From BlackRock’s ambitious push for blockchain tokenization to Coinbase’s legal battle over crypto classification, the industry is navigating a critical period of transformation. On the global stage, compliance initiatives like MiCA and innovation-driven efforts by projects like Tron reflect a sector striving for mainstream acceptance while grappling with challenges like misuse and regulatory uncertainty. Let’s dive into six of the most impactful stories shaping the future of cryptocurrency and blockchain technology.

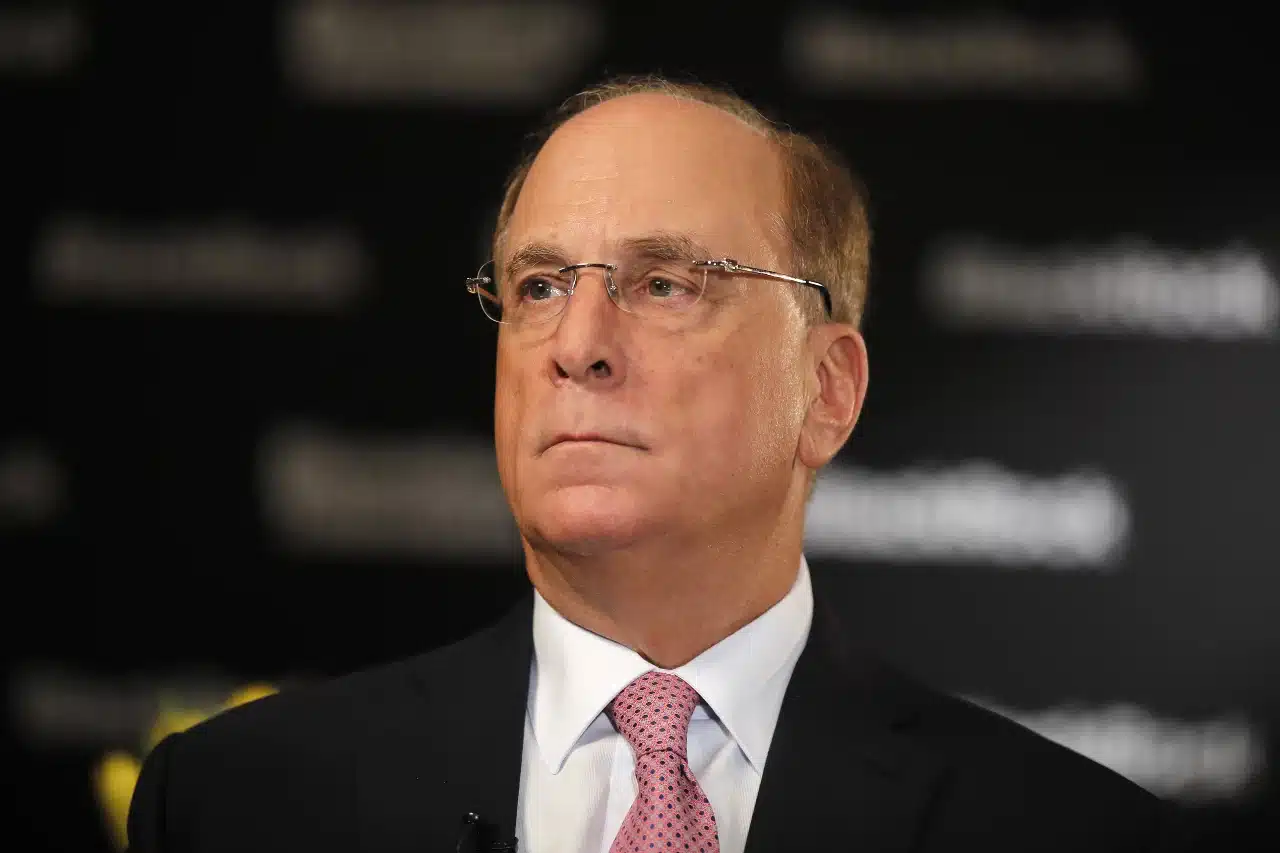

1. BlackRock CEO Larry Fink Calls on SEC to Approve Tokenization of Bonds

BlackRock CEO Larry Fink’s call for SEC approval of bond tokenization is a testament to the growing institutional interest in blockchain technology. Fink’s argument centers on the ability of blockchain to improve transparency, streamline transactions, and eliminate intermediaries. These benefits are particularly relevant in bond markets, which rely heavily on complex infrastructure and manual processes for settlement. By tokenizing bonds, transactions could occur instantly on decentralized ledgers, cutting costs and opening the door for increased liquidity.

BlackRock’s advocacy signals a shift in how traditional finance views blockchain. The company’s previous application for a Bitcoin spot ETF demonstrated its intent to be a leader in integrating digital assets into mainstream markets. Now, its push for tokenized bonds indicates a broader ambition to modernize traditional asset classes using blockchain technology. If the SEC greenlights this move, it could accelerate the adoption of blockchain in institutional finance, potentially driving demand for blockchain-based infrastructure and solutions.

The potential impact on the crypto market is significant. Approval would validate blockchain as a tool for institutional applications, driving both innovation and adoption. However, regulatory uncertainty remains a key barrier. The SEC’s hesitation stems from concerns over investor protection and market stability, but Fink’s backing adds considerable pressure for progress. If successful, this could create a domino effect, encouraging other financial giants to explore tokenization.

2. Crypto Donations to Extremist Groups on the Rise in Europe

The rise in cryptocurrency donations to extremist groups in Europe highlights a darker use case for blockchain technology. These groups exploit the pseudonymous nature of crypto transactions to circumvent traditional banking restrictions, funneling funds into their operations. According to recent reports, there has been a 50% increase in crypto donations to extremist organizations over the past year. While Bitcoin remains the dominant choice, privacy-oriented tokens like Monero are gaining popularity due to their enhanced anonymity features.

