Market Analysis

The current market outlook presents a cautiously optimistic picture, though the overall trend remains neutral to bearish. Ongoing global economic tensions and prevailing uncertainties continue to unsettle investor sentiment, a factor that is clearly reflected in the cryptocurrency market's behavior.

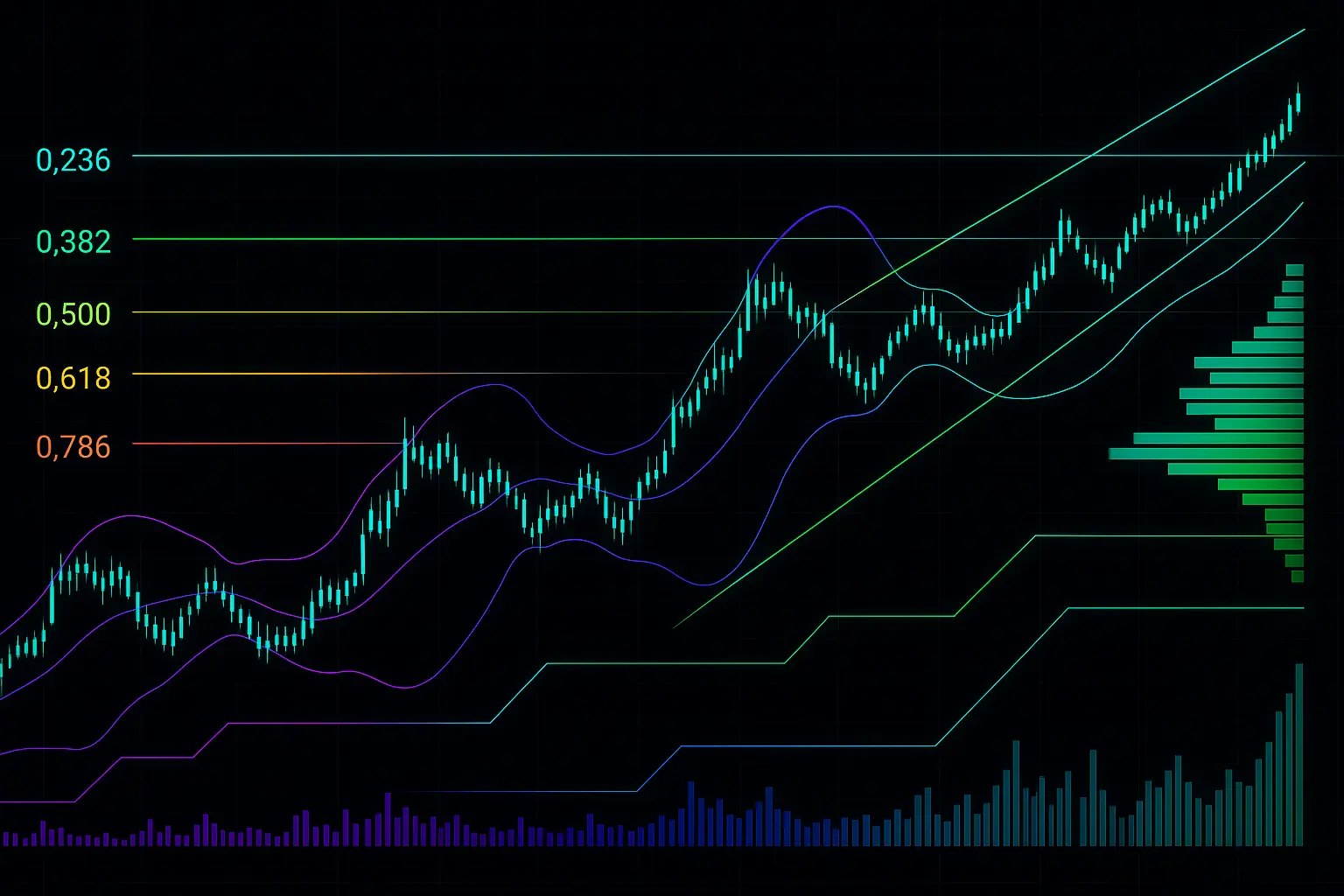

Over the past five days, Bitcoin has experienced notable price fluctuations that have kept market sentiment relatively balanced. On December 5th, the price opened at 92,078 and closed lower at 89,330, indicating a clear dip. However, subsequent days showed gradual recovery, with the price rebounding to 92,678 by December 9th—a sign of renewed strength. The 7-day RSI rose from 44 to 59, suggesting a modest increase in positive momentum, though it stops short of signaling an overbought or strongly bullish phase. Similarly, the 14-day Money Flow Index increased to 64, indicating capital inflow but still reflecting a lack of full investor confidence.

Looking at the Bollinger Bands, the price has hovered near the midline at 89,513 while attempting to approach the upper band at 94,370, which could act as a resistance zone. The Hull Moving Averages for 7, 14, and 21 days have moved from below the price to above it, hinting at a weak yet emerging upward trend. Notably, on December 9th, the 7-day HMA crossed above the price level at 91,551, signaling a short-term uptick in buying interest.

Regarding support and resistance levels, the nearest support zone (S1) lies between 92,552 and 90,791, close to current price levels. Should this break, a stronger support range (S2) between 87,369 and 85,800 could come into play. On the upside, resistance (R1) is identified between 94,270 and 95,461, potentially limiting upward movement. Psychological support at the 90,000 mark remains crucial for stabilizing market sentiment, while the ambitious resistance target around 100,000 still feels distant.

