Market Analysis

Signs of modest improvement have emerged in the cryptocurrency market today; however, the overall trend remains uncertain and pressured. The complexities of the global economy continue to weigh on investor sentiment, resulting in a cautious and subdued market atmosphere.

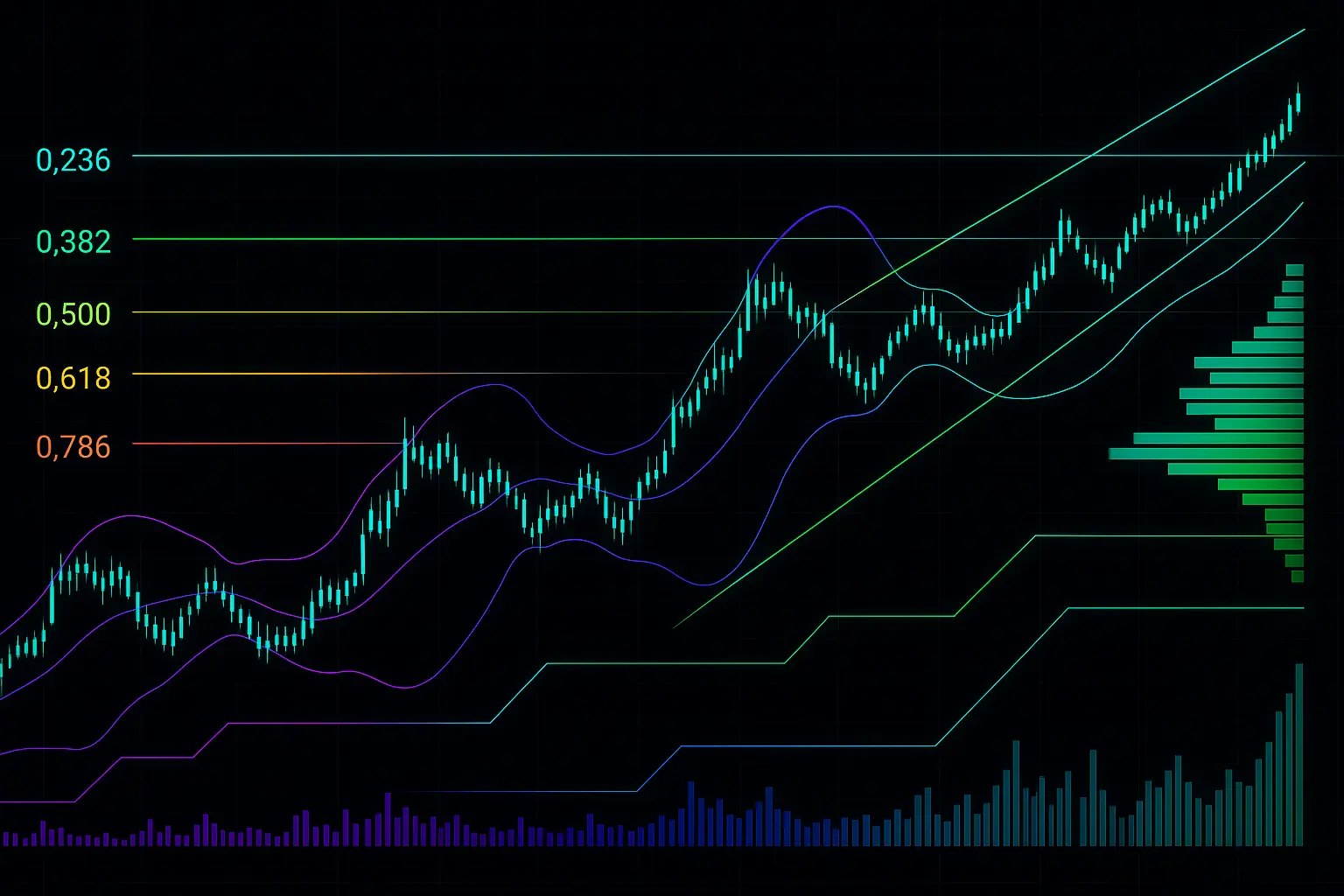

Over the past five days, Bitcoin’s price has experienced fluctuations accompanied by mixed technical signals, reflecting the current market uncertainty. On January 26, Bitcoin opened at 86,670 and closed at 88,347, followed by a slight upward movement over the next two days, closing near 89,299 on January 28. Yet, a sharp decline occurred on January 29 and 30, with the price dropping to 84,260, indicating clear downward pressure. The Relative Strength Index (RSI) for seven days hovered around 25 on both January 26 and 30, signaling weakness, while the Money Flow Index (MFI) for 14 days remained near 33, suggesting reduced liquidity in the market.

