Market Analysis

Bitcoin’s price has experienced significant fluctuations over the past week, influenced by global economic factors and major investment decisions. In this analysis, we delve into the latest news and market sentiment to assess the current trajectory of Bitcoin’s price and identify potential trends.

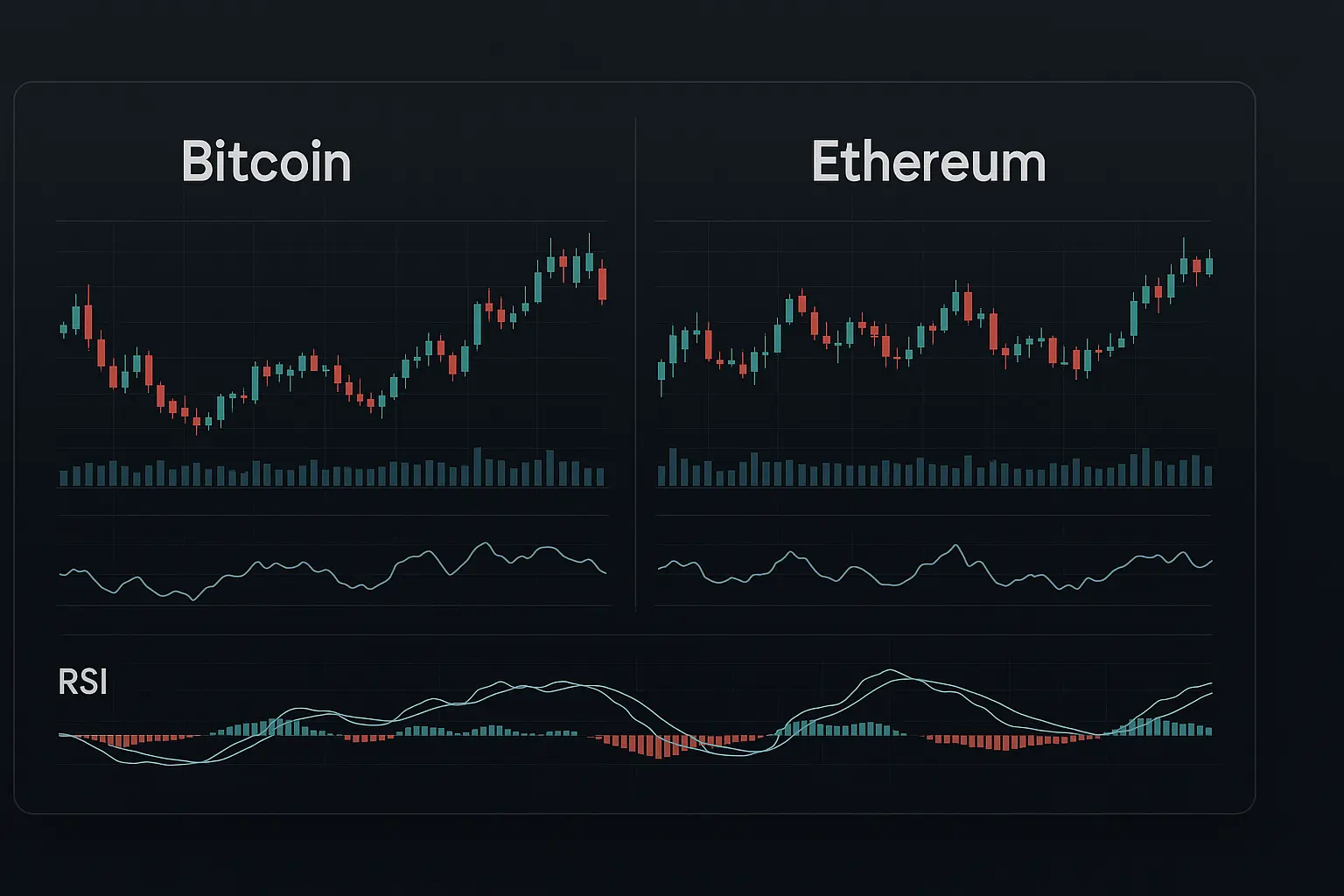

Over the past five days, Bitcoin has seen a noticeable decline, reflecting broader financial uncertainty worldwide and increased volatility within the crypto market. On August 12, Bitcoin closed near 120,134 USDT, but prices steadily dropped to approximately 112,500 USDT by August 21. The Relative Strength Index (RSI) fell from 69 to around 35, signaling weakening momentum. Meanwhile, the Money Flow Index (MFI) remained relatively stable near 50, indicating no significant shifts in capital inflow or outflow. The Fear and Greed Index also dropped from 68 to 50, suggesting a balanced market mood; however, investors are maintaining a cautious stance.

