Political scrutiny, legal disputes, and macroeconomic policy shifts are converging with Crypto momentum and institutional behavior to shape the current crypto narrative. While the U.S. Senate battles controversy over the stablecoin framework, Europe tightens monetary policy in the shadow of its digital euro ambitions. Meanwhile, bullish market indicators and whale activity are hinting at renewed optimism in Bitcoin’s trajectory, all while Binance faces a resurrected multibillion-dollar lawsuit from discontented Bitcoin SV investors.

1. Senate Stablecoin Bill Stalls Amid Political Controversy

The U.S. Senate’s attempt to pass the GENIUS Act, aimed at establishing a federal regulatory framework for stablecoins, has hit a roadblock. Despite earlier bipartisan support, the bill failed a procedural vote, largely due to concerns over former President Donald Trump’s involvement in cryptocurrency ventures. Democrats expressed apprehension about potential conflicts of interest, citing Trump’s launch of a meme coin and connections to a stablecoin project receiving significant foreign investment.

The legislation’s future remains uncertain, with ongoing negotiations attempting to address issues related to money laundering, foreign issuers, and accountability. Senator Mark Warner has indicated a commitment to refining the bill to garner broader support.

The crypto industry, which has invested heavily in lobbying for regulatory clarity, views the bill’s failure as a significant setback. The situation underscores the complexities of crafting legislation in a rapidly evolving financial landscape, especially when political interests intersect with regulatory efforts.

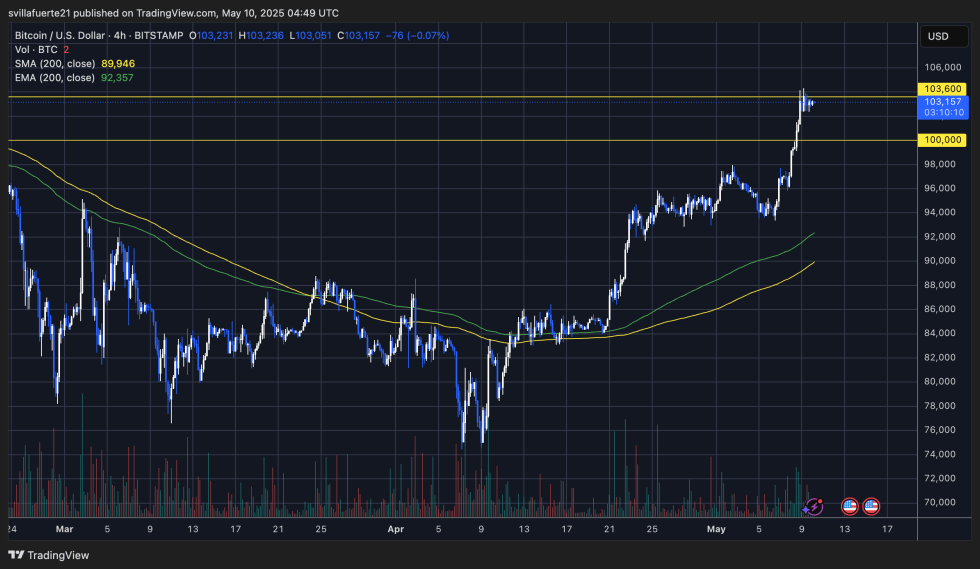

2. Bitcoin Bull-Bear Cycle Indicator Signals Potential Uptrend

CryptoQuant’s Bull-Bear Market Cycle Indicator has flashed its first bullish signal since February, suggesting a possible shift in Bitcoin’s market dynamics. The indicator, which had consistently signaled bearish conditions, now points to a trend reversal as Bitcoin consolidates around the $103,000 mark.

Analysts interpret this development as a sign of renewed investor confidence, with the potential for Bitcoin to challenge its all-time high of $109,000. The current market behavior indicates accumulation, often a precursor to significant price movements.

While the bullish signal is promising, market participants remain cautious, acknowledging the need for sustained momentum and external factors that could influence the trajectory.

3. Bitcoin SV Investors Revive $13.3 Billion Claim Against Binance

Investors in Bitcoin SV (BSV) are seeking to reinstate a “loss of chance” claim in a UK lawsuit against Binance, alleging that the exchange’s delisting of BSV led to significant financial losses. The claim, valued at approximately $13.3 billion, centers on the argument that Binance’s actions deprived investors of potential gains.

A judge previously highlighted a discrepancy in the claimed damages, noting a substantial overstatement. Despite this, the investors are pushing to have their case reconsidered, emphasizing the impact of Binance’s decision on their investment opportunities.

The outcome of this legal battle could set a precedent for how exchanges handle token listings and the responsibilities they bear toward investors.

4. Europe Faces Capital Controls Amid Digital Euro Concerns

European nations are implementing capital controls in response to growing apprehensions about the digital euro initiative. Critics argue that the central bank digital currency could lead to increased surveillance and reduced financial privacy.

Concerns include the potential for the digital euro to limit cash availability and grant authorities greater control over individual spending habits. The European Central Bank maintains that the digital euro aims to modernize the financial system, but public skepticism persists.

The debate highlights the challenges central banks face in balancing innovation with privacy and autonomy in the digital age.

5. Institutional Bitcoin Holdings Surge by 41,300 BTC

Institutional investors have significantly increased their Bitcoin holdings, with a reported addition of 41,300 BTC. This surge reflects a growing institutional interest in Bitcoin as a hedge against economic uncertainty and a store of value.

Analysts attribute this trend to factors such as global economic instability and the search for alternative assets. The accumulation by large-scale investors suggests confidence in Bitcoin’s long-term prospects.

This development could influence market dynamics, potentially leading to increased price stability and further adoption of Bitcoin in institutional portfolios.

Key Takeaways

1. Senate Stablecoin Bill Stalls Amid Political Controversy

-

The GENIUS Act failed to pass due to political disputes tied to Trump’s crypto involvement.

-

Key issues include foreign issuer oversight, anti-money laundering, and governance structures.

-

A major regulatory setback for stablecoin clarity and institutional crypto expansion in the U.S.

2. Bitcoin Bull-Bear Cycle Indicator Signals Potential Uptrend

-

CryptoQuant’s indicator flipped bullish for the first time since February.

-

Bitcoin hovers around $103K with renewed institutional and retail accumulation signals.

-

A potential trend shift could lead BTC toward retesting its all-time high of $109K.

3. Bitcoin SV Investors Revive $13.3 Billion Claim Against Binance

-

Investors allege Binance’s delisting of BSV caused lost opportunities.

-

The case highlights exchange accountability and risks tied to token removals.

-

A judicial precedent could emerge affecting future token listing decisions globally.

4. Europe Faces Capital Controls Amid Digital Euro Concerns

-

EU capital restrictions raise alarms over surveillance and cash access.

-

Public distrust grows around CBDCs despite ECB’s assurances.

-

The development adds friction to the broader push toward digital financial systems.

5. Institutional Bitcoin Holdings Surge by 41,300 BTC

-

Bitcoin whale wallets saw a sharp spike in holdings, signaling institutional confidence.

-

Motivated by macroeconomic concerns and long-term value positioning.

-

May fuel price stability and boost institutional adoption.