House Democrats Near Impeachment Vote Against Trump (imported from Binance News)

Crypto Rover posted on X. House Democrats are reportedly close to securing enough votes to impeach U.S. President Donald Trump, with only five more needed to reach the required number. The push for impeachment is aimed to be completed before March 31. This development comes amid ongoing political tensions and debates within the U.S. government regarding Trump’s presidency and actions. The situation remains dynamic as both parties continue to strategize their next moves in this high-stakes political scenario.

US Government Investigating Alleged $40 Million Crypto Theft by Federal Contractor’s Son

Bitcoin Magazine US Government Investigating Alleged $40 Million Crypto Theft by Federal Contractor’s Son Members of the U.S. government are investigating allegations that tens of millions of dollars in cryptocurrency seized by law enforcement were stolen through insider access via a federal contractor, according to public statements from officials. The U.S. Marshals Service (USMS) confirmed to CoinDesk that it is investigating claims that more than $40 million in confiscated digital assets were siphoned from government-linked wallets. The allegations center on Command Services & Support (CMDSS), a Virginia-based technology firm contracted by the USMS to manage and dispose of certain categories of seized cryptocurrency. Blockchain investigator ZachXBT alleged that John “Lick” Daghita — the son of CMDSS president and chief executive Dean Daghita — gained unauthorized access to crypto wallets holding government-seized digital assets and diverted funds for personal use. ZachXBT said he reported the alleged activity to authorities and linked multiple wallet addresses to assets controlled by or associated with the USMS. Brady McCarron, chief of public affairs for the USMS, told CoinDesk that the agency could not comment further on the case because investigations were underway. Details of the digital asset theft fraud The allegations first surfaced after a dispute in a private Telegram chat was recorded and later circulated online. According to ZachXBT, the individual identified as “Lick” appeared to screen-share a wallet holding millions of dollars in cryptocurrency and demonstrated the ability to move funds in real time. Subsequent on-chain analysis linked those wallets to addresses known to hold government-seized assets, including funds associated with prior high-profile law enforcement seizures. “Meet the threat actor John (Lick), who was caught flexing $23M in a wallet address directly tied to $90M+ in suspected thefts from the US Government in 2024 and multiple other unidentified victims from Nov 2025 to Dec 2025,” ZachXBT wrote on X over the weekend. ZachXBT later identified the individual as John Daghita, alleging that he is the son of CMDSS’s president and that CMDSS currently holds an active federal IT contract. CMDSS was awarded a contract in October 2024 to assist the USMS in managing and disposing of seized and forfeited digital assets, including crypto not supported by major exchanges and assets tied to complex criminal cases. Those crypto assets reportedly include funds seized from the 2016 Bitfinex hack, one of the largest cryptocurrency thefts on record. ZachXBT has said it remains unclear how John Daghita allegedly obtained access to the wallets, including whether that access was facilitated through his father or CMDSS’s internal systems. According to ZachXBT, one wallet he attributed to Daghita held 12,540 ether — worth roughly $36 million at recent prices. He also alleged that Daghita sent him 0.6767 ETH, which the investigator said he would forward to a U.S. government seizure address. ZachXBT further claimed that transaction trails suggest approximately $20 million was removed from USMS-linked wallets in October 2024, most of which was returned within a day, though roughly $700,000 routed through instant exchanges was not recovered. In additional posts, ZachXBT estimated that total suspected thefts could exceed $90 million in various crypto when accounting for other wallet activity observed in late 2025, some of which he said remains in compromised wallets. United States’s bitcoin security under scrutiny The allegations have raised valid concerns over how the U.S. government safeguards its growing stockpile of seized bitcoin and other digital assets. The federal government may control between roughly 198,000 BTC and more than 300,000 BTC, worth tens of billions of dollars at current market prices. According to bitcointreasuries.net, the U.S. government holds 328,372 bitcoin worth roughly $29 billion. The controversy comes amid heightened scrutiny of how seized bitcoin is handled following reports earlier this year questioning whether forfeited assets tied to the Samourai Wallet case were improperly sold despite executive orders directing that seized bitcoin be retained as part of a U.S. Strategic Bitcoin Reserve. While U.S. officials later denied that any sale took place, the lack of on-chain evidence provided publicly has continued to fuel skepticism. This post US Government Investigating Alleged $40 Million Crypto Theft by Federal Contractor’s Son first appeared on Bitcoin Magazine and is written by Micah Zimmerman. Original and detailed news is here: Read More

