Market Analysis

The market is showing some positive signs today; however, the overall situation remains uncertain and under pressure. Complexities in the global economy have negatively impacted investor sentiment, causing the market to oscillate between neutral and bearish trends.

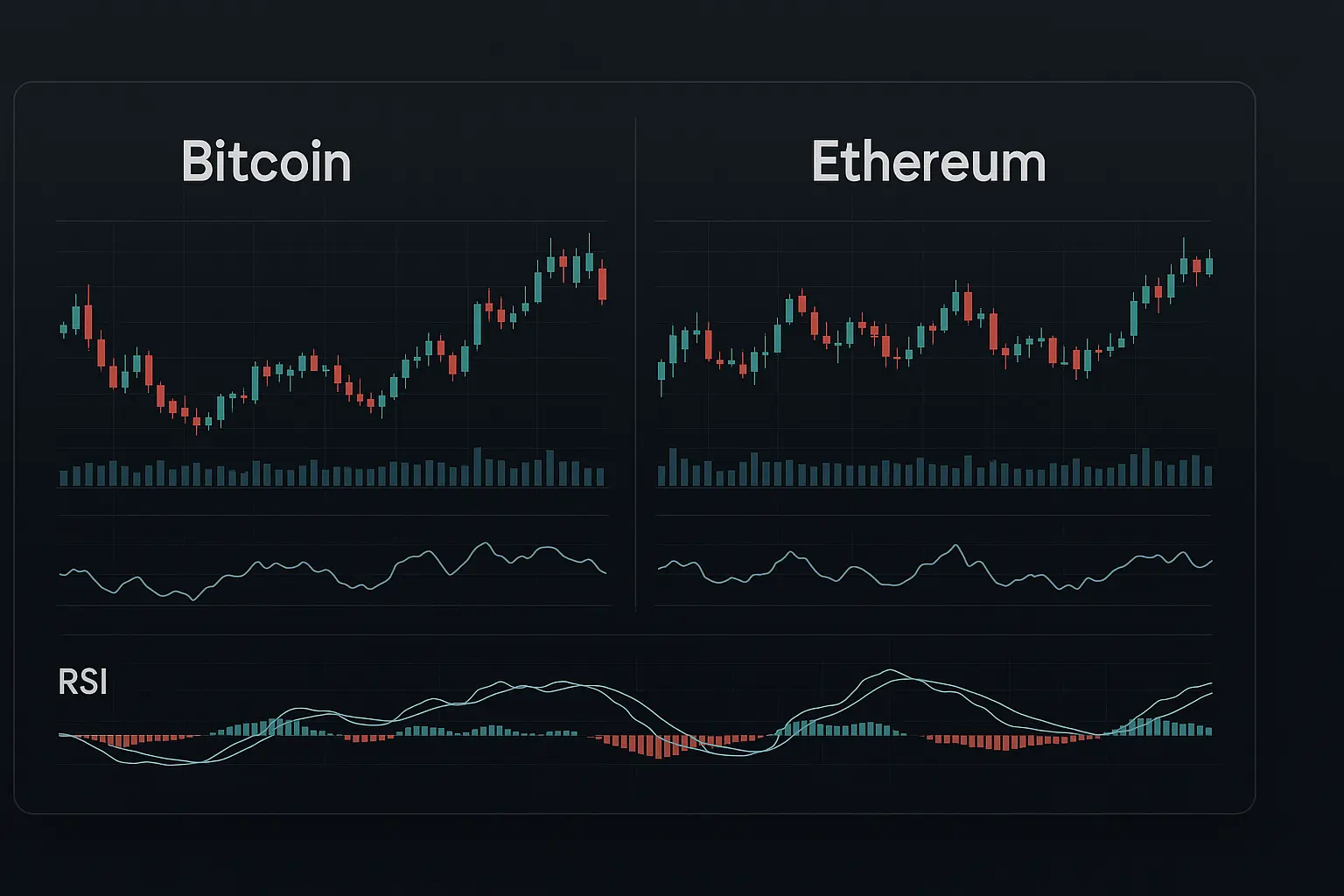

Bitcoin’s price has experienced significant volatility over the past five days, highlighting ongoing market uncertainty. On February 5th, the price dropped sharply, closing at 62,909.86—a considerable decline. During that period, the RSI stood at 8.95 and the MFI at 25.35, both indicating an oversold condition and short-term bearish sentiment. The following day, February 6th, saw a recovery as the price rose to close at 70,580.26, with improvements in RSI and MFI values as well. Despite this, both indicators remained below 50, suggesting a neutral but weakly bullish trend. Meanwhile, trading volume and the number of trades declined, raising concerns about the sustainability of this upward movement.