Looking at the Bollinger Bands, Bitcoin’s price approached the lower band on January 30, typically a sign of an oversold condition, though no definitive reversal signal has emerged so far. Examining moving averages, the Hull Moving Averages (HMA) for 7, 14, and 21 days have been trending downward, with the 30-day and 50-day moving averages also turning lower, indicating short- to mid-term selling pressure. Importantly, the closing price on January 30 fell below the 7-day HMA, reinforcing the weak trend.

The Fear and Greed Index currently sits at 16, reflecting extreme fear in the market. It is worth noting that during such periods, support levels can become fragile. Open interest has risen by 4.9%, suggesting some level of investor engagement, though the funding rate remains close to zero, implying a lack of a clear directional trend at present. On the global front, economic slowdown and uncertainty regarding monetary policies continue to dampen market sentiment. Additionally, trade tensions between the U.S. and China have further contributed to a challenging investment environment.

Regarding support levels, the range between 84,250 and 81,981 (S1) is critical; a break below this could open the door to the next support zone between 78,595 and 76,322 (S2). On the resistance side, the levels of 84,591 to 86,129 (R1) and then 87,232 to 88,175 (R2) are key, with the psychological resistance near 90,000 representing a significant hurdle. Should the price approach 90,000, bearish pressure may intensify, especially given the prevailing fearful and uncertain market mood.

In summary, Bitcoin is currently navigating a landscape dominated by short-term pressure and uncertainty, though some technical indicators hint at potential positive momentum. Investors are advised to closely monitor support and resistance levels while keeping an eye on global economic developments, as these factors will play a crucial role in determining Bitcoin’s price direction. At this stage, no clear bullish or bearish trend is emerging, making a cautious approach the prudent choice.

Data Summary

- 1. Time:

2026-01-31 – 00:00 UTC - 2. Prices:

Open: 84650.16000000High: 84735.75000000Low: 81118.00000000Close: 84260.49000000

- 8. Supports:

S1: 84250.09000000 – 81981.12000000S2: 78595.86000000 – 76322.42000000S3: 67969.6 – 66034.5

- 9. Resistances:

R1: 84591.58000000 – 86129.64000000R2: 87232.01000000 – 88175.98000000R3: 93859.71000000 – 95228.45000000R4: 96551 – 97464

- 10. Psychological Support:

80000.00000000

- 11. Psychological Resistance:

90000.00000000

- 3. Last 5 days’ closing prices:

2026-01-26: 88347.080000002026-01-27: 89250.000000002026-01-28: 89299.990000002026-01-29: 84650.160000002026-01-30: 84260.49000000

- 4. Volume:

BTC: 35195.8479USD: $2918624066.4818

- 5. Number of trades:

8998829

- 6. Indicators:

RSI: 24.7200MFI: 33.8500BB Upper: 97782.30000000BB Lower: 83792.34000000

- 7. Moving Averages:

SMA:7=87386.2000000014=89299.8300000021=90787.3200000030=90941.2900000050=89714.06000000100=93766.28000000200=104318.20000000EMA:

7=87129.6000000014=88649.9200000021=89365.0500000030=89824.6500000050=90793.52000000100=94283.18000000200=97966.61000000HMA:

7=84550.1900000014=86313.3300000021=86080.5600000030=87583.6000000050=90821.18000000100=89853.16000000200=83871.46000000 - 12. Funding Rate:

0.0003% (Technically Positive)

- 13. Open Interest:

106511.1870

- 14. Fear & Greed Index:

16 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.