Market Analysis

Bitcoin’s price has recently entered a phase of uncertainty, where despite the Federal Reserve’s interest rate cuts, the market has yet to show a definitive positive response. In such an environment, investors need to adopt a cautious and flexible approach, as the price trajectory is becoming increasingly complex and unpredictable.

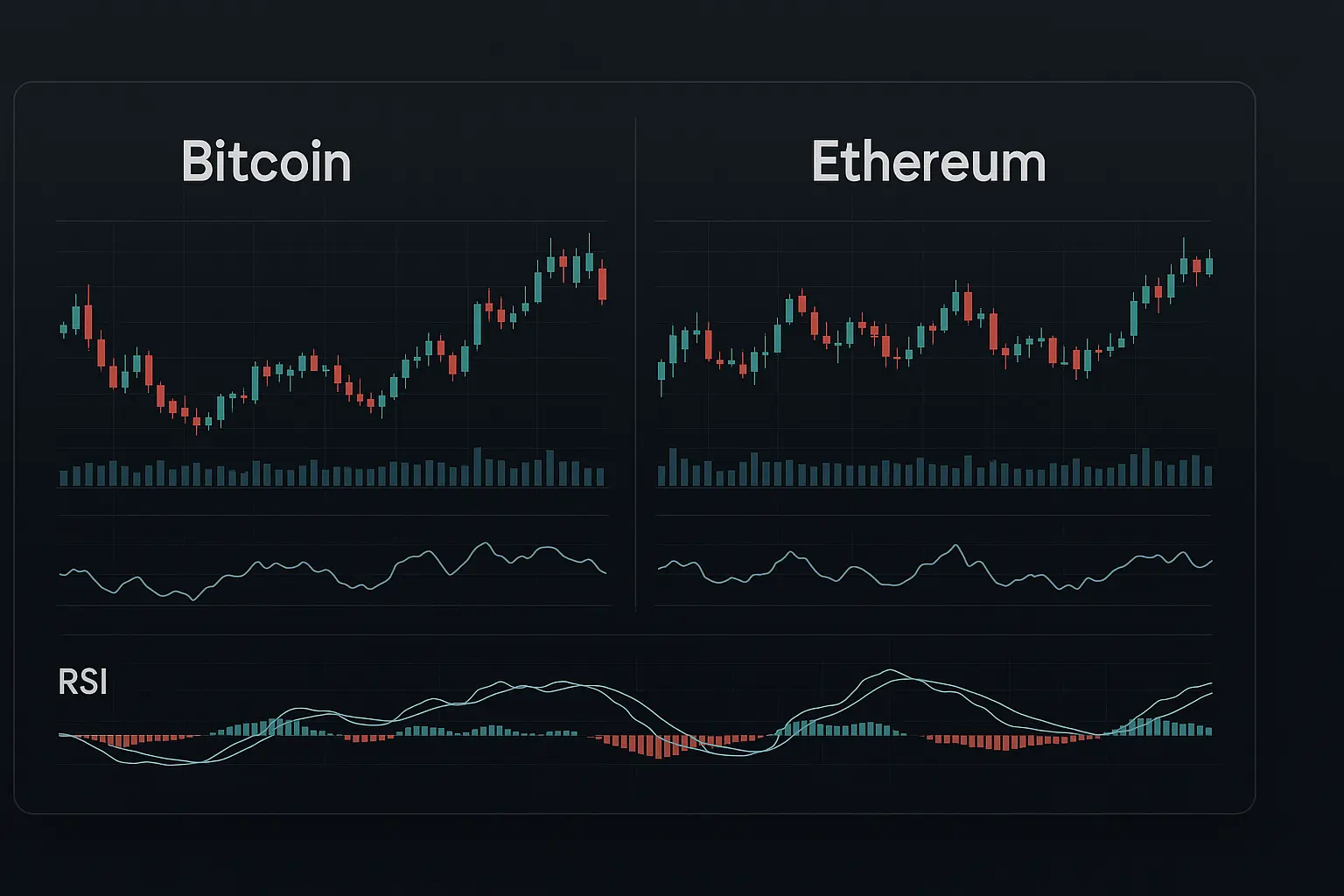

Over the past five days, Bitcoin has experienced significant volatility, with strong resistance observed between the 104,000 to 105,000 range. On November 5th, the price fluctuated between 98,966 and 104,534, closing at 103,885. This movement reflects ongoing buying and selling activity, though with diminished momentum. The Relative Strength Index (RSI) at 7 periods stood at 33.82, indicating a weak downward trend, while the Money Flow Index (MFI) at 14 periods hovered around 40.7, suggesting reduced liquidity and weak buying pressure. The Fear and Greed Index registered a low value of 23, signaling heightened fear and low market confidence.

