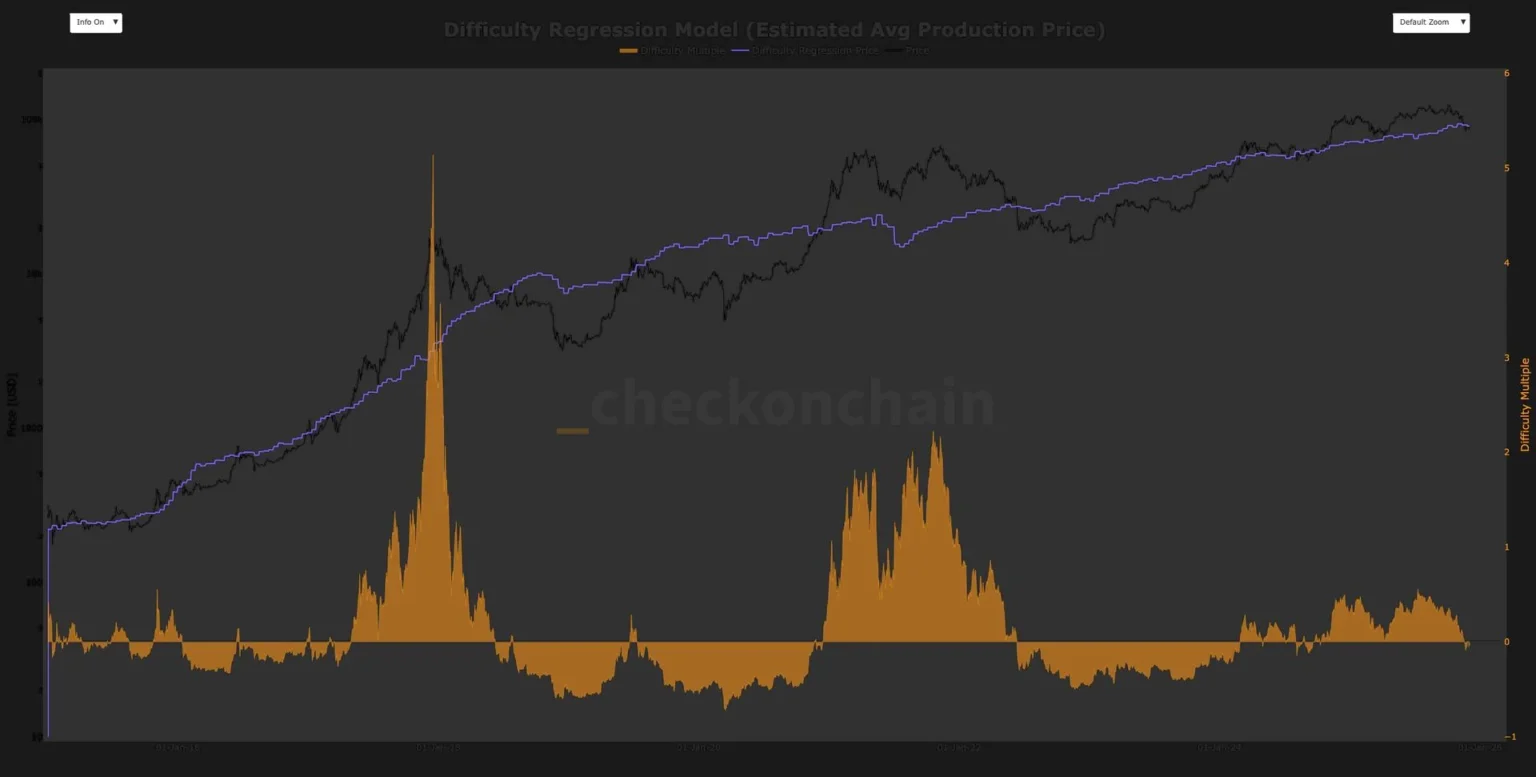

Bitcoin’s price is currently stabilizing near its production cost, estimated to be around $90,000. Market analysts indicate that network difficulty and valuation models suggest Bitcoin’s current price is close to its fair value. This scenario has increased tension between buyers and sellers, narrowing the gap between bullish and bearish outlooks. As the world’s largest cryptocurrency, Bitcoin’s price is influenced by the energy and resources required for mining. When the price approaches production cost, it signals a phase of market stability where investors adopt a cautious stance. Additionally, Bitcoin’s price volatility is affected by global financial markets and rising interest and risks within the crypto sector. Recent months have seen significant price fluctuations driven by global economic uncertainty, changes in central bank policies, and potential regulatory shifts regarding cryptocurrencies. Bitcoin’s price nearing production cost is viewed as a key milestone, indicating limited scope for drastic price declines or surges. Looking ahead, if Bitcoin’s price falls below production cost, miners could incur losses, potentially impacting network security and performance. Conversely, a sudden price increase could boost investment interest but also raise the risk of heightened volatility.

Source: coindesk