Digital asset investment firm CoinShares has announced that the rapid growth of tokenized real-world assets (RWAs) in 2025 is expected to accelerate further in 2026. This expansion is driven by increasing global demand for on-chain dollar yields and blockchain’s rising credibility as a financial infrastructure. According to CoinShares, RWA tokenization has evolved from a limited experiment into a competitive sector attracting large investors, regulated financial institutions, and reputable asset issuers.

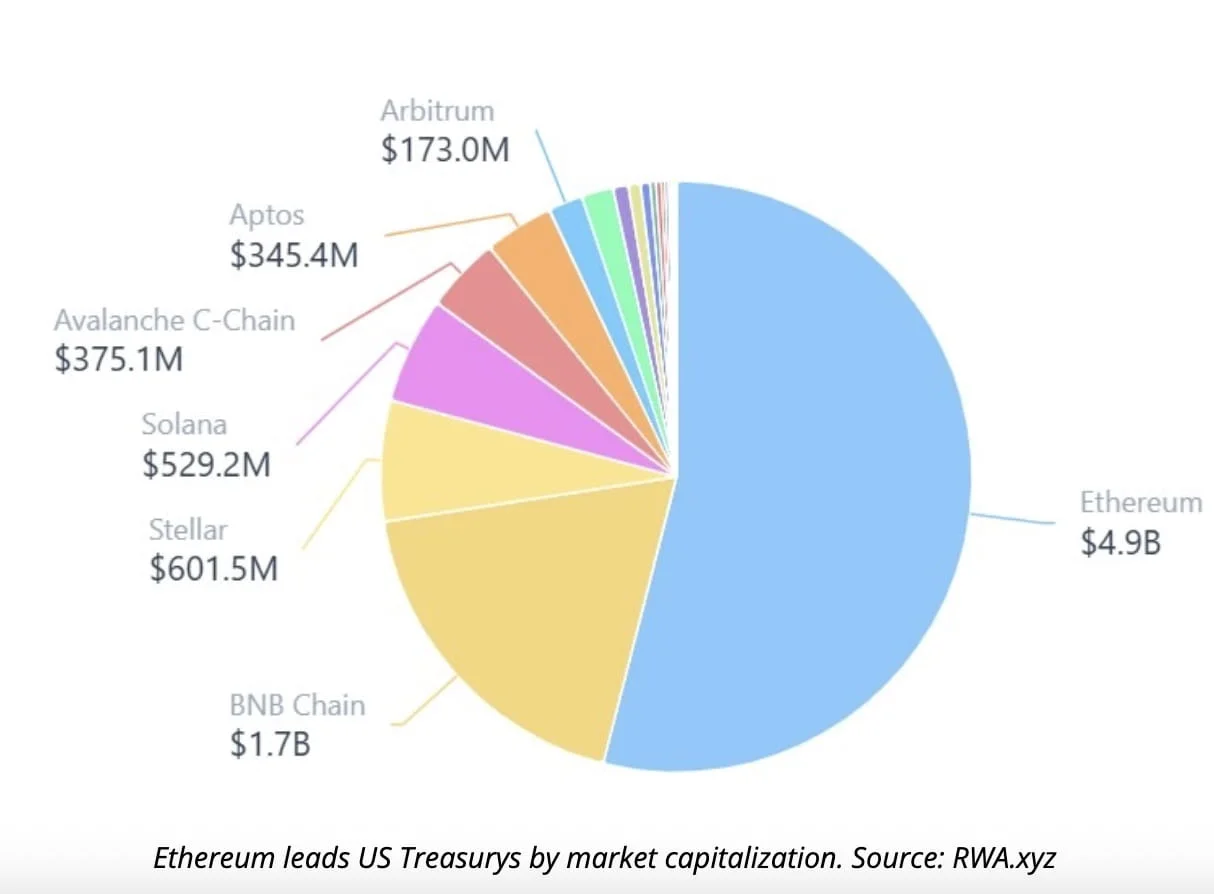

Tokenized U.S. Treasuries experienced the highest growth in 2025, nearly doubling in value from $3 billion to over $8 billion. Private credit RWAs also almost doubled, reaching close to $18 billion. Excluding stablecoins, the total value of tokenized RWAs surged to $18 billion, marking an impressive annual growth rate of 229%. Ethereum hosts the largest share of tokenized U.S. Treasuries, with over $5 billion tokenized on its blockchain. Financial institutions favor Ethereum due to its facilitation, liquidity, and mature tooling, although other networks are competing for market share. Ethereum remains the preferred platform for regulated RWA issuance.

CoinShares believes that U.S. Treasuries will remain the fastest-growing RWA category in 2026, supported by strong global demand for dollar-based yields, lower risk compared to stablecoins, and improved on-chain settlement performance. Traditional financial institutions are increasingly issuing RWAs on-chain as blockchain gains acceptance as a credible market infrastructure by regulators. This shift signifies a major structural change in financial systems, moving settlement processes from traditional custodial systems to direct on-chain operations. While competition among networks and settlement layers continues, the dominant platform in the long term remains uncertain. Overall, the remarkable growth of the RWA market marks a new chapter in crypto infrastructure history, with 2026 poised to be the year of full integration between digital assets and the real economy.

Source: binance