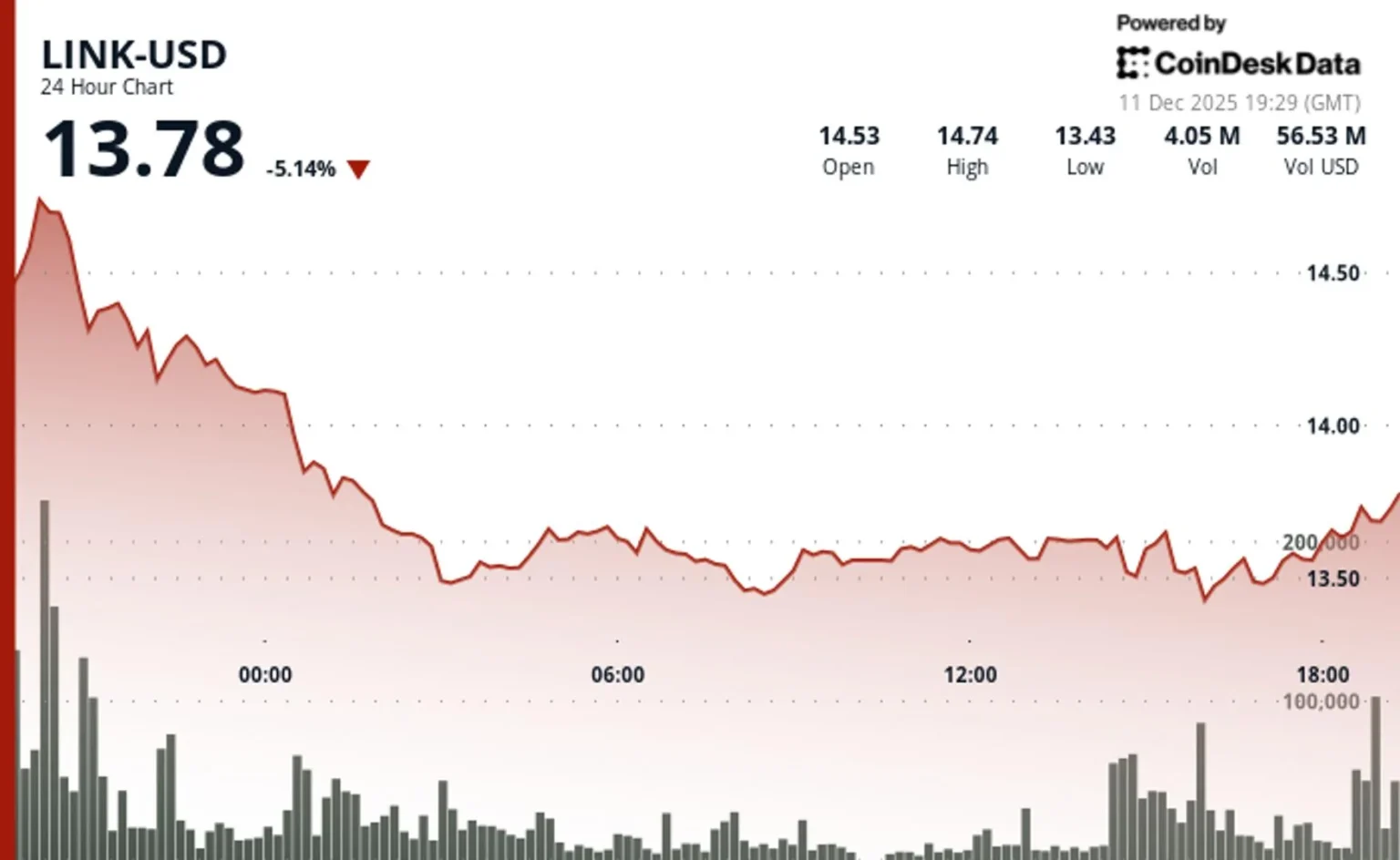

Despite a general downturn in the cryptocurrency market, Chainlink’s LINK token fell by 5% even after news of a $7 billion bridge agreement with Coinbase. Coinbase has selected Chainlink’s services for its blockchain-based bridge, designed to facilitate secure and efficient transfer of digital assets across different blockchain networks. This partnership was expected to boost Chainlink’s popularity and the utility of its oracle network; however, overall market uncertainty negatively impacted the token’s price. Chainlink is a well-known decentralized oracle protocol that delivers real-world data to smart contracts, enhancing the reliability of blockchain applications. Coinbase’s innovative bridge project aims to break blockchain barriers by enabling interoperability between networks, improving transaction speed and security in the crypto market. Although LINK’s price has declined, experts believe this may be a temporary trend, as early signs of consolidation suggest potential price recovery in the future. Moreover, Coinbase’s collaboration with Chainlink is anticipated to play a key role in promoting interoperability among blockchain networks, marking a positive development for the cryptocurrency industry. Nonetheless, market volatility remains common, and investors are advised to exercise caution due to global economic factors and regulatory changes that may affect prices. Further details about the Chainlink-Coinbase partnership are expected in the coming days, which will help clarify market direction.

Source: coindesk