39% of U.S. Merchants Now Accept Crypto, PayPal Survey Finds

Bitcoin Magazine 39% of U.S. Merchants Now Accept Crypto, PayPal Survey Finds Crypto is no longer niche bar-talk. It has become a part of mainstream commerce in the United States. A new survey conducted jointly by the National Cryptocurrency Association (NCA) and PayPal reveals that nearly 4 in 10 U.S. merchants (39%) now accept digital assets at checkout, with overwhelming consensus that crypto payments will become a standard option within the next five years. The survey, which polled 619 payment decision-makers across retail, e-commerce, hospitality, luxury goods, and digital gaming sectors, highlights customer demand as the primary driver of adoption. Nearly nine in ten merchants (88%) report receiving inquiries from customers about paying with cryptocurrency, and more than two-thirds (69%) say customers request these payments at least once a month. For businesses already accepting digital currencies, crypto is no longer a novelty: it accounts for over a quarter (26%) of sales, with roughly 72% of merchants reporting growth in transactions over the past year. “What we’re seeing both in this data and in conversations with our customers is that crypto payments are moving beyond experimentation and into everyday commerce,” said May Zabaneh, Vice President and General Manager of Crypto at PayPal. “Adoption is being driven by customer demand for faster, more flexible ways to pay — and once businesses start accepting crypto, they see real value.” Zabaneh emphasized that when crypto payments are integrated as seamlessly as traditional cards or online payments, they can become a powerful tool to attract new customers and improve cash flow. Crypto adoption in large enterprises Adoption is strongest among larger enterprises. According to the survey, 50% of companies earning over $500 million annually accept digital assets, compared to 34% of small businesses and 32% of midsize firms. The data also shows that younger shoppers are fueling demand, with 77% of Millennials and 73% of Gen Z or younger customers expressing interest in using digital assets. Small businesses, in particular, report high engagement from Gen Z, with 82% of inquiries coming from this demographic. Merchants cite several key benefits to accepting digital assets, including faster transaction speed (45%), access to new customers (45%), enhanced security (41%), and greater privacy for buyers (40%). Industries leading adoption include hospitality and travel (81%), digital goods, gaming, and luxury retail (76%), as well as retail and e-commerce (69%), where speed, global reach, and digital-native audiences play a significant role. Despite the momentum, simplicity and usability remain barriers to wider adoption. The survey found that 90% of merchants would consider accepting digital assets if the setup were as straightforward as accepting credit cards, and the same percentage said they would adopt it if the payment experience were as seamless as traditional methods. “Interest isn’t the problem; understanding is,” said Stu Alderoty, President of the NCA. “Partnerships with trusted platforms like PayPal are crucial to bridge the knowledge gap and demonstrate that crypto can be simple, accessible, and effective for everyday businesses and consumers.” This post 39% of U.S. Merchants Now Accept Crypto, PayPal Survey Finds first appeared on Bitcoin Magazine and is written by Micah Zimmerman. Original and detailed news is here: Read More

Crypto money laundering balloons to $82B as Chinese-language services dominate, Chainalysis says

Chinese-language networks now handle a disproportionate share of global crypto money laundering flows, according to a new Chainalysis report. Original and detailed news is here: Read More

Privacy-focused Miden, Korea Digital Asset agree to build crypto infrastructure for institutional adoption

The partnership focuses on privacy, compliance and standards for regulated digital-asset adoption in South Korea. Original and detailed news is here: Read More

