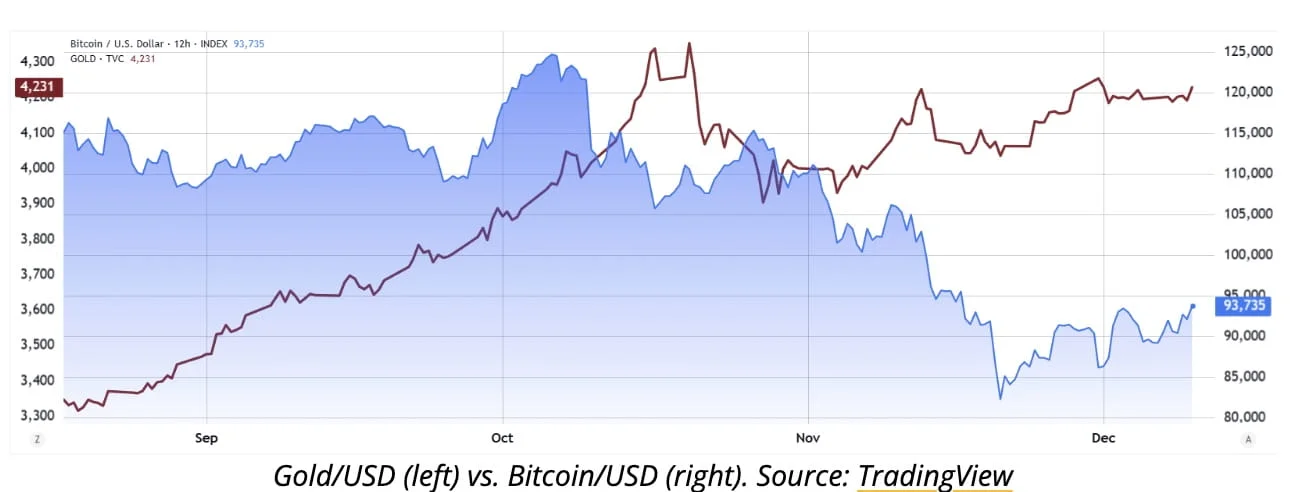

The Federal Reserve’s recent 25 basis point rate cut to 3.75% and its announcement to purchase $40 billion in short-term Treasury bonds have increased market liquidity and enhanced banks’ lending capacity to support investment amid economic slowdown. While these measures could benefit Bitcoin, options market data suggests a low probability of Bitcoin surpassing the $100,000 mark in the near term. The premium for the January 30 $100,000 Bitcoin call option has declined sharply over the past month from approximately $12,700 to around $3,440, indicating about a 70% chance, based on Black-Scholes modeling, that Bitcoin will remain below $100,000 by that date. This drop reflects diminished bullish sentiment despite improving macroeconomic conditions favoring risk assets. The option’s expiration coincides with the upcoming Federal Open Market Committee meeting, where further rate cuts are under consideration, although recent US government data has introduced uncertainty. Currently, stocks are performing well due to the rate cut, but Bitcoin has lagged behind gold and has not attracted significant large-scale investment from short-term bond investors. Over the past six months, the S&P 500 has gained approximately 13%, and yields on five-year US Treasury bonds have fallen. Rising concerns about US debt have increased gold’s appeal as a safe haven, placing downward pressure on Bitcoin’s value. Experts note that if risk premiums in stock markets, particularly in AI-related shares, rise, capital may shift to alternative assets including Bitcoin. However, Bitcoin’s price remains capped below $100,000, and market indicators do not currently suggest a strong or sustained rally.

Source: binance