Market Analysis

Bitcoin has recently struggled to surpass the key resistance level of 124,000, creating an atmosphere of uncertainty in the market. Despite the Federal Reserve's interest rate cuts, prices have remained unstable, indicating that buyers are exercising caution. This hesitancy suggests the potential for increased downward pressure in the near term.

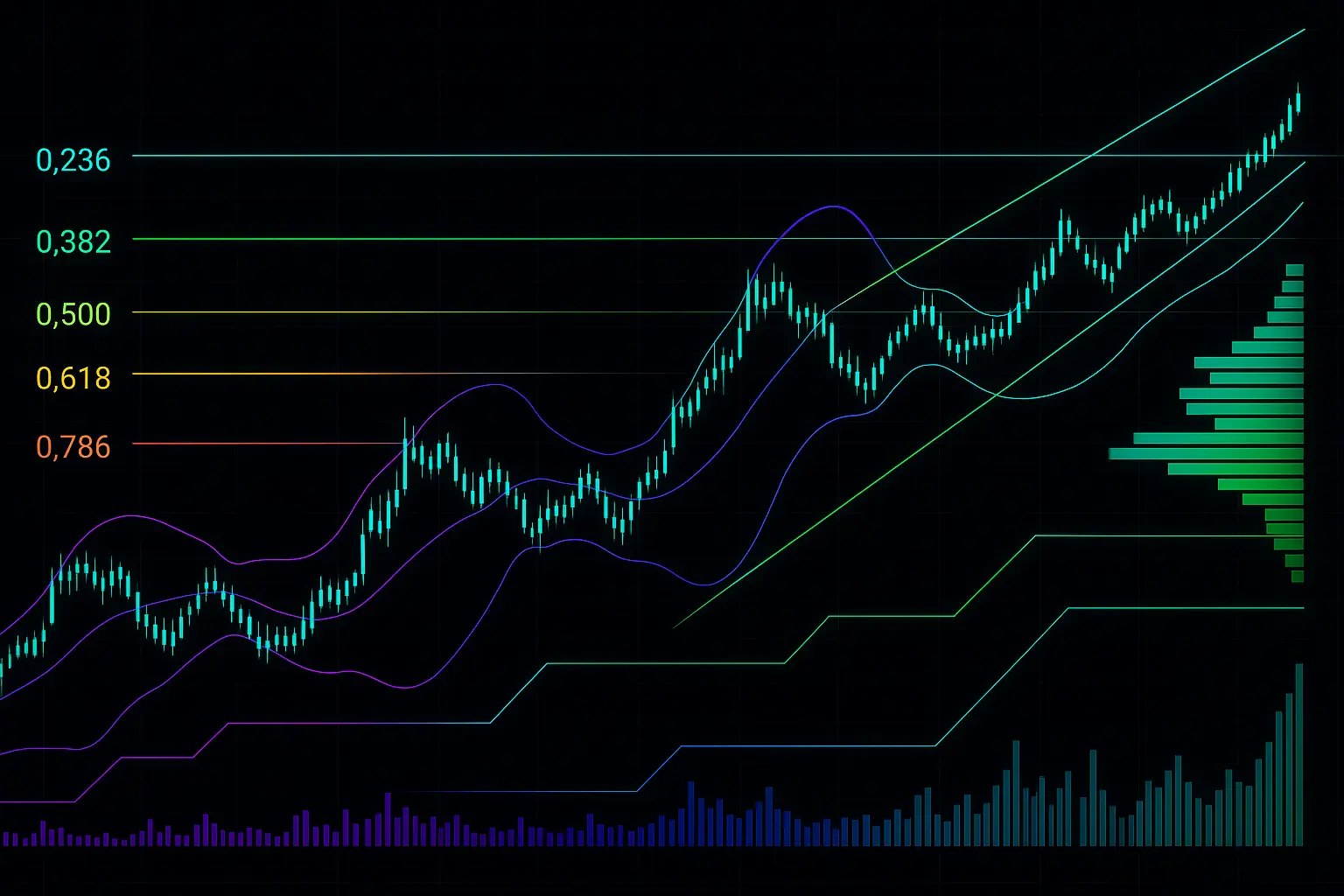

Over the past five days, Bitcoin’s price has experienced significant volatility, reflecting mixed signals in market sentiment and technical indicators. On October 31, the price reached 111,190 but momentum slowed thereafter, leading to a drop to 101,497 by November 4—a clear sign of weakening strength. The RSI (7) has fallen to 21.9, approaching oversold territory, which points to rising selling pressure. Meanwhile, the Money Flow Index (14) sits at 41.19 within a neutral range, hinting at some ongoing buying interest from investors.

Bollinger Bands analysis shows the price gravitating near the lower band, typically signaling a potential reversal or at least a temporary recovery. However, despite an increase in volume—peaking around 50,534 on November 4—there was no corresponding price surge, underscoring underlying market weakness. The Fear and Greed Index stands at 21, indicating a state of fear that could present a short-term buying opportunity. That said, any breakdown of key support levels might intensify selling pressure.

Moving averages further confirm the bearish trend. The 7- and 14-day Hull Moving Averages (HMA) have slipped below the current price, while the 21-, 30-, and 50-day HMAs are also turning downward. On November 4, the 7-day HMA was at 104,147, but the price closed lower at 101,497, reinforcing the downtrend. If the support zone between 101,420 and 100,119 breaks, the next significant support lies between 96,945 and 90,056, which could trigger further declines.

Overall, the current technical and sentiment indicators suggest Bitcoin remains under pressure, with a likelihood of further short-term price drops. Yet, given the RSI and Fear and Greed Index signaling oversold conditions, a rebound might be possible. Investors are advised to avoid hasty decisions and closely monitor key support and resistance levels to make informed choices. While Fed rate cuts and other macroeconomic factors could have a positive impact over the long term, exercising caution is the best strategy in the present market environment.

Data Summary

- 1. Time:

2025-11-05 – 00:00 UTC - 2. Prices:

Open: 106583.05000000High: 107299.00000000Low: 98944.36000000Close: 101497.22000000

- 8. Supports:

S1: 101420.00000000 – 100119.04000000S2: 96945.63000000 – 90056.17000000S3: 89855.99000000 – 87325.59000000S4: 84474.7 – 83949.5

- 9. Resistances:

R1: 104103.72000000 – 105500.00000000R2: 105857.99000000 – 106457.44000000R3: 108816.33000000 – 109450.07000000R4: 116789 – 117544

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 3. Last 5 days’ closing prices:

2025-10-31: 109608.010000002025-11-01: 110098.100000002025-11-02: 110540.680000002025-11-03: 106583.040000002025-11-04: 101497.22000000

- 4. Volume:

BTC: 50534.8738USD: $5197697635.2124

- 5. Number of trades:

9099609

- 6. Indicators:

RSI: 21.9000MFI: 41.1900BB Upper: 115083.70000000BB Lower: 103828.71000000

- 7. Moving Averages:

SMA:7=108095.8900000014=109895.2500000021=109456.2000000030=111870.4000000050=113365.17000000100=113908.83000000200=108907.61000000EMA:

7=107487.7100000014=109113.1400000021=110076.5000000030=110944.1900000050=111980.43000000100=111899.64000000200=107810.16000000HMA:

7=104147.8000000014=106857.9100000021=109022.4500000030=109466.4400000050=108102.53000000100=112078.71000000200=114784.08000000 - 12. Funding Rate:

0.0063%

- 13. Open Interest:

77417.8460

- 14. Fear & Greed Index:

21 (Extreme Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.