Market Analysis

The cryptocurrency market is currently showing signs of cautious optimism, though overall sentiment remains fragile and hesitant. Global economic pressures and ongoing uncertainty have made investors wary, resulting in a lack of clear market direction at this time.

Bitcoin’s price has experienced some fluctuations over the past five days, starting at 87,237 on December 29 and rising to 89,995 by January 2. The 7-day Relative Strength Index (RSI) increased from 41.34 to 66.11, indicating a strengthening buying momentum. Similarly, the Money Flow Index (MFI) climbed from 62.5 to 74.55, signaling an influx of capital into the market. However, the Fear & Greed Index remained between 20 and 28, reflecting only a slight improvement in sentiment and emphasizing that uncertainty still prevails among investors.

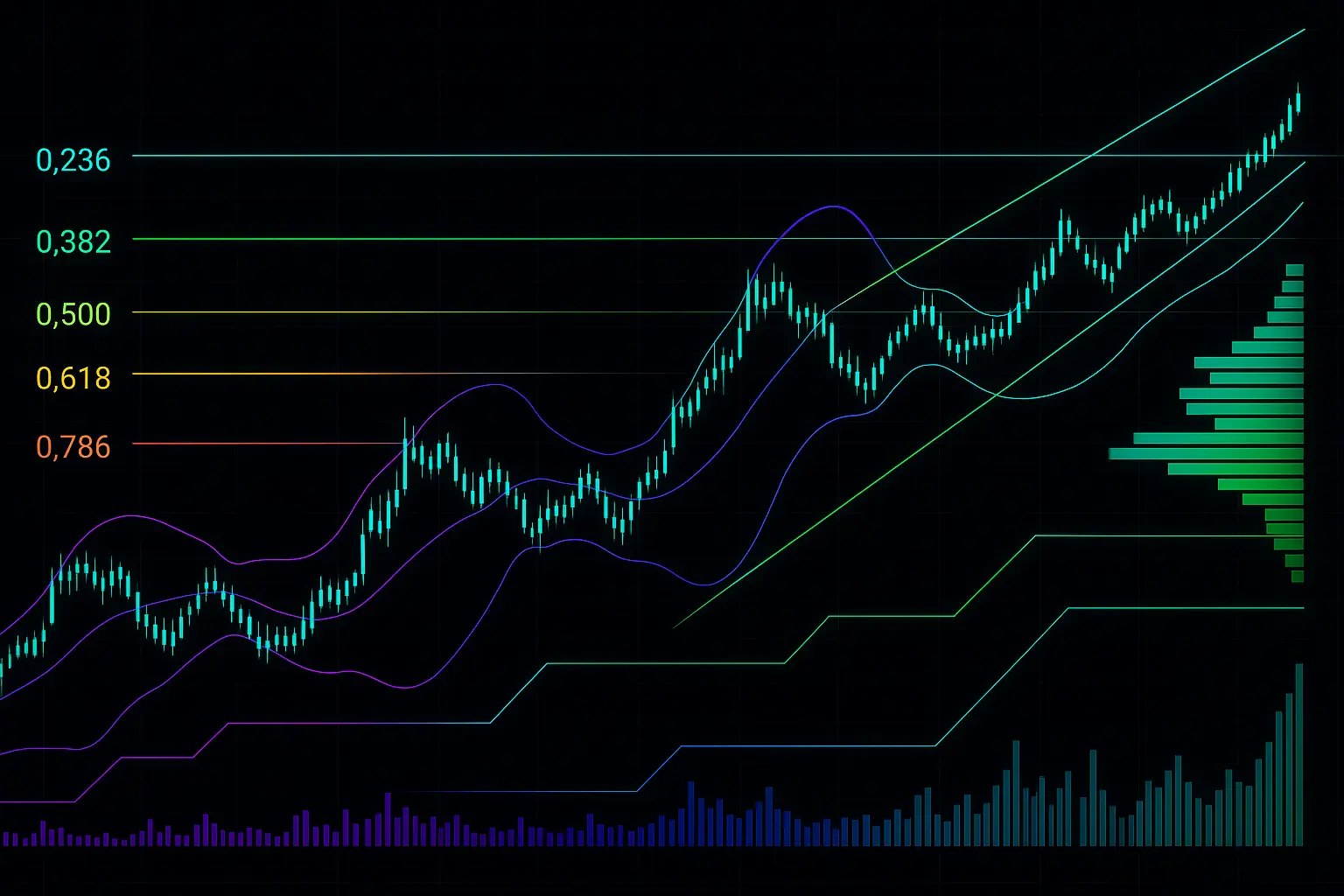

From a technical standpoint, Bitcoin’s price moved above the 21-day Bollinger Bands midline at approximately 87,906 and touched the upper band at 90,069 on January 2—a positive sign, albeit with limited band expansion, suggesting the momentum is not strong enough to confirm a sustained breakout. The Hull Moving Averages (HMA) for 7, 14, and 21 days have shown consistent upward crossovers, reinforcing a robust uptrend, especially as the price remains above the 50, 100, and 200-day moving averages.

Regarding support and resistance levels, the price has firmly maintained the S1 support range between 87,952 and 84,667. Additional support zones, S2 and S3, lie between 84,474 and 80,818, which could act as buffers if the primary support is breached. On the resistance side, the R1 range from 90,375 to 93,555 represents the first significant hurdle, notably close to the psychological resistance at 90,000. Should the price overcome this range, further upward movement toward R2 and R3 levels is likely.

In terms of market news, global economic uncertainties and shifts in monetary policies across various countries continue to influence Bitcoin’s price. Notably, economic policy ambiguity during a potential second term for the U.S. administration and tightening financial regulations in China have contributed to investor caution. Additionally, stable financing rates and a slight decrease in open interest suggest that while no major shocks have occurred in the short term, investors remain prudent.

