Market Analysis

The market is showing slight signs of improvement today, but overall conditions still call for a cautious approach. Uncertainties in the global economy have heightened investor hesitation, which is clearly reflected in Bitcoin’s price movements.

An analysis of data from the past five days reveals that despite some price fluctuations, Bitcoin has yet to establish a definitive trend. On December 4th, the price opened at 93,429 and closed lower at 92,078, indicating weakness. This decline continued on December 5th, with the closing price dropping further to 89,330. During this period, the Relative Strength Index (RSI) fell from 54.51 to 44.43, signaling a weakening market and reduced buying momentum. Meanwhile, the Money Flow Index (MFI) rose from 54.69 to 64.11, suggesting some buying pressure, though this contradicts the RSI and presents mixed signals.

December 6th saw relative stabilization, with the price closing at 89,236. The RSI held steady at 44.1, and the MFI slightly decreased to 60.4, highlighting ongoing uncertainty. On December 7th, there was a modest improvement as the price closed at 90,395. The RSI rose to 49.43, and the MFI to 59.52, indicating cautious but positive movement in the market. By December 8th, the price closed at 90,634, with the RSI at 50.57 and MFI at 58.26, pointing to a moderate, yet optimistic trend.

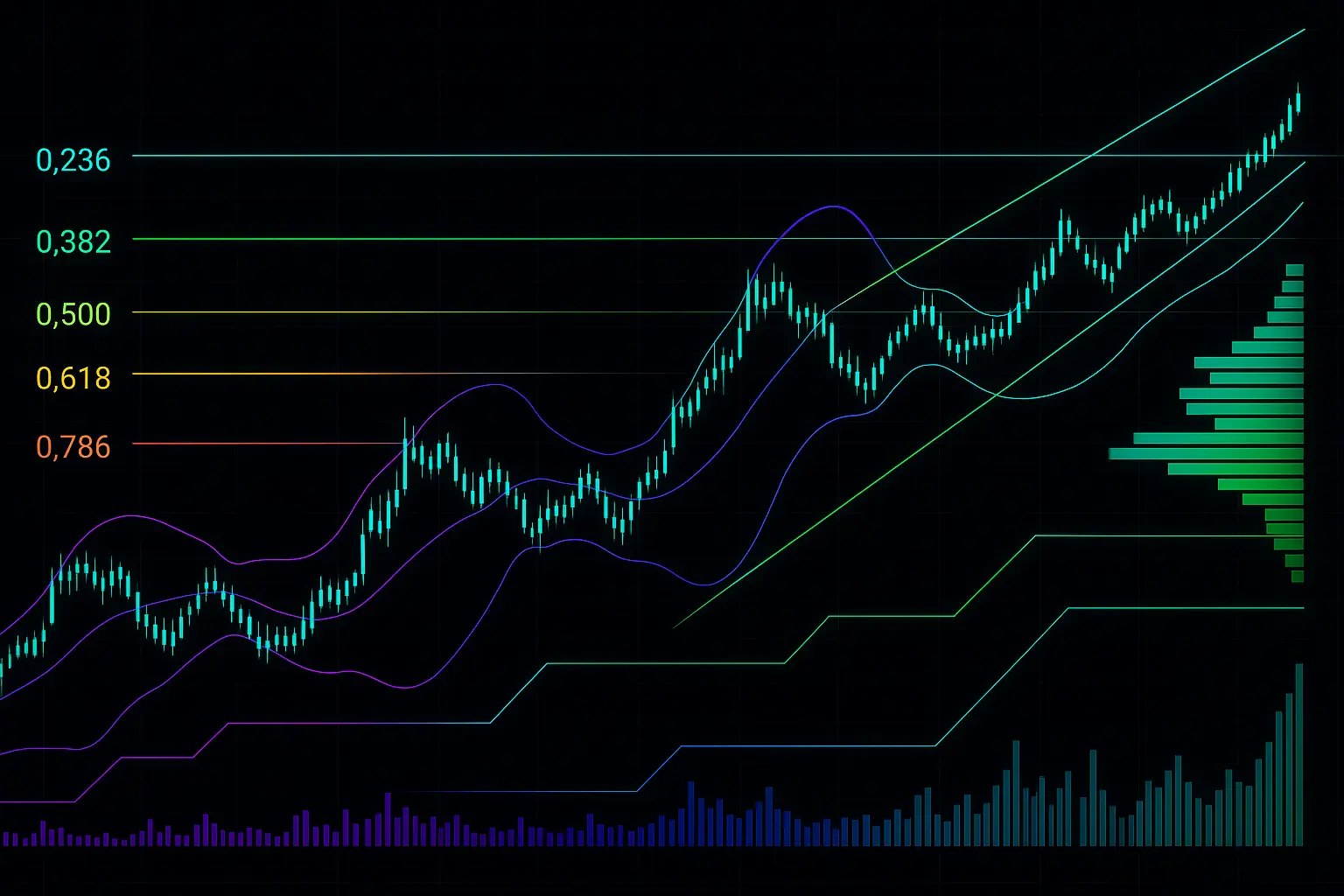

Looking at the Bollinger Bands, prices have predominantly hovered near the midline around 89,526, with the upper band at 94,420 and the lower at 84,633. This clustering around the midline suggests a lack of clear bullish or bearish momentum, indicating a range-bound market. The Fear and Greed Index remains between 20 and 28, reflecting a fearful market sentiment, which has helped strengthen support levels.

Regarding moving averages, the 7-day Hull Moving Average (HMA) stands at 89,820, below the 14-day HMA at 90,568 and the 21-day HMA at 90,993. This positioning indicates short-term moving averages are under some pressure, pointing to a lack of strong upward momentum. Similarly, the 30-, 50-, and 100-day moving averages are all positioned below the current price, suggesting a moderate but fragile uptrend. The 200-day moving average, near 98,348, acts as a significant long-term resistance level.

Support levels are crucial at this point. The S1 zone spans from 89,855 to 88,608, close to today’s price, serving as an important support area. Should this zone fail, the next major support range, S2, lies between 87,369 and 85,800. Additional supports at S3 and S4 levels provide further downside protection but breaching these could signal a stronger bearish trend. On the resistance front, R1 ranges from 91,032 to 92,307, sitting above current prices. A breakout above this level could open the door to R2 and R3 resistance zones, located between 94,270–95,461 and 97,185–98,270 respectively.

