Market Analysis

The market is showing some signs of positive momentum today, yet the overall outlook remains cautious and fragile. Ongoing uncertainties in the global economy continue to weigh on investor sentiment, making it difficult to establish a clear direction for the cryptocurrency market.

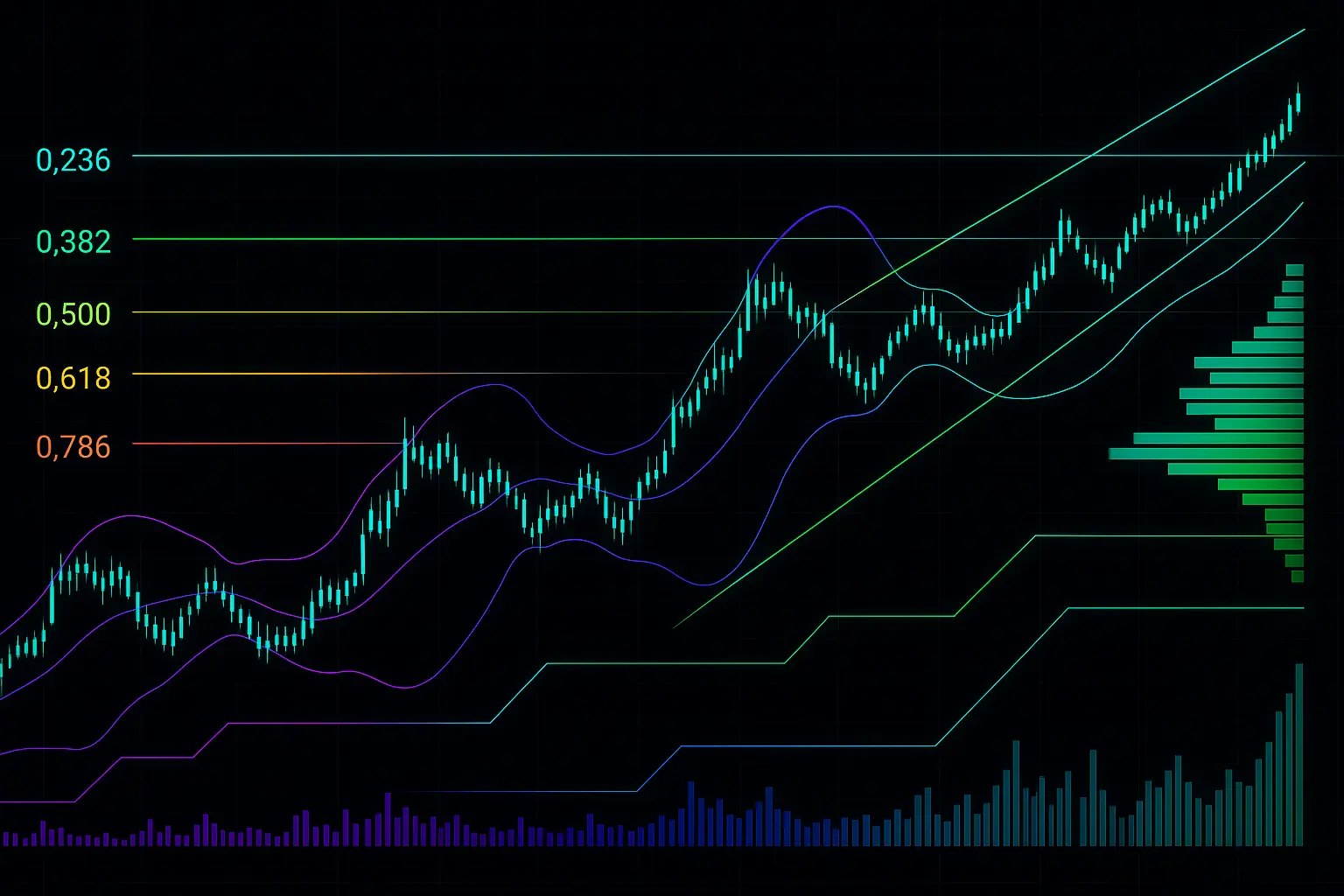

Over the past five days, Bitcoin’s price has experienced considerable volatility, sending mixed signals on both technical and sentiment fronts. On January 15, the price opened around 96,951 but closed lower at approximately 95,604, indicating some downward pressure despite a strong start. The 7-day Relative Strength Index (RSI) stood near 69.47, close to the overbought threshold, before gradually declining. Similarly, the 14-day Money Flow Index (MFI) dropped from 65.16 to 45.21, reflecting a reduction in capital inflows. During this period, the Fear & Greed Index fell from 61 to 44, pointing to a more cautious and subdued market sentiment.

