Market Analysis

Bitcoin has recently approached the 124,000 level multiple times but has been unable to sustain gains, leading to increased uncertainty within the market. Despite a reduction in the Federal Reserve’s interest rates, investor confidence appears fragile, signaling the possibility of downward pressure on prices.

An analysis of Bitcoin’s data over the past five days reveals significant volatility and prevailing uncertainty. The 7-day Relative Strength Index (RSI) dropped sharply from 61.2 on October 7 to 28.11 by October 11, indicating a notable decline in buying momentum. Similarly, the Money Flow Index (MFI) fell from 67.57 to 52.03, reflecting reduced cash flow into the market. The Fear & Greed Index also plunged dramatically from 70 to 27, highlighting a growing atmosphere of fear among investors. These technical and sentiment indicators point toward underlying market weakness, especially following the sharp price drop on October 10 that touched a low near 102,000.

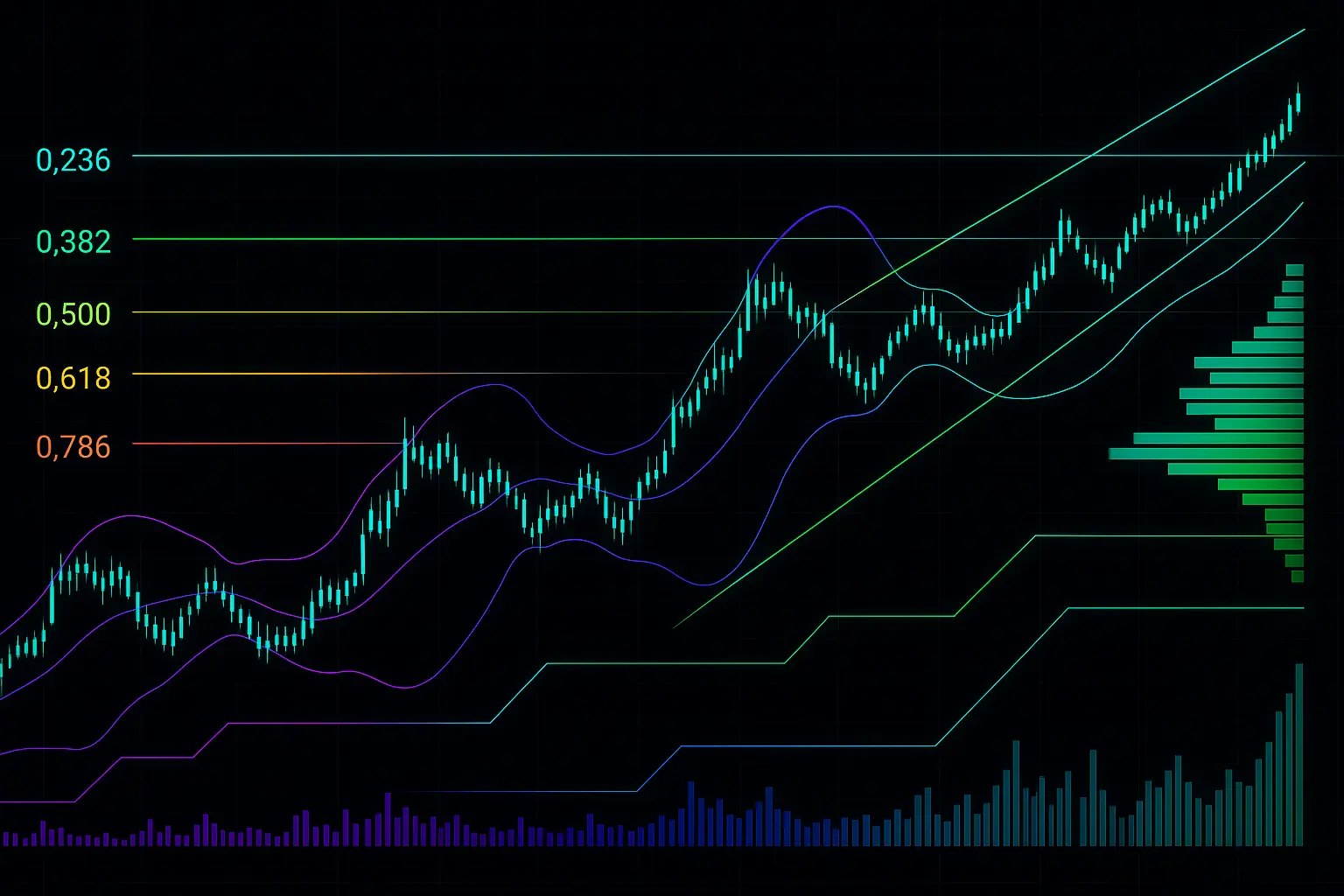

Looking at the Bollinger Bands, the price hit the upper band on October 7, typically a sign of overbought conditions. However, this was followed by a rapid decline, with prices nearing the lower band by October 10, signaling heightened selling pressure and increased volatility. These bands effectively illustrate the market’s swiftly changing trends. Moving averages are also signaling weakness; the 7-day Hull Moving Average (HMA) has been trending downward, closing at 110,873 on October 11, reflecting a bearish pattern. Furthermore, the 14-, 21-, and 30-day moving averages are all declining, suggesting medium- to long-term weakness.

Regarding support and resistance levels, Bitcoin closed at 110,644 on October 11, hovering near the key psychological support at 110,000. If this support fails, the next critical levels to watch are S1 (108,377–107,172), S2 (105,681–104,872), and S3 (101,508–99,950). On the upside, resistance zones at R1 (111,696–112,371), R2 (116,788–117,543), and R3 (119,177–121,022) will pose significant challenges for any market recovery. Additionally, low financing rates combined with a 24.93% drop in open interest reflect weakening market engagement, indicating short-term selling pressure.

