Market Analysis

Bitcoin recently made an attempt to challenge the significant resistance level near 124,000 but was unable to sustain momentum, leading to increased uncertainty within the market. Despite a reduction in the Federal Reserve’s interest rates, Bitcoin’s strength appears to be waning, suggesting short-term pressure on the asset. Investors are advised to carefully evaluate the current technical indicators and market sentiment before making any decisions.

Over the past five days, Bitcoin’s price has experienced notable volatility, reflecting the prevailing uncertainty. On October 26, the price opened at 111,646 and closed slightly higher at 114,559, indicating some early bullish momentum. However, the Relative Strength Index (RSI) declined steadily from 64.63 to 36.4, signaling weakening buying pressure. Meanwhile, the Money Flow Index (MFI) showed a modest uptick from 51.4 to 55.27, suggesting relatively stable capital inflows. The Fear & Greed Index dropped from 40 to 34, highlighting growing market apprehension. Collectively, these indicators point to increasing downside pressure with the potential for further declines.

Examining the Bollinger Bands, Bitcoin's price hovered near the mid-band level of approximately 110,801 on October 26 but moved closer to the lower band around 105,579 by October 30. This shift reflects heightened volatility and a tilt toward bearish short-term momentum. The Hull Moving Averages (HMA) also underscore this trend: the 7-day HMA settled near 109,001, while the 14-day HMA stands around 112,741—both positioned above the current price—indicating weakening trend strength and a possible downward trajectory.

