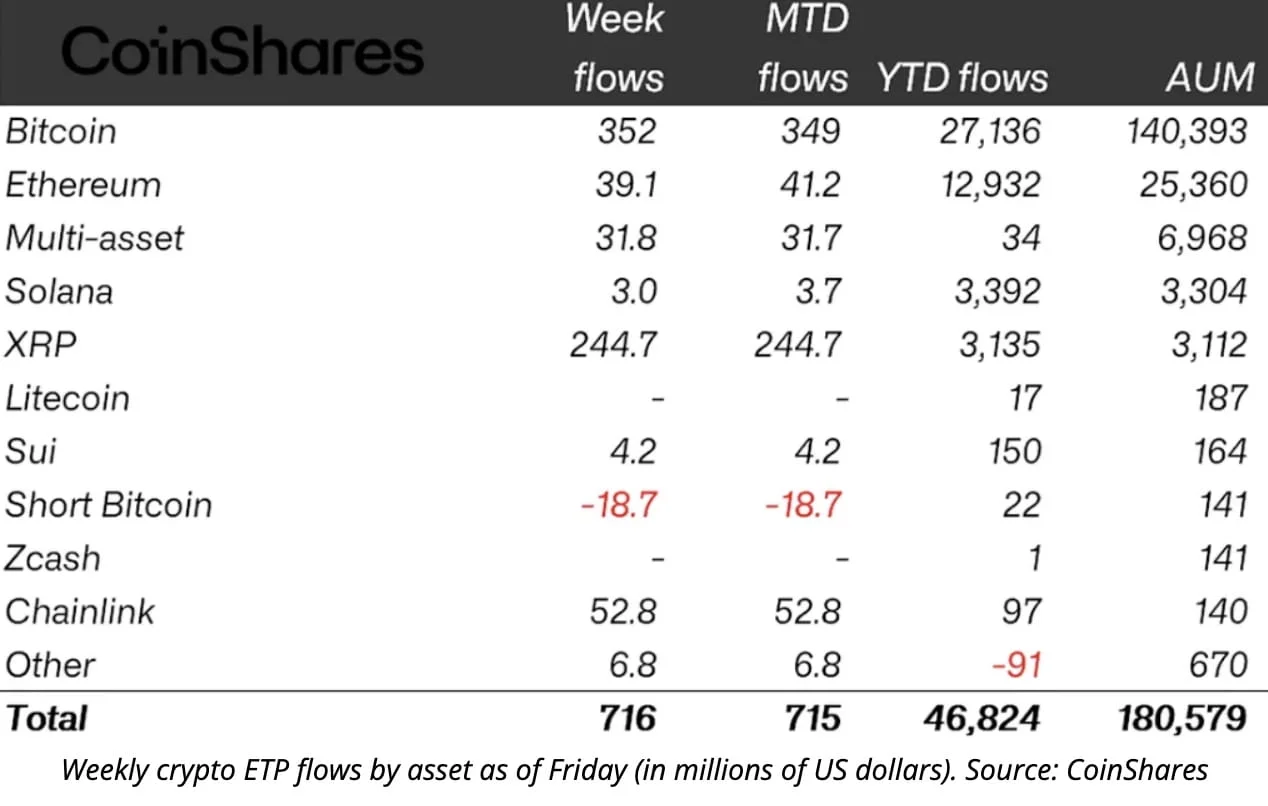

Crypto investment products continued their recovery last week, marking the second consecutive weekly inflow following a steep $5.5 billion decline over four weeks in November. According to the latest CoinShares report, digital asset ETFs attracted $716 million in new investments, building on the previous week’s $1 billion surge. Total assets under management have now surpassed $180 billion, an approximate 8% increase from the monthly low, though still below the peak of $264 billion. The report noted minor outflows at the weekend due to U.S. economic indicators pointing to persistent inflationary pressures, but the overall trend remained positive. Bitcoin ETFs led inflows with $352 million, accounting for nearly half of the total, while XRP funds saw robust investments of $244 million, reflecting growing institutional interest following the launch of ETFs. Chainlink recorded a record inflow of $52.8 million, representing 54% of its total assets—the largest percentage increase for any asset this year. Ethereum products also gained $39 million, whereas short Bitcoin ETFs experienced $19 million in outflows, signaling reduced bearish expectations. Institutional investment showed divergence, with ProShares seeing the largest inflow of $210 million, BlackRock withdrawing $105 million despite being the biggest crypto ETF issuer, RK Invest withdrawing $78 million, and Grayscale seeing a modest $7 million withdrawal. These shifts indicate changing strategies within institutional portfolios. Globally, positive investment trends were observed in the U.S., Germany, and Canada, while Sweden experienced a $5.6 million outflow, marking the largest withdrawal of the year.

Source: binance