Market Analysis

Bitcoin recently captured investor attention by approaching its peak near 124,000. However, the market is currently exhibiting signs of sluggishness and underlying weakness. Despite the Federal Reserve’s interest rate cuts, Bitcoin has struggled to maintain its price level, suggesting a cautious approach to investment is advisable at this time.

A closer look at Bitcoin’s recent price movements reveals notable selling pressure over the past five days. On October 13, Bitcoin reached a high of 115,963 but has since trended downward. This decline is reflected in the 7-day RSI, which dropped from 43.95 to 25.42 by October 17, indicating diminished buying strength and dominant bearish signals. Similarly, the 14-day Money Flow Index fell from 59.25 to 32.68, pointing to reduced liquidity and heightened investor caution. The Fear & Greed Index also slid from 38 to 22, underscoring growing market apprehension.

The Bollinger Bands show that the price is approaching the lower band, suggesting increased volatility. Bitcoin closed at 106,431 on October 17, close to the lower band level of 104,615, signaling proximity to support but ongoing downward pressure. Examining the Hull Moving Averages (HMA), the 7-day HMA stands near 106,189, close to the current price, while the longer-term HMAs (14, 21, 30, 50, 100, and 200-day) remain upward-trending. This indicates that while the long-term trend is still bullish, short-term weakness is apparent. An expanding gap between the 7-day HMA and the price could signal further declines.