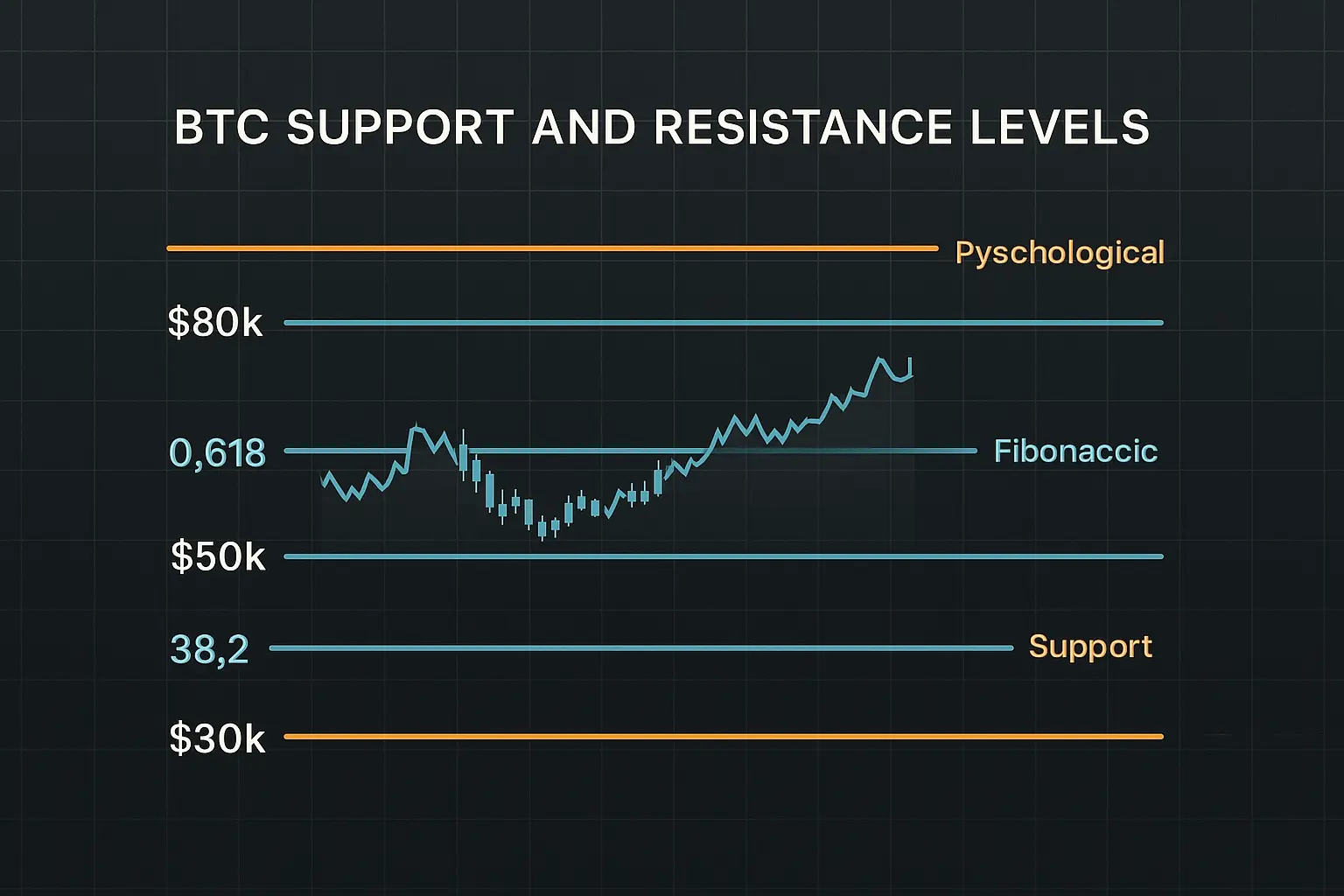

Regarding critical support and resistance levels, the current price is near 108,322, situated within the S1 support zone between 108,262 and 107,172. A breakdown below this range could see the next solid support around the S2 level, spanning 101,508 to 99,950. On the upside, the first resistance band, R1, lies between 108,816 and 109,450, a level that has proven challenging to break given recent closes below it. Should the price manage to surpass R1, the next target would be the R2 range, from 114,271 to 115,127; however, given the prevailing technical and sentiment factors, a strong move upward appears unlikely at this time. Despite the Fed’s rate cuts, investor enthusiasm remains subdued, reflecting ongoing concerns tied to global economic and geopolitical uncertainties.

From a news perspective, Bitcoin’s liquidity and the rising global risk appetite—particularly following positive developments in US-China trade relations—have provided some support. Yet, Bitcoin’s value relative to gold has hit a three-year low, indicating cautious investor behavior. Additionally, increased institutional interest and growing investments in various crypto ETFs offer a positive outlook, though these factors have yet to significantly impact price action. The combination of heightened volatility and rising fear suggests short-term downward pressure is likely to persist.

In summary, the current technical landscape and market sentiment signal mounting short-term pressure on Bitcoin’s price, with downside risks increasingly apparent. Nonetheless, longer-term prospects remain cautiously optimistic, supported by global economic trends and institutional participation. Investors should closely monitor key support and resistance levels while taking into account prevailing market emotions and technical signals to mitigate unexpected losses.

Data Summary

- 1. Time:

2025-10-31 – 00:00 UTC - 2. Prices:

Open: 110021.30000000High: 111592.00000000Low: 106304.34000000Close: 108322.88000000

- 8. Supports:

S1: 108262.94000000 – 107172.52000000S2: 101508.68000000 – 99950.77000000S3: 96945.63000000 – 90056.17000000S4: 87325.6 – 86310

- 9. Resistances:

R1: 108816.33000000 – 109450.07000000R2: 114271.24000000 – 115127.81000000R3: 116788.96000000 – 117543.75000000R4: 123306 – 124197

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 3. Last 5 days’ closing prices:

2025-10-26: 114559.400000002025-10-27: 114107.650000002025-10-28: 112898.450000002025-10-29: 110021.290000002025-10-30: 108322.88000000

- 4. Volume:

BTC: 25988.8284USD: $2827221287.4228

- 5. Number of trades:

6373451

- 6. Indicators:

RSI: 36.4000MFI: 55.2700BB Upper: 116022.43000000BB Lower: 105579.96000000

- 7. Moving Averages:

SMA:7=111794.4000000014=110092.5500000021=110801.1900000030=114167.1500000050=114131.79000000100=114421.43000000200=108252.21000000EMA:

7=110837.3500000014=111244.5500000021=111785.8800000030=112348.6100000050=112971.42000000100=112353.34000000200=107819.62000000HMA:

7=109001.2400000014=112741.8700000021=112243.5000000030=109424.3200000050=109628.34000000100=113193.21000000200=115742.51000000 - 12. Funding Rate:

0.0036% (Technically Positive)

- 13. Open Interest:

78319.0520

- 14. Fear & Greed Index:

34 (Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.