Market Analysis

**Introduction:**

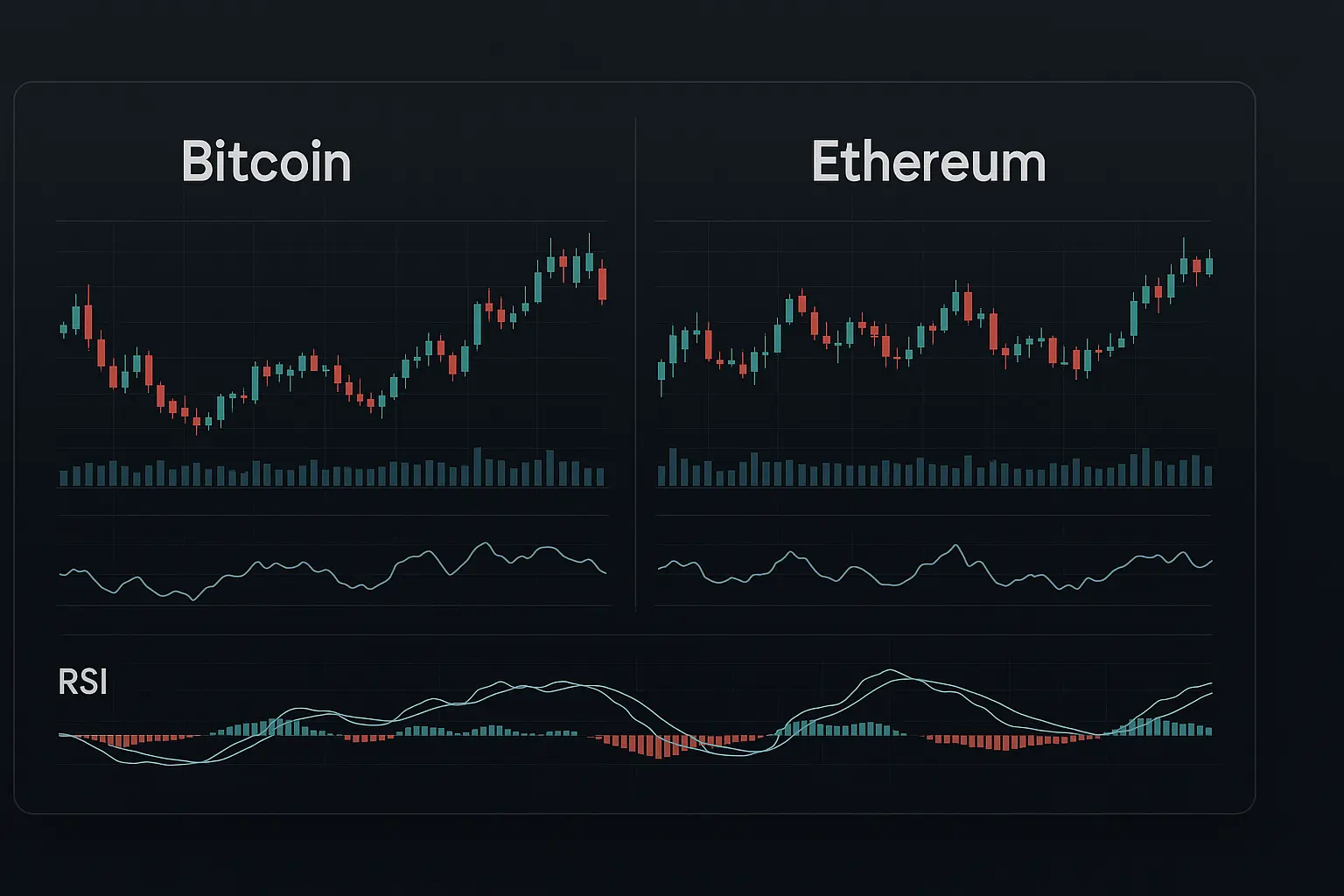

In today’s analysis, we will closely examine how recent political tensions and technical hurdles have impacted Bitcoin’s price movement. The escalating conflict between Israel and Iran has introduced a significant level of uncertainty into the market. Alongside these geopolitical factors, Bitcoin’s technical price structure continues to play a crucial role, offering valuable insights into the cryptocurrency’s potential trajectory.

**Analysis:**

Over the past several days, Bitcoin has attempted to break above the sideways trading range between 85,000 and 110,000 but was unable to surpass the critical liquidity cluster near 113,000. Once again, the price failed to breach the upper boundary of this range. Heightened political tensions have amplified fear and uncertainty in the market, exerting downward pressure and pushing Bitcoin’s price closer to 103,000.

Guided by technical indicators and market sentiment, we will take a comprehensive look at Bitcoin’s current price dynamics, key support and resistance levels, and possible future trends to help investors make informed decisions.

The combination of geopolitical developments and technical constraints has created a complex environment that warrants careful scrutiny in order to better understand the market’s direction.

Looking at data and news from the past five days: On June 9, Bitcoin traded within a solid range from 105,734 to 110,530, closing at 110,263. This reflected a temporarily positive market sentiment. The Relative Strength Index (RSI) stood at 70.42, and the Money Flow Index (MFI) was 40.91—both indicating strong buying interest, though not yet overbought. The MACD indicator was positive, and the Fear & Greed Index registered 62, pointing to moderate market optimism. Trading volume was robust, signaling active participation.