Overall, Bitcoin’s current market condition reflects a balanced yet cautious uptrend. Rising RSI and MFI values, the price touching the upper Bollinger Band, and positive moving average crossovers all support a favorable outlook. Still, the presence of fear as indicated by the Fear & Greed Index, combined with ongoing global economic pressures, prevents investors from fully committing. Close monitoring of support and resistance levels is crucial, as a breach of key support could trigger a downturn, whereas a successful breakout above resistance could propel prices higher. Investors are advised to avoid hasty decisions and carefully interpret market signals before making moves.

Data Summary

- 1. Time:

2026-01-03 – 00:00 UTC - 2. Prices:

Open: 88839.05000000High: 90961.81000000Low: 88379.88000000Close: 89995.13000000

- 8. Supports:

S1: 87952.01000000 – 84667.03000000S2: 84474.69000000 – 83949.52000000S3: 82715.03000000 – 80818.84000000S4: 76322.4 – 76239.9

- 9. Resistances:

R1: 90375.20000000 – 93555.00000000R2: 94270.00000000 – 95461.53000000R3: 96887.14000000 – 98345.00000000R4: 103262 – 104550

- 10. Psychological Support:

80000.00000000

- 11. Psychological Resistance:

90000.00000000

- 3. Last 5 days’ closing prices:

2025-12-29: 87237.130000002025-12-30: 88485.490000002025-12-31: 87648.220000002026-01-01: 88839.040000002026-01-02: 89995.13000000

- 4. Volume:

BTC: 17396.9730USD: $1558958860.8871

- 5. Number of trades:

5010211

- 6. Indicators:

RSI: 66.1100MFI: 74.5500BB Upper: 90069.82000000BB Lower: 85742.55000000

- 7. Moving Averages:

SMA:7=88290.6800000014=88101.8300000021=87906.1800000030=88839.3400000050=89404.69000000100=100276.55000000200=106475.70000000EMA:

7=88544.3200000014=88345.6600000021=88571.0700000030=89253.4400000050=91602.09000000100=96942.95000000200=100250.26000000HMA:

7=89457.9600000014=88528.2600000021=88197.7900000030=87616.5000000050=87249.96000000100=83120.75000000200=87446.80000000 - 12. Funding Rate:

0.0048%

- 13. Open Interest:

93941.0260

- 14. Fear & Greed Index:

28 (Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.