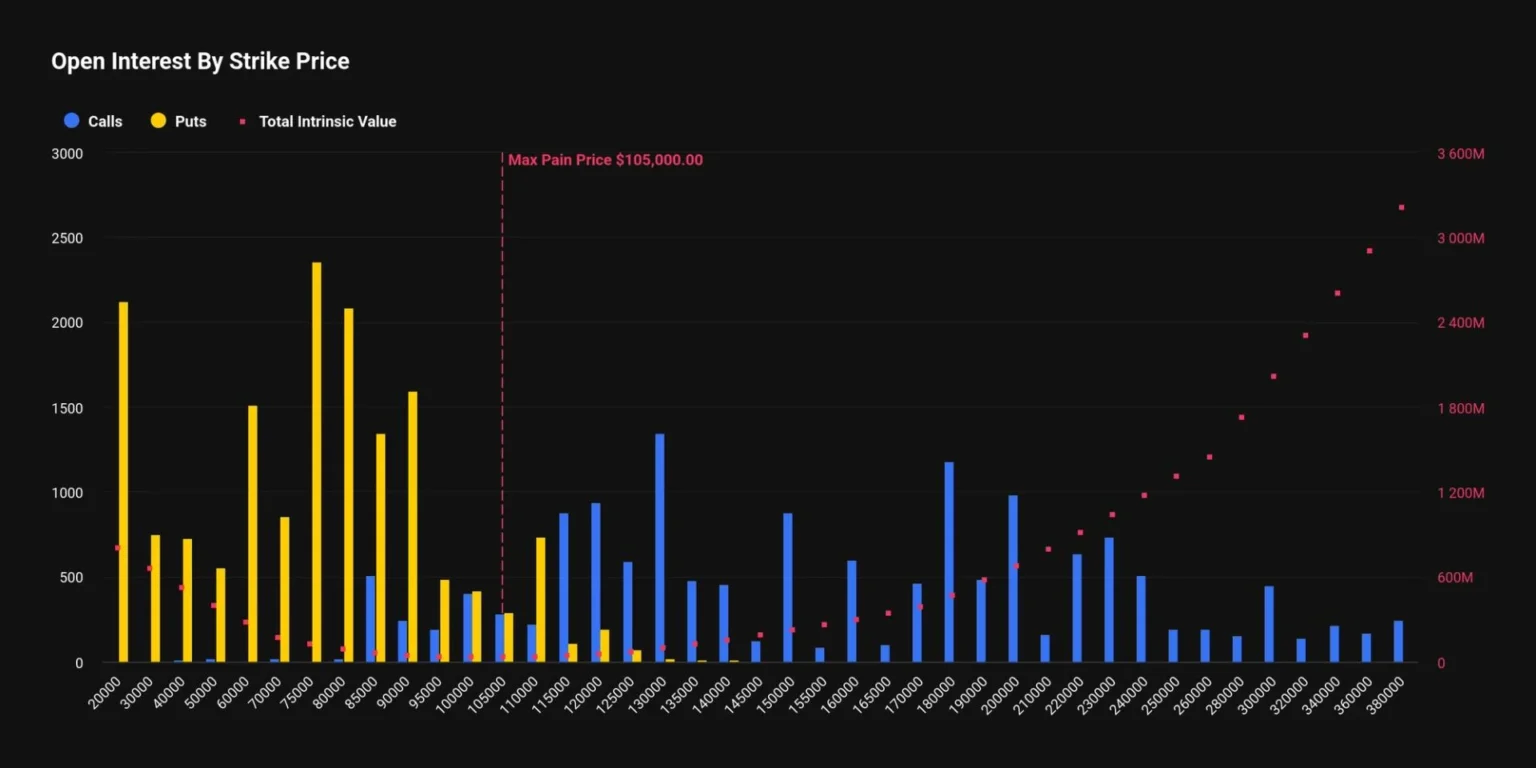

Traders in the Bitcoin market have increased their purchases of options with strike prices significantly above the current value, indicating expectations that Bitcoin’s price could reach $20,000 in the near future. This buying trend primarily signals a positive outlook and reflects bets on greater volatility rather than protective measures against price declines. Bitcoin, the world’s largest cryptocurrency, has gained popularity among investors over recent years, with its price volatility being a common characteristic. The trading of various types of options adds complexity to the market. Deep out-of-the-money options, which have strike prices far from the current market price, aim to generate higher profits if the price reaches the anticipated level. Experts suggest that the increased buying of such options indicates traders foresee a substantial price increase soon. Additionally, this strategy reflects a positive sentiment toward market volatility, offering investors opportunities for greater returns. With expectations of rising Bitcoin prices, investors appear willing to take on more risk, seeking opportunities even amid market uncertainties. However, due to the inherently volatile nature of the crypto market, investors also face potential losses. Overall, this trend highlights a bullish sentiment in the Bitcoin market and reinforces expectations of future price growth, though investors are advised to remain cautious given the unpredictable nature of cryptocurrency markets.

Source: coindesk