Over the past five days, tensions in the global economy have persisted, driven by trade disputes between the US and China and slowing growth in the European Union. Moreover, increasing regulatory concerns within the crypto space have amplified investor anxiety. These factors collectively exert downward pressure on Bitcoin prices, especially as major financial institutions proceed cautiously.

Financing rates have shown mild positivity, but open interest has declined, pointing to weak buying activity or diminished market participation. The low Fear and Greed Index, combined with reduced trading volumes, further indicates that investors remain cautious and are avoiding large-scale commitments.

In summary, Bitcoin’s market currently lacks a clear bullish or bearish direction, maintaining a balanced but cautious stance. Technical indicators and moving averages suggest the market is in a neutral phase, with prices likely to remain within a limited range. Given ongoing global economic uncertainties and crypto regulatory concerns, investor behavior remains conservative, reducing the likelihood of significant price swings in the near term. However, a break below key support levels could accelerate bearish momentum, while surpassing resistance zones might revive bullish prospects. Investors are advised to exercise patience and await clearer market signals before making decisive moves.

Data Summary

- 1. Time:

2025-12-09 – 00:00 UTC - 2. Prices:

Open: 90395.32000000High: 92287.15000000Low: 89612.00000000Close: 90634.34000000

- 8. Supports:

S1: 89855.99000000 – 88608.00000000S2: 87369.96000000 – 85800.00000000S3: 84250.09000000 – 81981.12000000S4: 76322.4 – 76239.9

- 9. Resistances:

R1: 91032.07000000 – 92307.65000000R2: 94270.00000000 – 95461.53000000R3: 97185.18000000 – 98270.00000000R4: 103262 – 104550

- 10. Psychological Support:

90000.00000000

- 11. Psychological Resistance:

100000.00000000

- 3. Last 5 days’ closing prices:

2025-12-04: 92078.060000002025-12-05: 89330.040000002025-12-06: 89236.790000002025-12-07: 90395.310000002025-12-08: 90634.34000000

- 4. Volume:

BTC: 15793.6389USD: $1436920018.8936

- 5. Number of trades:

5458731

- 6. Indicators:

RSI: 50.5700MFI: 58.2600BB Upper: 94420.24000000BB Lower: 84633.25000000

- 7. Moving Averages:

SMA:7=90911.7700000014=90279.2500000021=89526.7500000030=92395.6000000050=98802.29000000100=106432.41000000200=108742.91000000EMA:

7=90368.9400000014=90616.4900000021=91610.1400000030=93379.7000000050=97172.79000000100=102460.20000000200=103591.53000000HMA:

7=89820.7800000014=90568.0300000021=90993.0500000030=89896.7500000050=85429.59000000100=87796.95000000200=98348.25000000 - 12. Funding Rate:

0.0034% (Technically Positive)

- 13. Open Interest:

87157.6650

- 14. Fear & Greed Index:

20 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.