This growing trend underscores the challenges regulators face in managing the misuse of cryptocurrencies. Governments are pushing for stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) measures to track illicit transactions. Exchanges and blockchain analytics firms are also working to refine tracing technologies to identify and disrupt these funding streams. However, the decentralized nature of crypto complicates enforcement, as transactions often occur outside the jurisdiction of any single government or entity.

The impact of these developments extends beyond regulation. Misuse of crypto could tarnish its reputation as a tool for financial freedom and innovation. For the industry, balancing the promotion of privacy with the need for oversight will be critical. Regulators must act swiftly, but crypto companies must also take the lead in addressing this issue to maintain credibility and trust in their platforms.

3. According to the CEO of ConsenSys, the Trump Family Might Utilize Ethereum for Upcoming Business Endeavors

Joe Lubin’s suggestion that the Trump family might explore Ethereum for future business projects highlights the growing appeal of blockchain for large enterprises. Ethereum’s ability to support smart contracts, streamline supply chains, and tokenize assets positions it as an attractive solution for traditional businesses seeking efficiency and cost reduction. Given the Trump Organization’s focus on real estate, hospitality, and luxury goods, Ethereum could play a pivotal role in improving operations like property tokenization or secure data management.

While this remains speculative, it reflects Ethereum’s growing presence in the corporate space. Major organizations are beginning to understand blockchain’s potential to enhance transparency and reduce intermediaries, especially in industries reliant on trust and security. If a high-profile family like the Trumps were to adopt Ethereum, it would serve as a symbolic endorsement, likely drawing more attention to the network’s capabilities.

For the crypto market, such developments could boost Ethereum’s adoption and valuation. However, without confirmation, this remains a “what if” scenario. Lubin’s comments do, however, highlight how Ethereum is positioning itself as the blockchain of choice for enterprise-level adoption, particularly in industries tied to the real economy.