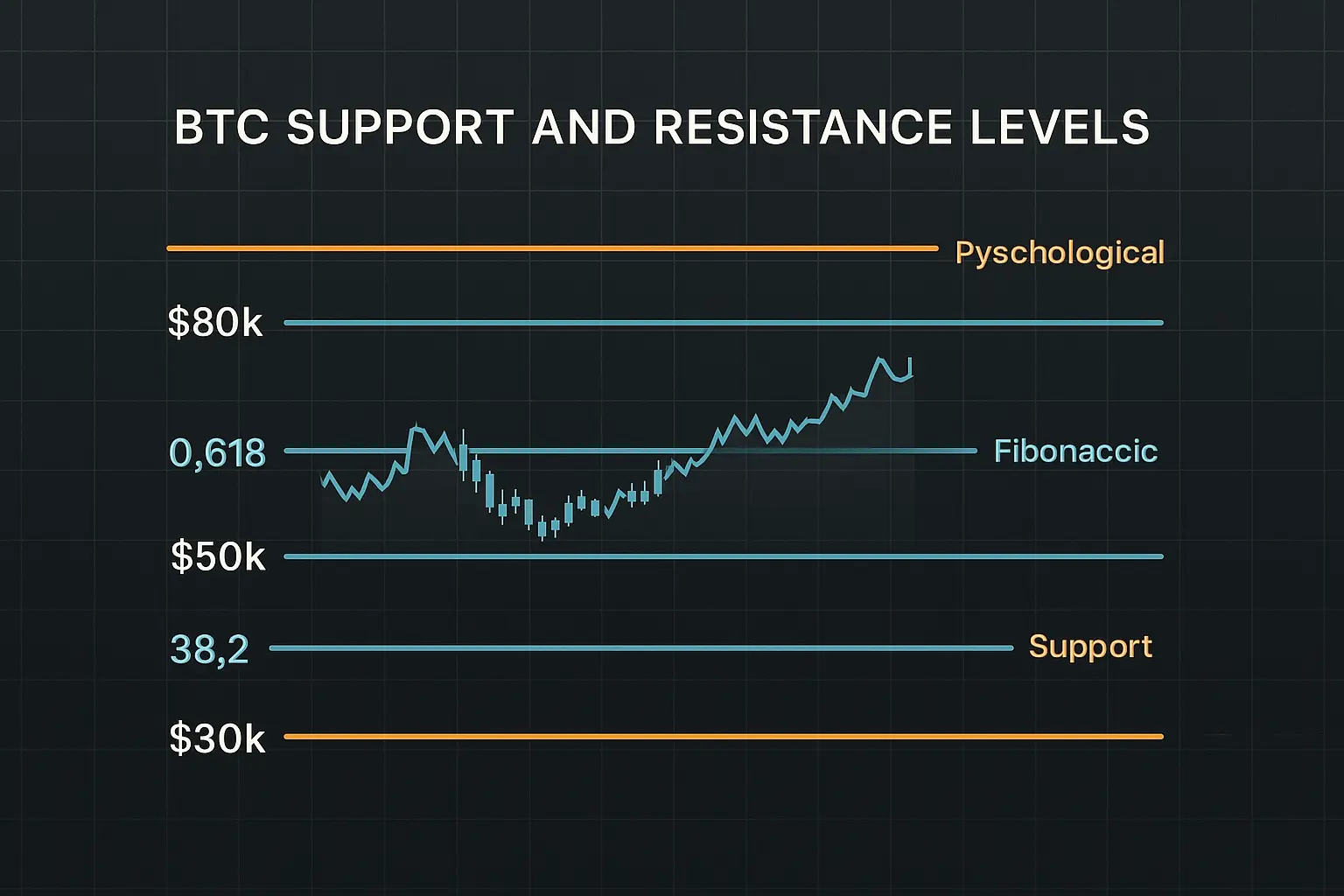

In terms of support and resistance, Bitcoin is currently hovering near the S1 support zone between 105,681 and 104,872. Should this level break, the next support range (S2) lies between 101,508 and 99,950, presenting a critical test for the market. On the upside, resistance is identified between 108,816 and 109,299, representing a key hurdle for any price recovery. Failure to break above this resistance could lead to continued downward movement. Psychological support at the 100,000 mark remains a significant threshold; falling below this could trigger more negative sentiment. Despite Fed rate cuts and large institutional purchases, pervasive market fear is causing investors to remain cautious, resulting in lower liquidity.

Recent developments indicate that major institutions like Strategy and MARA Holdings have increased their Bitcoin holdings during this market dip, signaling long-term confidence. Brazil’s OranjeBTC has also expanded its positions. Such institutional investments provide a positive foundation and could help stabilize prices. However, bearish trends and weakening technical indicators cannot be overlooked. While recent recoveries in meme coins and altcoins have injected some liveliness into the market, Bitcoin’s price stability is yet to be fully restored. Additionally, ongoing geopolitical and economic uncertainties, including U.S.-China trade tensions, continue to exert pressure on the market.

The MACD indicator presents mixed signals. Although the MACD and signal lines are converging, the histogram is shrinking, suggesting weakening buying momentum. A negative funding rate points to an increase in short positions, while open interest has grown by 2.05%, indicating heightened volatility ahead. Volume surged notably on October 17, reflecting increased market activity, but the overall trend remains downward. Combined, these factors reveal rising bearish pressure, though a clear downward trend has yet to be firmly established.

Overall, Bitcoin is at a delicate juncture. Institutional buying is providing support on a longer-term basis, but short-term technical indicators and market sentiment reveal significant vulnerability. Maintaining the S1 support range would be a positive sign; failure to do so could open the door toward lower support levels (S2 and S3). Attention to resistance zones is equally important, as a sustained move above approximately 108,800 would be necessary to restore market strength. Despite the Fed’s rate reductions, persistent fear and uncertainty are prompting investors to proceed with caution. Price fluctuations in the coming days are expected, with possibilities in both directions, though bearish pressure currently dominates the landscape.

Data Summary

- 1. Time:

2025-10-18 – 00:00 UTC - 2. Prices:

Open: 108194.27000000High: 109240.00000000Low: 103528.23000000Close: 106431.68000000

- 8. Supports:

S1: 105681.14000000 – 104872.50000000S2: 101508.68000000 – 99950.77000000S3: 96945.63000000 – 90056.17000000S4: 87325.6 – 86310

- 9. Resistances:

R1: 108816.33000000 – 109299.99000000R2: 111696.21000000 – 112371.00000000R3: 116788.96000000 – 117543.75000000R4: 123306 – 124197

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 3. Last 5 days’ closing prices:

2025-10-13: 115166.000000002025-10-14: 113028.140000002025-10-15: 110763.280000002025-10-16: 108194.280000002025-10-17: 106431.68000000

- 4. Volume:

BTC: 37920.6684USD: $4022645635.2212

- 5. Number of trades:

7570685

- 6. Indicators:

RSI: 25.4200MFI: 32.6800BB Upper: 127375.06000000BB Lower: 104615.98000000

- 7. Moving Averages:

SMA:7=111312.3700000014=116342.4500000021=115995.5200000030=115430.9500000050=114164.87000000100=114873.60000000200=106488.20000000EMA:

7=111184.6400000014=113609.8700000021=114425.6500000030=114724.3700000050=114633.47000000100=112916.23000000200=107459.07000000HMA:

7=106189.5500000014=108040.2400000021=110021.1500000030=115003.8000000050=117163.89000000100=116073.68000000200=118454.07000000 - 12. Funding Rate:

-0.0003% (Technically Positive)

- 13. Open Interest:

79755.5530

- 14. Fear & Greed Index:

22 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.