On November 6th, prices slipped slightly, closing at 101,346 after opening at 103,885. The RSI dropped further to 28.44, reinforcing the bearish outlook, and the MFI fell to 33.82, reflecting continued weak buying interest. Trading volume and activity also declined that day, pointing to reduced market engagement. However, on November 7th, Bitcoin rebounded to 103,339, but with RSI and MFI values of 37.55 and 36.98 respectively, the buying strength remained subdued, offering no clear bullish signals.

From a technical perspective, Bitcoin’s price frequently hovered near the lower Bollinger Bands, indicative of a weak and pressured market. On November 9th, the price reached a high of 105,495 before closing slightly lower at 104,722, close to the resistance zone. The 7-day Hull Moving Average (HMA) settled near 103,400, showing some recent improvement, yet the 14-day and 21-day moving averages still remain above current prices, pointing to medium-term weakness.

Looking at critical support and resistance levels, the support zone between 101,508 and 99,950 appears robust. Should this zone break, the next support lies between 97,700 and 95,676. On the resistance side, the range from 105,857 to 106,457 is key, with a higher challenge looming between 108,816 and 109,450. Psychological support is firmly established at the 100,000 mark, serving as an important reference point, while psychological resistance hovers near 110,000.

The financing rate remains steady at 0.000089, but open interest has decreased by approximately 3%, indicating waning market interest and possibly a rise in short positions. News sentiment largely reflects caution and uncertainty, as Bitcoin’s price has not responded strongly despite the Fed’s rate cuts. Low readings on the Fear and Greed Index further illustrate that investors remain wary and reluctant to commit to large-scale buying.

In summary, Bitcoin’s current market environment is marked by complexity and uncertainty, with near-term price movements potentially trending either up or down. While some technical indicators suggest weakness, the strength of key support levels and modest improvements in moving averages imply that a sudden sharp decline is unlikely. Investors should monitor market fluctuations closely and conduct thorough analysis before making significant decisions, to safeguard against unexpected losses.

Data Summary

- 1. Time:

2025-11-10 – 00:00 UTC - 2. Prices:

Open: 102312.95000000High: 105495.62000000Low: 101400.00000000Close: 104722.96000000

- 8. Supports:

S1: 101508.68000000 – 99950.77000000S2: 97700.59000000 – 95676.64000000S3: 94881.47000000 – 92206.02000000S4: 84474.7 – 83949.5

- 9. Resistances:

R1: 105857.99000000 – 106457.44000000R2: 108816.33000000 – 109450.07000000R3: 116788.96000000 – 117543.75000000R4: 119178 – 121022

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 3. Last 5 days’ closing prices:

2025-11-05: 103885.160000002025-11-06: 101346.040000002025-11-07: 103339.080000002025-11-08: 102312.940000002025-11-09: 104722.96000000

- 4. Volume:

BTC: 16338.9710USD: $1687020822.3668

- 5. Number of trades:

3404204

- 6. Indicators:

RSI: 45.4900MFI: 38.3000BB Upper: 116097.55000000BB Lower: 100375.73000000

- 7. Moving Averages:

SMA:7=103383.7800000014=107091.6800000021=108236.6400000030=108932.7900000050=112051.45000000100=113139.03000000200=109380.77000000EMA:

7=104310.1300000014=106096.3100000021=107461.2700000030=108736.7700000050=110378.36000000100=111065.27000000200=107581.74000000HMA:

7=103400.2800000014=101069.9400000021=101783.9600000030=104418.2900000050=105250.77000000100=109710.81000000200=113379.92000000 - 12. Funding Rate:

0.0089%

- 13. Open Interest:

84277.9060

- 14. Fear & Greed Index:

22 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.