Market Analysis

The market is showing some tentative signs of recovery today; however, the overall environment remains cautious and fragile. Ongoing complexities in the global economy have dampened investor sentiment, leaving the market’s direction uncertain.

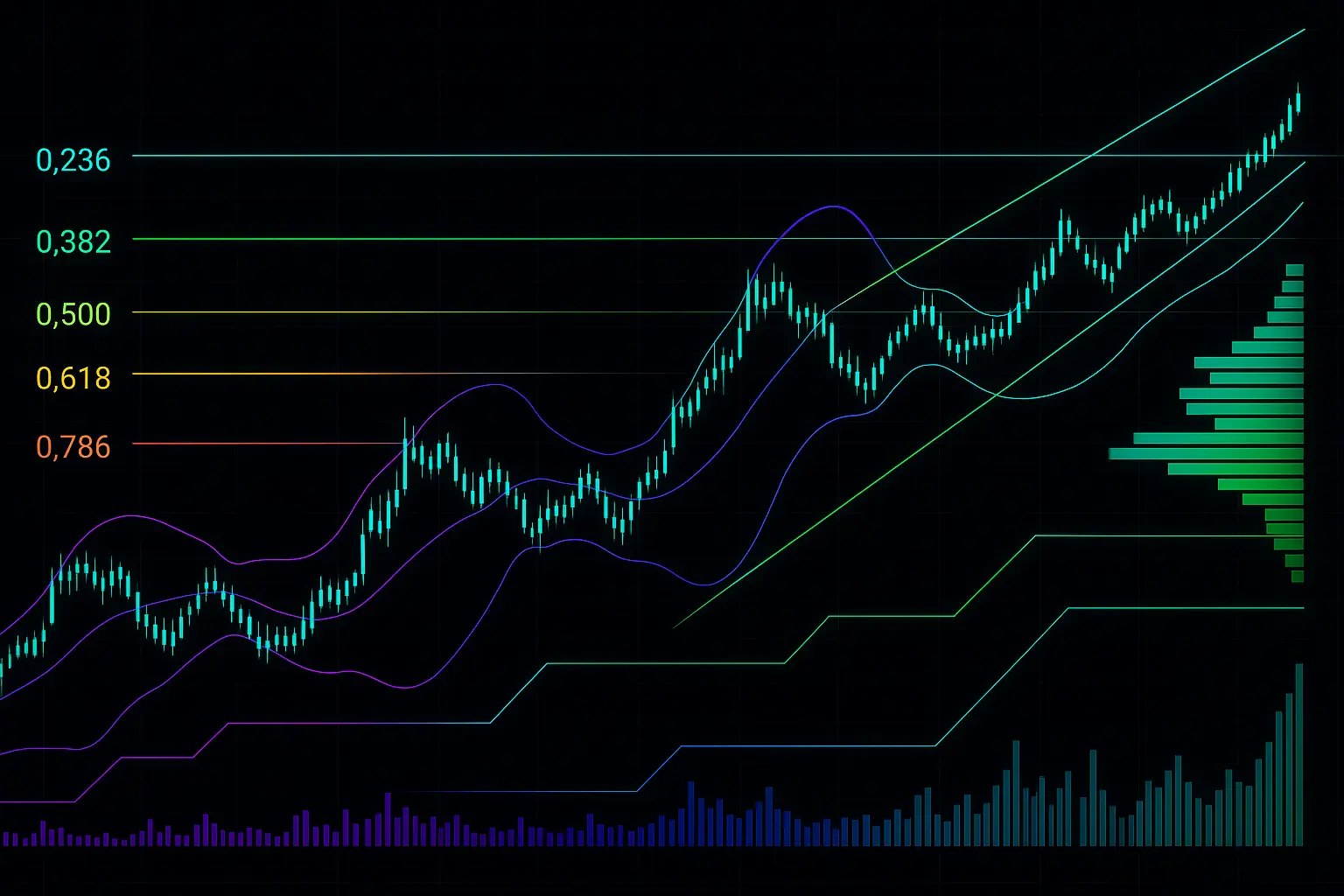

Bitcoin’s price has experienced significant volatility over the past five days. Following a sharp decline on February 5, 2026, there were attempts at partial recovery on February 6 and 7. On February 3, the price opened at 78,738.6 and closed lower at 75,770.21, before plunging further to 62,909.86 on February 5—a clear indication of strong selling pressure. Technical indicators reinforce this view: the Relative Strength Index (RSI) plunged to an oversold extreme of 8.95 on February 5, signaling an unusually weak trend. Similarly, the Money Flow Index (MFI) stood at 25.35, pointing towards a scarcity of liquidity and subdued buying interest. During this period, the Fear & Greed Index remained in the extreme fear zone, suggesting potential short-term buying opportunities; however, global economic instability has limited such prospects.

