Market Analysis

Bitcoin has recently struggled to surpass the significant threshold of 124,000, despite a reduction in the Federal Reserve’s interest rates. Market sentiment remains weak and under pressure, signaling increased caution for investors as the likelihood of a bearish trend intensifies.

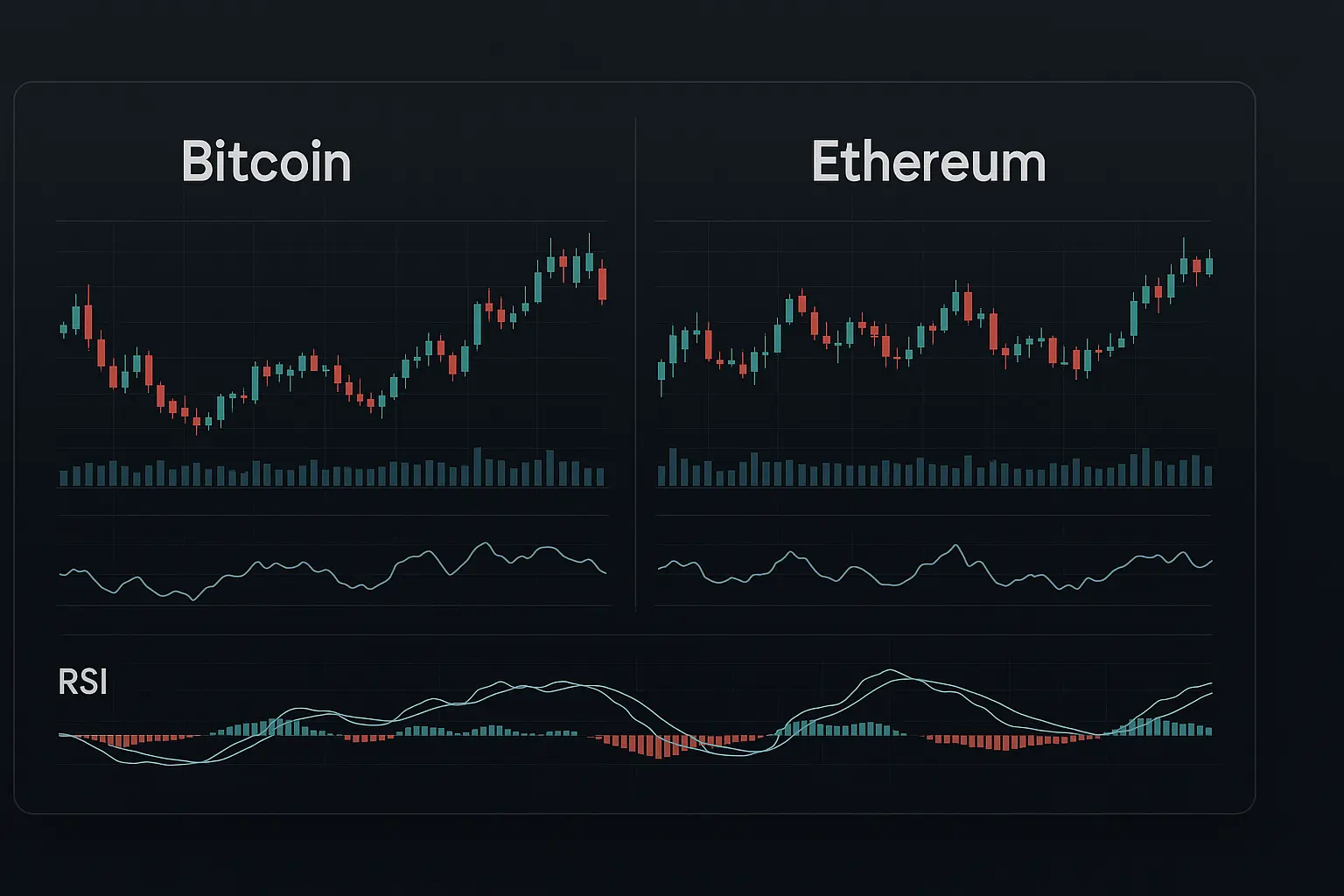

Over the past five days, Bitcoin’s price has shown a marked decline, reflecting growing market fragility. On November 11, it opened at 106,011 but closed lower at 103,058, followed by sustained downward momentum. The Relative Strength Index (RSI) has dropped sharply from 40.52 to 27.08 over seven days, indicating weakening market strength. Similarly, the Money Flow Index (MFI) decreased from 37.35 to 25.85, suggesting that buying power is diminishing. The Fear & Greed Index has plunged from 26 to 10, pointing to extreme fear among investors. This heightened fear may undermine support levels, increasing the risk of further price declines.

