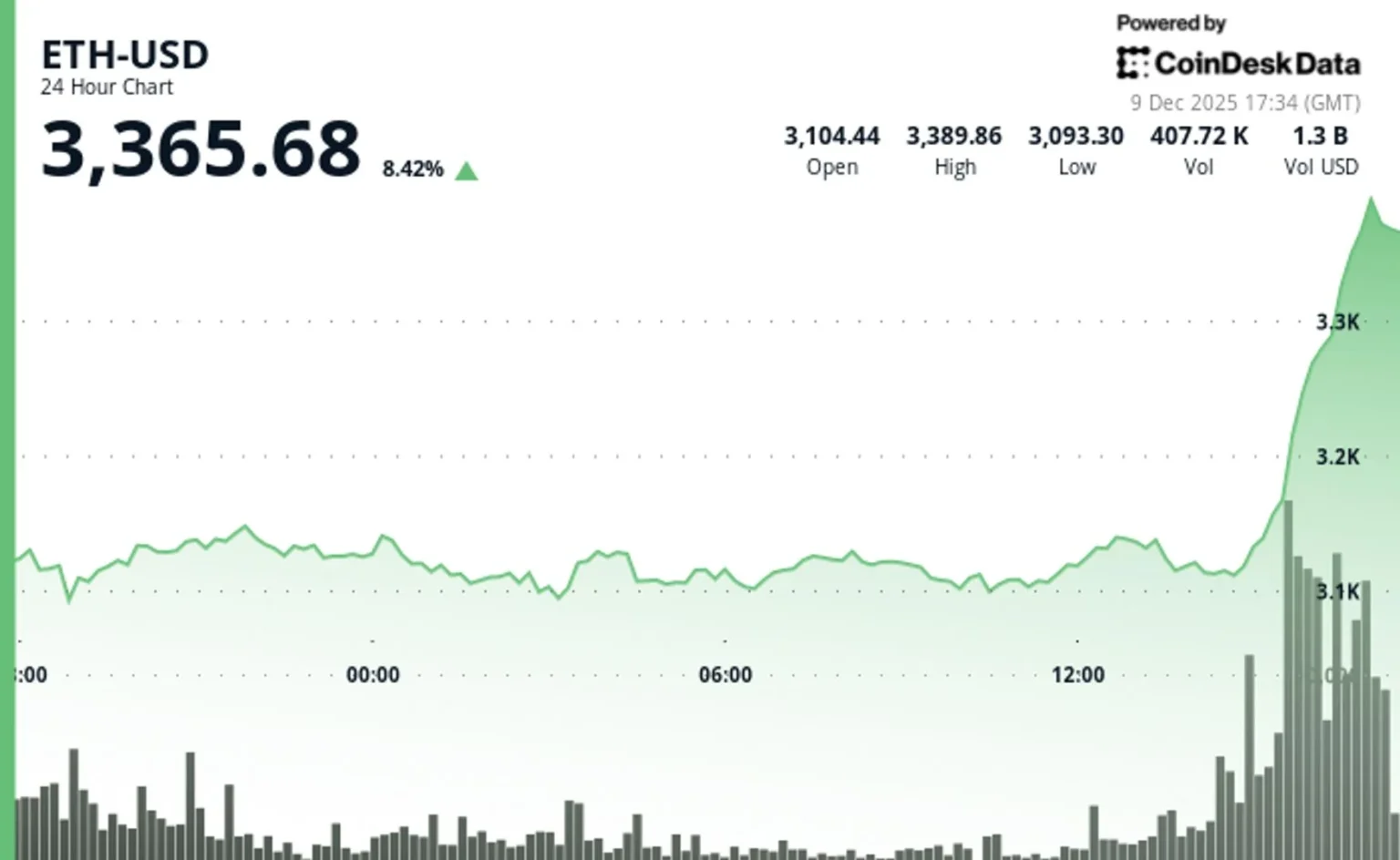

Ether (ETH) has experienced a significant price increase in recent days, outperforming Bitcoin (BTC) in the cryptocurrency market. This surge is primarily attributed to BlackRock’s application for a staking Ether ETF, which has generated positive investor sentiment towards Ether. As a prominent digital currency and smart contract platform based on blockchain technology, Ether stands to benefit from staking ETFs that allow investors to gain exposure without directly holding the asset, potentially boosting its market demand and popularity. Additionally, the growing trend of tokenization—converting digital assets into blockchain-based tokens—has further supported Ether’s value appreciation. The involvement of major investment firms like BlackRock in proposing a staking Ether ETF has reinforced Ether’s legal and financial acceptance, attracting more investors. Previously regarded as the most stable and popular cryptocurrency, Bitcoin’s dominance faces challenges amid these developments favoring Ether. Despite the encouraging price movement, the inherent volatility of the cryptocurrency market and evolving regulatory frameworks necessitate cautious investment. Looking ahead, the approval of staking ETFs and increasing tokenization trends could positively influence Ether’s price, although market fluctuations remain a possibility.

Source: coindesk