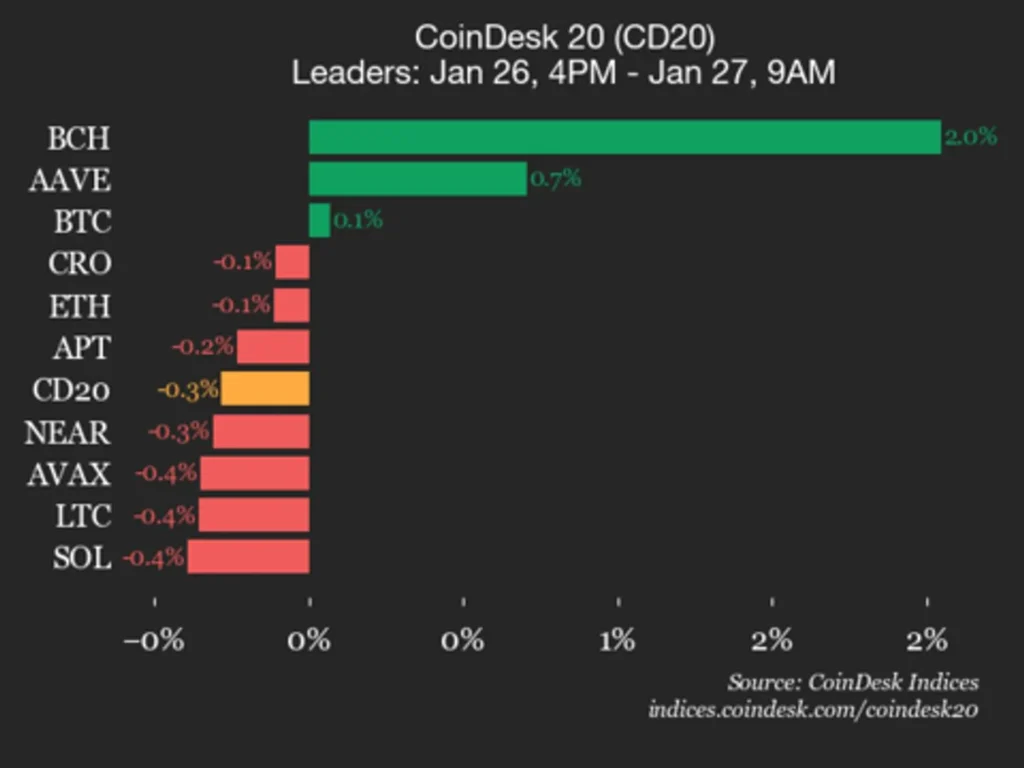

CoinDesk 20 Performance Update: Bitcoin Cash (BCH) Gains 2% While Index Declines

Polygon (POL) fell 3.1% and Internet Computer (ICP) dropped 3%, leading index lower. Original and detailed news is here: Read More

Standard Chartered says U.S. regional banks most at risk in $500 billion stablecoin shift

The delay of market structure legislation highlights a growing threat to domestic lenders as digital dollars begin to cannibalize traditional bank deposits. Original and detailed news is here: Read More

WH advisor Patrick Witt: Davos 2026 was ‘turning point’ for global crypto normalization

White House crypto advisor Patrick Witt said stablecoins are the “gateway drug” for global finance and that Washington is racing to deliver regulatory clarity. Original and detailed news is here: Read More

HYPE token surges 24% as silver futures volume soars on Hyperliquid exchange

Silver futures on the crypto derivatives exchange are currently showing $1.25 billion in volume and $155 million in open interest. Original and detailed news is here: Read More

Rick Rieder, a rising favorite for Trump’s Fed chair pick, sees bitcoin as new gold

As Trump mulls the next leader of the U.S. Federal Reserve, the BlackRock executive has caught a surge of online wagers, and he’d bring a pro-crypto view. Original and detailed news is here: Read More