Bollinger Bands also highlight this weakness, with prices recently approaching the lower band, hinting at a potential oversold condition. However, there is no clear sign yet of an immediate market reversal. Examining moving averages, the 7-day Hull Moving Average (HMA) has fallen from 105,231 to 93,548. Currently, the closing price of 95,596 sits just above the 7-day HMA, but the 14-, 21-, and 30-day HMAs remain above the price, indicating sustained medium- to long-term bearish pressure. This suggests that while short-term price stabilization is possible, downward momentum is likely to persist over the mid and longer term.

Looking at support and resistance levels, Bitcoin is trading near the S1 support zone between 94,881 and 92,206, which serves as the first critical support area. A breakdown below this range could open the door to further declines toward the next support level between 91,965 and 90,357. On the upside, resistance lies between 96,887 and 98,345, representing the first major barrier to recovery. Psychological levels at 90,000 support and 100,000 resistance add to market sensitivity. Despite the Fed’s rate cut, overall market conditions remain weak and uncertain, urging investors to avoid hasty decisions.

From a news perspective, Bitcoin’s price has not improved despite the recent interest rate reduction by the Fed, indicating fragile underlying confidence. Additionally, global economic uncertainties and volatility in other financial markets have negatively impacted Bitcoin’s performance. A slight uptick in financing rates (0.000059) and a 1.94% increase in open interest indicate some renewed market interest, but these signals are not robust enough to drive a strong upward move. In sum, fear dominates the market atmosphere, and investors should exercise prudence with their positions.

In summary, Bitcoin’s current technical and fundamental outlook points toward bearishness, especially after failing to break its recent peak at 124,000. Both RSI and MFI signal weakening momentum, while the Fear & Greed Index reflects extreme caution. Bollinger Bands and moving averages further confirm ongoing market pressure. A drop below the S1 support range could lead to further losses, although short-term stabilization remains a possibility. Investors are advised to remain cautious, avoid impulsive moves, and closely monitor market developments.

Data Summary

- 1. Time:

2025-11-16 – 00:00 UTC - 2. Prices:

Open: 94594.00000000High: 96846.68000000Low: 94558.49000000Close: 95596.24000000

- 8. Supports:

S1: 94881.47000000 – 92206.02000000S2: 91965.16000000 – 90357.00000000S3: 84474.69000000 – 83949.52000000S4: 82574.5 – 81644.8

- 9. Resistances:

R1: 96887.14000000 – 98345.00000000R2: 101109.59000000 – 101732.31000000R3: 103261.60000000 – 104550.33000000R4: 108816 – 109450

- 10. Psychological Support:

90000.00000000

- 11. Psychological Resistance:

100000.00000000

- 3. Last 5 days’ closing prices:

2025-11-11: 103058.990000002025-11-12: 101654.370000002025-11-13: 99692.020000002025-11-14: 94594.000000002025-11-15: 95596.24000000

- 4. Volume:

BTC: 15110.8939USD: $1449074019.0675

- 5. Number of trades:

4263558

- 6. Indicators:

RSI: 27.0800MFI: 25.8500BB Upper: 116377.82000000BB Lower: 94522.15000000

- 7. Moving Averages:

SMA:7=100761.3900000014=102488.1300000021=105449.9800000030=106527.8600000050=110506.20000000100=112121.79000000200=109736.90000000EMA:

7=99382.3100000014=102106.2000000021=103983.6800000030=105744.1600000050=108128.87000000100=109810.45000000200=107142.25000000HMA:

7=93548.2800000014=98300.2200000021=98686.3600000030=99596.7200000050=101964.39000000100=106415.72000000200=111327.67000000 - 12. Funding Rate:

0.0059%

- 13. Open Interest:

93386.8000

- 14. Fear & Greed Index:

10 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.