Market sentiment is further influenced by recent news developments. Bitcoin’s price has declined from recent record highs, with significant holders transferring coins to exchanges—a potential precursor to price corrections. Despite the Federal Reserve’s rate cuts, economic uncertainties and concerns surrounding a possible U.S. government shutdown have contributed to cautious investor behavior. Moreover, even with growing demand for ETFs, volatility remains elevated. The rising fear levels indicated by the Fear & Greed Index and fluctuating trading volumes suggest the market is currently under pressure, with a likelihood of further downside in the short term. However, the fundamental outlook for Bitcoin over the long term remains relatively strong.

Overall, recent price fluctuations and technical signals point to a vulnerable market condition, especially as prices hover near critical support levels and volatility intensifies. Investors are advised to exercise caution and await clearer market signals before making decisive moves. While there is a risk of further declines in the short term, a stable hold above support might pave the way for a recovery. Understanding the market dynamics and avoiding emotionally driven decisions will be crucial during this period.

Data Summary

- 1. Time:

2025-10-12 – 00:00 UTC - 2. Prices:

Open: 112774.49000000High: 113322.39000000Low: 109561.59000000Close: 110644.40000000

- 8. Supports:

S1: 108377.40000000 – 107172.52000000S2: 105681.14000000 – 104872.50000000S3: 101508.68000000 – 99950.77000000S4: 94881.5 – 92206

- 9. Resistances:

R1: 111696.21000000 – 112371.00000000R2: 116788.96000000 – 117543.75000000R3: 119177.56000000 – 121022.07000000

- 10. Psychological Support:

110000.00000000

- 11. Psychological Resistance:

120000.00000000

- 3. Last 5 days’ closing prices:

2025-10-07: 121332.950000002025-10-08: 123306.000000002025-10-09: 121662.400000002025-10-10: 112774.500000002025-10-11: 110644.40000000

- 4. Volume:

BTC: 35448.5165USD: $3961069473.2311

- 5. Number of trades:

6661929

- 6. Indicators:

RSI: 28.1100MFI: 52.0300BB Upper: 126854.95000000BB Lower: 106024.37000000

- 7. Moving Averages:

SMA:7=119694.4400000014=118408.5900000021=116439.6600000030=116307.4500000050=114374.12000000100=114657.33000000200=105711.12000000EMA:

7=117224.2400000014=117653.4200000021=117147.2300000030=116529.3000000050=115563.98000000100=113120.55000000200=107217.30000000HMA:

7=110873.4100000014=118810.3300000021=122558.0300000030=121752.5600000050=119568.39000000100=115803.90000000200=118635.87000000 - 12. Funding Rate:

0.0005% (Technically Positive)

- 13. Open Interest:

72613.7820

- 14. Fear & Greed Index:

27 (Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.