Looking at the Bollinger Bands, Bitcoin touched the upper band on August 12, followed by an expansion of the bands. As prices declined, the bands began to contract, with the price approaching the lower band by August 21, hinting at a potential support level. Despite this, the ongoing price drop alongside decreasing trading volume points to weak demand. Volume data shows elevated activity on August 18 and 19, but this was dominated by selling pressure due to falling prices. Additionally, the number of trades has declined, reflecting investor uncertainty.

Examining the Hull Moving Averages (HMA), all moving averages have trended downward since August 12, with prices closing below these levels—an indication of bearish momentum. Notably, the 7- and 14-day HMAs remain above the current price, signaling short-term selling pressure. In contrast, the 21- and 30-day moving averages demonstrate relative stability, suggesting some mid-term support for the price. Psychologically significant support stands at 110,000 USDT, near the price level reached on August 21. Should this level fail, secondary support zones lie between 105,681 to 104,872 USDT and then 101,508 to 99,950 USDT. Breaking these ranges could open the door for further declines. On the resistance side, key levels are found between 114,271 to 115,127 USDT and 119,177 to 120,998 USDT, where upward momentum may encounter obstacles.

From a news perspective, increased buying activity by large investors and potential institutional investments are positive signals for the market. However, ongoing global economic uncertainties, fluctuations in the US stock market, and declining prices across various cryptocurrencies have dampened market sentiment. Particularly, reductions in Bitcoin’s ETF holdings and a rising number of liquidations have heightened investor anxiety. Growing concerns around Bitcoin’s privacy features are also posing challenges for long-term investment confidence. Still, purchases by major “whales” can be interpreted as a sign of confidence, as these actors may view the current dip as a buying opportunity.

Overall, Bitcoin is at a delicate juncture, facing short-term downward pressure. Nevertheless, mid-term support levels and the prospect of institutional investment could help stabilize the price. Market sentiment is relatively balanced for now, but developments in global finance and sector-specific news will continue to influence Bitcoin’s direction. Investors are advised to exercise caution and closely monitor support and resistance levels to navigate potential volatility.

Data Summary

- 1. Time:

2025-08-22 – 00:00 UTC - 2. Prices:

Open: 114271.23000000High: 114821.76000000Low: 112015.67000000Close: 112500.00000000

- 8. Supports:

S1: 105681.14000000 – 104872.50000000S2: 101508.68000000 – 99950.77000000S3: 96945.6 – 90056.2

- 9. Resistances:

R1: 114271.24000000 – 115127.81000000R2: 119177.56000000 – 120998.71000000

- 10. Psychological Support:

110000.00000000

- 11. Psychological Resistance:

120000.00000000

- 3. Last 5 days’ closing prices:

2025-08-12: 120134.080000002025-08-18: 116227.050000002025-08-19: 112872.940000002025-08-20: 114271.240000002025-08-21: 112500.00000000

- 4. Volume:

BTC: 10839.6924USD: $1227373788.6156

- 5. Number of trades:

2357380

- 6. Indicators:

RSI: 35.3800MFI: 52.9000BB Upper: 120746.40000000BB Lower: 111430.50000000

- 7. Moving Averages:

SMA:7=116283.6200000014=115927.1600000021=116088.4500000030=116695.1200000050=114940.54000000100=110349.21000000200=100105.74000000EMA:

7=115016.9300000014=115717.6300000021=115844.8400000030=115575.7100000050=114153.79000000100=109734.35000000200=102343.33000000HMA:

7=111614.0100000014=115155.7000000021=116534.1100000030=116090.6500000050=116570.86000000100=119628.18000000200=120037.43000000 - 12. Funding Rate:

0.0074%

- 13. Open Interest:

85994.2630

- 14. Fear & Greed Index:

50 (Neutral)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.