4. OKX Obtains Pre-Authorization Under MiCA, Bolsters Malta Operations

OKX’s pre-authorization under the forthcoming MiCA regulations is a proactive step toward securing its foothold in Europe. By aligning with the Malta Financial Services Authority (MFSA), OKX demonstrates its commitment to operating within Europe’s evolving regulatory landscape. MiCA is expected to set the global benchmark for crypto regulation, addressing stablecoin governance, licensing, and investor protections. OKX’s early compliance could offer it a competitive edge as other exchanges rush to meet the framework’s standards.

Malta has long been a crypto-friendly jurisdiction, and OKX’s expansion of its Malta hub signals confidence in the EU’s regulatory direction. The platform’s move may also inspire other exchanges to pursue similar strategies, creating a wave of compliance across the industry. OKX’s readiness positions it as a potential leader in the European market as regulators aim to standardize crypto oversight across member states.

For the market, this signals an important shift. Regulatory clarity often leads to greater institutional participation, as investors gain confidence in the security and legitimacy of crypto assets. If OKX’s approach proves successful, it could encourage other jurisdictions to adopt similar regulations, further stabilizing the global crypto industry.

5. Coinbase Asks Appeals Court to Rule Crypto Trades Are Not Securities

Coinbase’s appeal for a federal court ruling on crypto trades not being securities could be a turning point for the U.S. crypto industry. The exchange has been at odds with the SEC, which accuses it of operating as an unregistered securities exchange. By asking for legal clarification, Coinbase aims to challenge the SEC’s interpretation of securities laws, which it argues are outdated and unsuitable for digital assets.

The implications of this case are far-reaching. A favorable ruling for Coinbase could limit the SEC’s authority over crypto assets, providing clarity for other platforms and projects. This could create a more business-friendly environment, enabling innovation without fear of regulatory overreach. Conversely, a loss could force significant operational changes across the industry, potentially leading to delistings and stricter compliance requirements.

This legal battle reflects broader tensions between regulators and the crypto industry in the U.S. While other regions like Europe are moving toward standardized frameworks like MiCA, the U.S. remains mired in ambiguity. The outcome of this case could either solidify the SEC’s control or push lawmakers to establish new, crypto-specific regulations, impacting the global perception of the U.S. as a leader in innovation.

6. Tron Aims to Eliminate Fees for Stablecoin Transactions

Tron’s initiative to remove fees for stablecoin transactions marks a bold attempt to dominate the stablecoin ecosystem. Stablecoins are essential for payments, remittances, and DeFi, and by eliminating fees, Tron aims to attract more users and projects to its network. This approach could make Tron a more appealing alternative to blockchains like Ethereum, where higher transaction costs remain a concern for users.

The platform’s founder, Justin Sun, has consistently emphasized accessibility and affordability, and this move aligns with that vision. Moreover, Tron’s close integration with Binance, a major stablecoin liquidity provider, strengthens its position. By making stablecoin transfers virtually costless, Tron could significantly boost adoption, especially among retail users and businesses operating on tight margins.

However, there are concerns about the sustainability of zero-fee models. Network maintenance and validator incentives typically rely on transaction fees, raising questions about how Tron will support its infrastructure long-term. If successful, this move could encourage other blockchains to lower their fees, intensifying competition and accelerating innovation in the stablecoin market.

- BlackRock’s advocacy for bond tokenization could revolutionize traditional finance and enhance blockchain’s role in institutional markets.

- Reports of extremist groups using crypto donations spotlight the darker side of blockchain, raising calls for stronger regulation and tracing tools.

- Speculation around the Trump family’s potential use of Ethereum underscores blockchain’s growing appeal in corporate strategies.

- OKX’s proactive compliance with MiCA regulations positions it as a leader in Europe’s evolving crypto market.

- Coinbase’s legal push to clarify the status of crypto trades could define the future of U.S. crypto regulation.

- Tron’s zero-fee initiative for stablecoin transactions aims to challenge high-cost networks like Ethereum while increasing adoption.