The Fear and Greed Index currently rests near 22, indicating a state of fear among investors, though not extreme panic. This suggests a cautious stance where major decisions are being postponed. A slight decline in open interest and a marginally positive but minimal funding rate further confirm the absence of a strong short-term trend. Economic pressures, high inflation, and geopolitical tensions continue to keep investors on edge, preventing any decisive breakout in Bitcoin’s price.

In summary, Bitcoin's recent price action shows some improvement but remains within a neutral to bearish range. There is a risk of breaking through support levels between 92,500 and 90,700 in the short term; however, if these levels hold, a challenge to resistance near 94,000 could be possible. Given the ongoing global economic uncertainties and prevailing market caution, investors are advised to avoid hasty decisions and wait for clearer technical signals before making significant moves.

Data Summary

- 1. Time:

2025-12-10 – 00:00 UTC - 2. Prices:

Open: 90634.35000000High: 94588.99000000Low: 89500.00000000Close: 92678.80000000

- 8. Supports:

S1: 92552.49000000 – 90791.10000000S2: 87369.96000000 – 85800.00000000S3: 84739.74000000 – 83111.64000000S4: 78595.9 – 76322.4

- 9. Resistances:

R1: 94270.00000000 – 95461.53000000R2: 96887.14000000 – 98345.00000000R3: 103261.60000000 – 104550.33000000R4: 105858 – 106457

- 10. Psychological Support:

90000.00000000

- 11. Psychological Resistance:

100000.00000000

- 3. Last 5 days’ closing prices:

2025-12-05: 89330.040000002025-12-06: 89236.790000002025-12-07: 90395.310000002025-12-08: 90634.340000002025-12-09: 92678.80000000

- 4. Volume:

BTC: 21240.4301USD: $1956261065.6072

- 5. Number of trades:

5940223

- 6. Indicators:

RSI: 59.6100MFI: 65.9500BB Upper: 94370.45000000BB Lower: 84656.18000000

- 7. Moving Averages:

SMA:7=91111.9000000014=90658.4500000021=89513.3200000030=91994.1300000050=98445.22000000100=106271.04000000200=108690.67000000EMA:

7=90946.4000000014=90891.4600000021=91707.2900000030=93334.4800000050=96996.55000000100=102266.51000000200=103482.95000000HMA:

7=91551.0500000014=90881.1200000021=91147.1200000030=90330.8200000050=85730.31000000100=87408.47000000200=97872.52000000 - 12. Funding Rate:

0.0054%

- 13. Open Interest:

87041.2470

- 14. Fear & Greed Index:

22 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.