Looking at moving averages, the 7-day Hull Moving Average (HMA) has crossed from below the price to above it, while the 14-, 21-, and 30-day HMAs are similarly turning upward—potentially signaling an emerging uptrend. However, the longer-term 50-, 100-, and 200-day moving averages still lie significantly above the current price level, reflecting ongoing bearish pressure in the long term. The price touched the lower Bollinger Band before bouncing upward, which could indicate a short-term reversal. Yet, the wide band range still points to continued market volatility.

Support levels range from 67,969.65 down to 62,302, with the psychological support near 70,000 also playing a critical role close to the current price. If this zone breaks, the next solid support lies between 65,376 and 63,339. Resistance levels are positioned between 70,330 and 72,271, close to recent highs, with the 75,000 mark posing a significant psychological barrier. The Fear and Greed Index recently fell sharply from 12 to 6 but has slightly improved to 14, indicating persistent market fear. Financing rates are negative, and open interest has declined, signaling the presence of short positions and weak bullish momentum.

In the context of global economic challenges—such as inflation, international tensions, and uncertainty in monetary policy—Bitcoin’s price trend remains volatile and unpredictable. Investors are cautious, with the possibility of further short-term declines or stabilization. While technical indicators suggest some potential for improvement, prevailing market sentiment and global factors increase the likelihood of ongoing bearish pressure.

Overall, Bitcoin is currently in a phase between neutral and bearish, with some short-term positive movements. However, given the long-term downtrend and external economic pressures, a cautious approach is advisable. Close monitoring of support and resistance levels is essential to respond promptly to any significant shifts. Investors are encouraged to manage their positions carefully and avoid unnecessary risks amid the prevailing uncertainty.

Data Summary

- 1. Time:

2026-02-10 – 00:00 UTC - 2. Prices:

Open: 70330.38000000High: 71453.53000000Low: 68308.00000000Close: 70138.00000000

- 8. Supports:

S1: 67969.65000000 – 66034.50000000S2: 65376.00000000 – 64800.01000000S3: 63339.99000000 – 62302.00000000S4: 60649.3 – 59724.9

- 9. Resistances:

R1: 70330.38000000 – 72271.41000000R2: 72736.42000000 – 120134.08000000R3: 83680.1 – 84850.3

- 10. Psychological Support:

70000.00000000

- 11. Psychological Resistance:

75000.00000000

- 3. Last 5 days’ closing prices:

2026-02-05: 62909.860000002026-02-06: 70580.260000002026-02-07: 69289.380000002026-02-08: 70330.380000002026-02-09: 70138.00000000

- 4. Volume:

BTC: 29152.7284USD: $2038959539.4210

- 5. Number of trades:

6644769

- 6. Indicators:

RSI: 35.3200MFI: 39.3200BB Upper: 97675.07000000BB Lower: 63789.46000000

- 7. Moving Averages:

SMA:7=70311.9900000014=76720.8900000021=80732.2700000030=84755.3600000050=86648.84000000100=89909.14000000200=102078.31000000EMA:

7=71536.1600000014=75538.5500000021=78566.9100000030=81167.2700000050=84689.15000000100=90328.75000000200=95549.34000000HMA:

7=70246.8700000014=66291.4000000021=65898.7700000030=68959.2900000050=75626.49000000100=83861.42000000200=80835.87000000 - 12. Funding Rate:

-0.0043% (Technically Positive)

- 13. Open Interest:

80494.1010

- 14. Fear & Greed Index:

14 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.