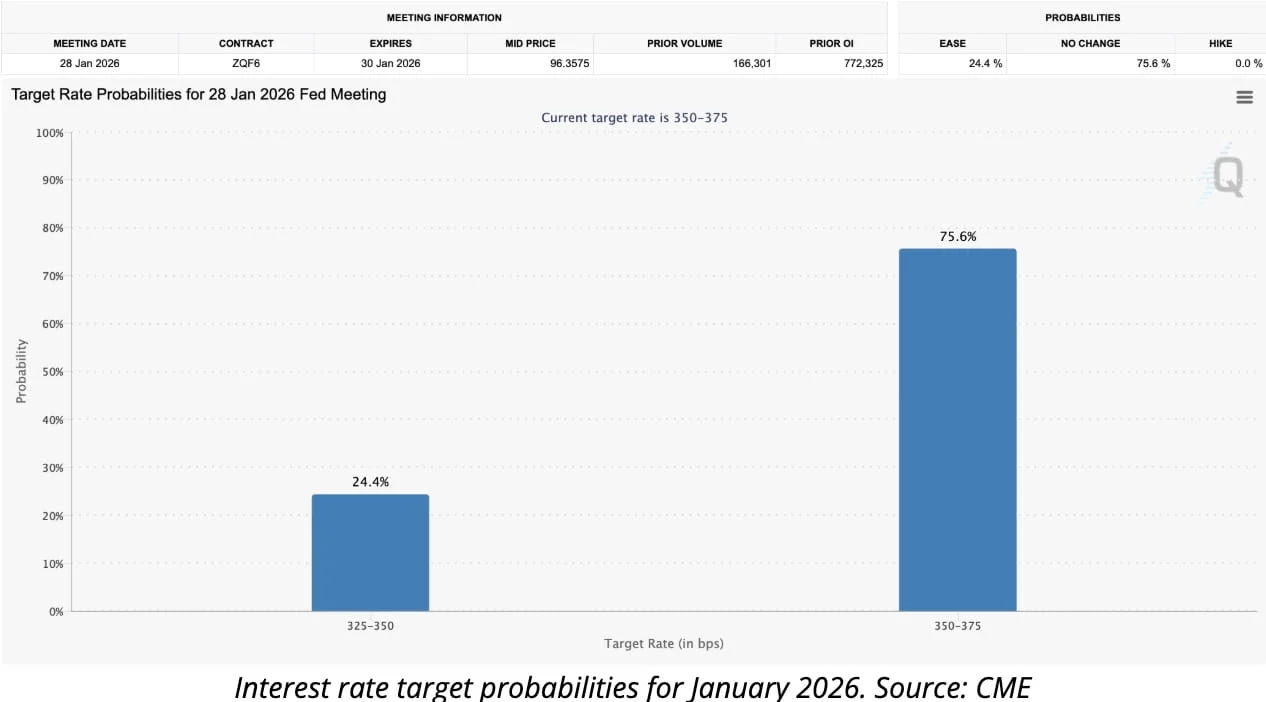

The U.S. Federal Reserve has made an anticipated 25 basis point reduction in interest rates for the fourth consecutive quarter, setting the target range between 3.50% and 3.75%. However, Chairman Jerome Powell’s ambiguous guidance has weakened expectations of a swift and robust recovery for Bitcoin. Powell’s remarks neither indicated a fully hawkish nor dovish stance, leading investment experts to believe that significant rate cuts may not begin until 2026, leaving the crypto market without strong macroeconomic stimuli in the meantime. During the recent Federal Open Market Committee meeting, Powell described the current economic situation as complex, with rising inflation risks and potential declines in employment opportunities. He emphasized that no risk-free policy path exists, a statement that fell short of providing the market with clear direction. According to crypto analyst Nick Pickering, under the Fed’s current policy, the next rate cut is likely only in early 2026, with focus remaining on liquidity and balance sheet policies beforehand. While lower interest rates generally benefit Bitcoin by increasing investment opportunities, skepticism persists regarding future rate reductions. CME FedWatch data shows that only about 24.4% of traders anticipate further cuts by January next year. This uncertainty is partly due to recent U.S. government shutdowns causing gaps in key economic data. Powell noted that consumer spending and business investment remain stable and employment opportunities have not weakened, but high inflation and housing sector weakness limit the Fed’s room for aggressive rate cuts. He also acknowledged that the lack of recent economic reports forces policymakers to rely on market-based signals, complicating decision-making. Meanwhile, political changes loom as Powell’s term ends in May 2026, and former President Donald Trump has hinted at leadership changes at the Federal Reserve, expressing expectations for sharper rate cuts that could increase political pressure on markets. Overall, the Fed’s current stance suggests Bitcoin prices will remain within a stable range for the near term, with limited chances of an immediate surge unless clearer actions or significant rate cuts are implemented.

Source: binance