Looking at the Bollinger Bands, the price touched the lower band on February 5, often interpreted as a signal for a possible reversal or at least a temporary pause in downward momentum. Subsequently, there was a mild recovery toward the middle band, yet signs of renewed weakness emerged by February 7. Moving averages present a mixed picture: the 7-day moving average at 66,174.87 shows slight improvement compared to previous days, but the 14-day and 21-day averages remain elevated, indicating sustained medium- to long-term downward pressure. This suggests that while there may be some short-term bullish momentum, the prevailing trend remains neutral to bearish.

On February 7, Bitcoin closed at 69,289.38, hovering near the R1 resistance zone between 69,290.57 and 69,914.37. Support lies below within the S1 range of 67,969.65 to 66,034.5. Should the price break below this support, the next significant support level (S2) ranges from 65,376 to 64,800, followed by further support zones at S3 and S4. A key psychological support level is around 60,000, which is widely regarded as critical. Despite some signs of positive movement, a decline of 8.19% in open interest alongside a negative funding rate (-0.000029) suggests that investors remain cautious, likely favoring short positions.

From a broader perspective, uncertainties in the global economy and financial pressures across several countries have undermined investor confidence. Rising inflation and interest rate hikes in the US and Europe have exerted negative influence on the market. Additionally, stricter cryptocurrency regulations in China and ongoing tensions between Russia and Ukraine have further contributed to instability in global financial markets. These factors have collectively weighed on Bitcoin’s price, making it essential to maintain a cautious stance despite short-term upward movements.

The MACD indicator also reflects this mixed sentiment, with the absence of a crossover between the signal and MACD lines underscoring the lack of a clear uptrend. On February 5, trading volume spiked unusually, signaling selling pressure amid price declines; volume tapered off in subsequent days, indicating weak buying strength. The continuous decline in the Fear & Greed Index further highlights the prevailing market anxiety, which could weaken support levels while reinforcing resistance zones.

Overall, Bitcoin’s current market condition presents a complex and uncertain landscape. While oversold conditions and signals from Bollinger Bands point to possible short-term gains, the status of moving averages, funding rates, and open interest advises caution. Global economic headwinds and negative news flow continue to pose challenges, suggesting that investors should adopt a prudent approach in the short to medium term. Should support levels fail, prices may decline further; conversely, breaking through resistance could strengthen bullish momentum. For now, the market sentiment leans predominantly from neutral to bearish.

Data Summary

- 1. Time:

2026-02-08 – 00:00 UTC - 2. Prices:

Open: 70580.26000000High: 71690.07000000Low: 67300.00000000Close: 69289.38000000

- 8. Supports:

S1: 67969.65000000 – 66034.50000000S2: 65376.00000000 – 64800.01000000S3: 60864.99000000 – 60459.90000000S4: 57541.1 – 56018

- 9. Resistances:

R1: 69290.57000000 – 69914.37000000R2: 72736.42000000 – 120134.08000000R3: 78738.6 – 79424

- 10. Psychological Support:

60000.00000000

- 11. Psychological Resistance:

70000.00000000

- 3. Last 5 days’ closing prices:

2026-02-03: 75770.210000002026-02-04: 73165.830000002026-02-05: 62909.860000002026-02-06: 70580.260000002026-02-07: 69289.38000000

- 4. Volume:

BTC: 44255.4804USD: $3058983879.0692

- 5. Number of trades:

7167427

- 6. Indicators:

RSI: 32.5400MFI: 40.1400BB Upper: 99793.33000000BB Lower: 66036.51000000

- 7. Moving Averages:

SMA:7=72488.9100000014=79188.6800000021=82914.9200000030=86111.2800000050=87379.87000000100=90701.52000000200=102561.48000000EMA:

7=72559.4900000014=77298.4900000021=80317.7400000030=82727.7400000050=85893.39000000100=91148.90000000200=96060.75000000HMA:

7=66174.8700000014=66595.4900000021=68413.6100000030=72511.4200000050=79279.96000000100=85713.53000000200=81719.85000000 - 12. Funding Rate:

-0.0029% (Technically Positive)

- 13. Open Interest:

85124.1080

- 14. Fear & Greed Index:

6 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.