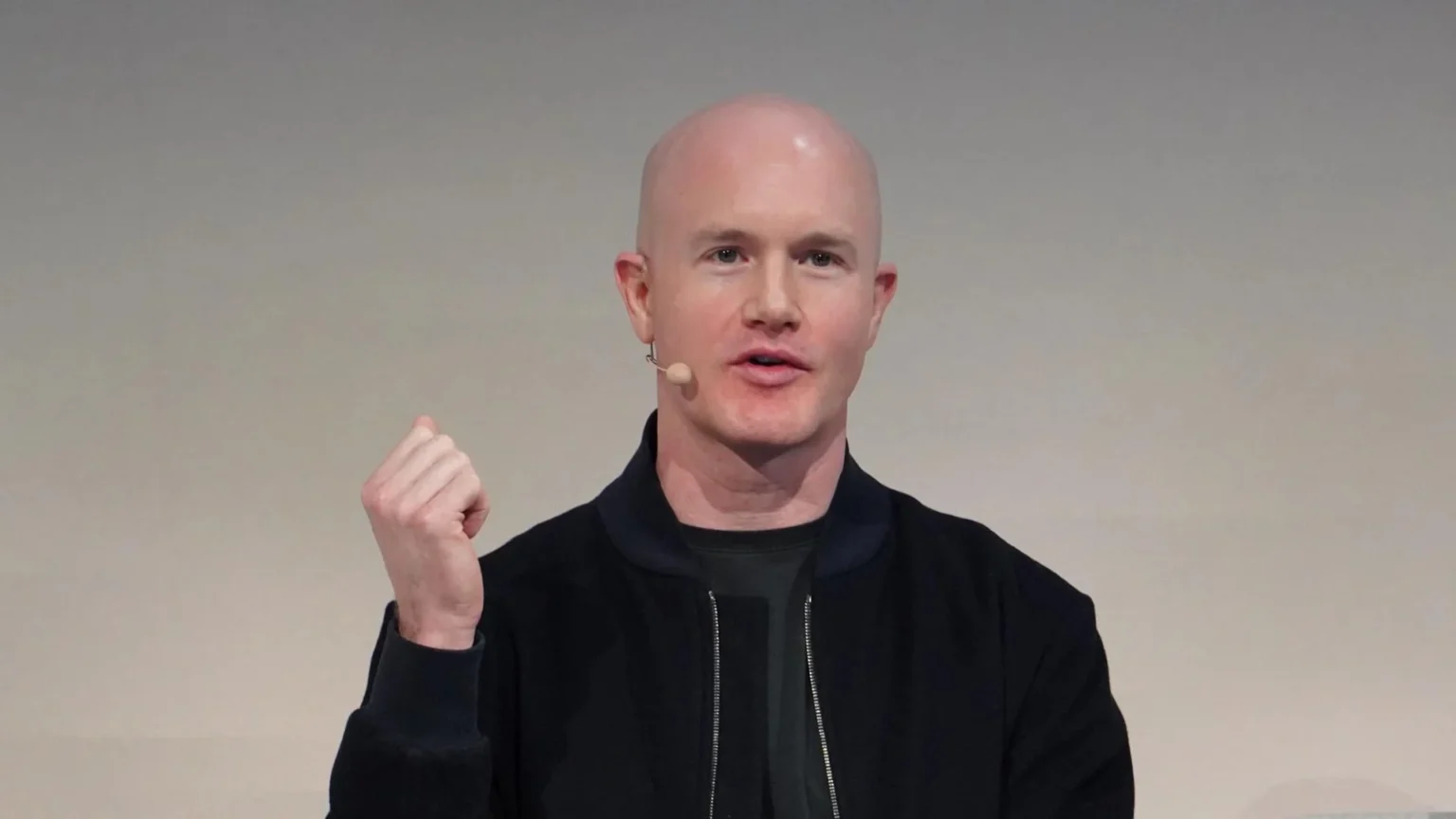

Coinbase CEO Brian Armstrong has warned that banks failing to integrate stable cryptocurrencies, or stablecoins, into their financial systems risk falling behind in the financial sector. He noted that major banks view this development as both a significant challenge and an investment opportunity, reflecting Wall Street’s quiet acceptance of crypto infrastructure. Stablecoins, valued for their price stability compared to typical cryptocurrencies, are rapidly gaining popularity in the financial system by offering banks and customers faster and more efficient digital payments and transactions. Recognizing this trend, Coinbase, a leading global cryptocurrency exchange, is emphasizing increased use of stablecoins in its services. This advancement comes as many financial institutions strive to modernize their services through blockchain technology and digital currencies. Adopting stablecoins will not only help banks meet modern financial demands but also enhance their competitiveness in the global financial market. Despite ongoing legal and security concerns surrounding cryptocurrencies, major financial firms are strengthening their position by investing in this sector. In the future, banks that embrace this transformation are expected to secure a stronger foothold in the financial market, while others may lag behind.

Source: coindesk