Looking at moving averages, the Hull Moving Average (HMA) over various intervals suggests moderate market pressure. The 7-day HMA has been steadily declining, signaling short-term weakness, while the 14- and 21-day HMAs have remained relatively stable but show no clear upward trend. This indicates the absence of a strong bullish momentum. Price action around the Bollinger Bands has frequently hovered near the middle band, with an increasing tendency toward the lower band, signaling weak demand and potential downside pressure.

From a support and resistance perspective, Bitcoin closed near 92,631, close to the S1 support zone (92,552.49 to 90,791.1). Should this support break, the next significant support level lies at S2 (87,952.01 to 84,667.03), which might provide some relief from further declines. On the resistance side, the R1 zone (93,859.71 to 95,228.45) presents the first notable barrier, with further resistance capped at R2 (96,551.01 to 97,463.95). The psychological level of 90,000 acts as a critical support, while 100,000 remains a major resistance boundary for the market.

On the macro front, global economic uncertainties—particularly ongoing trade tensions between the U.S. and China and ambiguous fiscal policies within the European Union—are exerting downward pressure on the crypto market. Additionally, speculation about potential interest rate hikes by central banks is raising caution among investors, leading to a more conservative approach toward cryptocurrency investments in the short term. Minor declines in funding rates and open interest further reflect weakening market sentiment, highlighting an increase in short positions.

Overall, Bitcoin is navigating a delicate phase both technically and sentimentally. The falling RSI and MFI, price action near the Bollinger Bands middle line, and a declining Fear & Greed Index collectively indicate ongoing pressure. Moving averages confirm the lack of a firm uptrend. Still, the proximity to the S1 support range, combined with some positive volume activity, suggests a possibility of a short-term reversal. Given the persistent global economic uncertainties and prevailing market news, investors are advised to remain cautious, avoid rushed decisions, and carefully consider both technical and fundamental factors before taking any positions.

Data Summary

- 1. Time:

2026-01-20 – 00:00 UTC - 2. Prices:

Open: 93673.14000000High: 93673.14000000Low: 91910.20000000Close: 92631.00000000

- 8. Supports:

S1: 92552.49000000 – 90791.10000000S2: 87952.01000000 – 84667.03000000S3: 84474.69000000 – 83949.52000000S4: 78595.9 – 76322.4

- 9. Resistances:

R1: 93859.71000000 – 95228.45000000R2: 96551.01000000 – 97463.95000000R3: 103261.60000000 – 104550.33000000R4: 105858 – 106457

- 10. Psychological Support:

90000.00000000

- 11. Psychological Resistance:

100000.00000000

- 3. Last 5 days’ closing prices:

2026-01-15: 95604.800000002026-01-16: 95550.940000002026-01-17: 95147.770000002026-01-18: 93673.140000002026-01-19: 92631.00000000

- 4. Volume:

BTC: 14295.5275USD: $1326770336.0490

- 5. Number of trades:

3359066

- 6. Indicators:

RSI: 44.6200MFI: 45.2100BB Upper: 97242.53000000BB Lower: 87102.87000000

- 7. Moving Averages:

SMA:7=94996.2000000014=93188.6700000021=92172.7000000030=90857.4500000050=90336.66000000100=96186.49000000200=105421.91000000EMA:

7=93897.2200000014=93196.0900000021=92500.9500000030=92020.5900000050=92388.61000000100=95832.03000000200=99122.17000000HMA:

7=92886.8300000014=95667.0800000021=95585.3100000030=95301.2400000050=93857.67000000100=88696.13000000200=84568.24000000 - 12. Funding Rate:

0.0025% (Technically Positive)

- 13. Open Interest:

95771.1450

- 14. Fear & Greed Index:

44 (Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.