On June 10, prices showed relative stability, opening at 110,263 and closing almost unchanged at 110,274, while the intra-day high-low range narrowed. RSI and MFI hovered near 70, with a slight uptick in MACD. Meanwhile, the Fear & Greed Index rose to 71, suggesting increased enthusiasm. However, a drop in trading volume hinted at a slowing momentum in buying pressure.

June 11 marked a shift as Bitcoin declined from 110,274 to close at 108,645. RSI dropped to 59.71, signaling weakening buying strength, while MFI remained steady at 50.64. MACD gained momentum, but decreased volume and a steady Fear & Greed Index of 72 suggested cautious optimism. Notably, news of Israeli strikes on Iran emerged this day, fueling market uncertainty and adding downward pressure on prices.

On June 12, the decline became more evident, with Bitcoin closing at 105,671 after falling below 108,645 during the day. RSI dipped to 45.08, indicating a move toward a weaker, neutral trend. MFI held at 51.14, suggesting some liquidity in the market. MACD fell to 1214, while volume and trade count increased, pointing to heightened selling activity. The Fear & Greed Index remained elevated at 71, but political escalation and retaliatory strikes between Israel and Iran intensified fear, negatively impacting prices.

June 13 saw further price erosion as Bitcoin fell to close at 106,066, showing some signs of stabilization. RSI rose slightly to 47.09 from below, indicating a weak but neutral stance. MFI remained stable at 50.52, while MACD decreased to 1068. Notably, volume and trade numbers surged, reflecting growing market activity. However, the Fear & Greed Index declined to 61, pointing to rising apprehension. Bitcoin once again tried to break above the 85,000–110,000 range but could not overcome the 113,000 liquidity cluster, ultimately retreating toward 103,000.

Concerning moving averages, from June 12-13, the 7, 14, and 21-day Simple and Exponential Moving Averages closely tracked the price, signaling a stable short-term trend. However, the Hull Moving Average dipped below the price on June 13 for the 7-day period, hinting at weakening momentum. The 50 and 100-day moving averages remained below the current price, offering mid-term support. Should the support zone between 103,985 and 103,105 break, the next key support lies between 101,508 and 99,950—around the psychologically important 100,000 level. On the resistance side, ranges from 106,133 to 108,891 and then 110,274 to 110,797 will pose significant hurdles to any upward movement.

Bollinger Bands have also illustrated the recent volatility. On June 13, Bitcoin touched the lower band before retracing toward the middle band, possibly signaling a reversal or weakening momentum. The expanding band width points to increased market volatility driven by the interplay of political and technical factors.

Regarding market sentiment, the financing rate is slightly positive but minimal, while open interest has declined by 3.44%, indicating somewhat reduced market engagement. The Fear & Greed Index’s downward trend underscores growing anxiety, largely fueled by geopolitical tension and technical obstacles. Major investors and institutional players appear cautious, with bearish sentiment becoming dominant.

In summary, recent geopolitical conflicts combined with technical resistance have unsettled Bitcoin’s price action. Its inability to surpass the upper boundary of the 85,000–110,000 range and the resistance around the 113,000 liquidity cluster have kept the price under pressure. RSI and MFI readings suggest a weak but neutral posture, while rising volume and trade counts denote active market participation. Support near 103,000 seems relatively robust, though further declines remain possible amid ongoing political tension. Should the price fall below this level, close attention to subsequent support zones will be critical. Presently, fear dominates market sentiment, and investors are advised to proceed cautiously, carefully weighing both technical and fundamental factors before making significant moves.

Data Summary

- 1. Time:

2025-06-14 – 00:00 UTC - 2. Prices:

Open: 105671.74000000High: 106179.53000000Low: 102664.31000000Close: 106066.59000000

- 3. Last 5 days’ closing prices:

2025-06-09: 110263.020000002025-06-10: 110274.390000002025-06-11: 108645.120000002025-06-12: 105671.730000002025-06-13: 106066.59000000

- 4. Volume:

BTC: 26180.8173USD: $2735461890.6930

- 5. Number of trades:

5452577

- 6. Indicators:

RSI: 47.0900MFI: 50.5200BB Upper: 110994.65000000BB Lower: 102021.23000000MACD: 1068.95000000Signal: 1274.52000000Histogram: -205.57000000

- 7. Moving Averages:

SMA:7=107458.1400000014=106012.1900000021=106507.9400000030=106485.2500000050=103173.73000000100=93799.40000000200=95583.36000000EMA:

7=106876.4900000014=106557.0800000021=106083.0100000030=105111.0100000050=102547.85000000100=98183.78000000200=92312.46000000HMA:

7=105893.7900000014=108687.3900000021=107608.6600000030=106261.7100000050=107752.47000000100=111467.83000000200=100549.49000000 - 8. Supports:

S1: 103985.48000000 – 103105.09000000S2: 101508.68000000 – 99950.77000000S3: 96945.63000000 – 90056.17000000S4: 87325.6 – 86310

- 9. Resistances:

R1: 106133.74000000 – 108891.91000000R2: 110274.39000000 – 110797.38000000

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 12. Funding Rate:

0.0039% (Technically Positive)

- 13. Open Interest:

79455.0850

- 14. Fear & Greed Index:

61 (Greed)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.