Market Analysis

Bitcoin has recently been trading within a relatively strong range, approaching the 124,000 level. Despite the Federal Reserve’s interest rate cuts, the anticipated surge in momentum has yet to materialize. Current market sentiment and technical indicators suggest that the price could move downward at any moment, signaling the need for investors to proceed with caution.

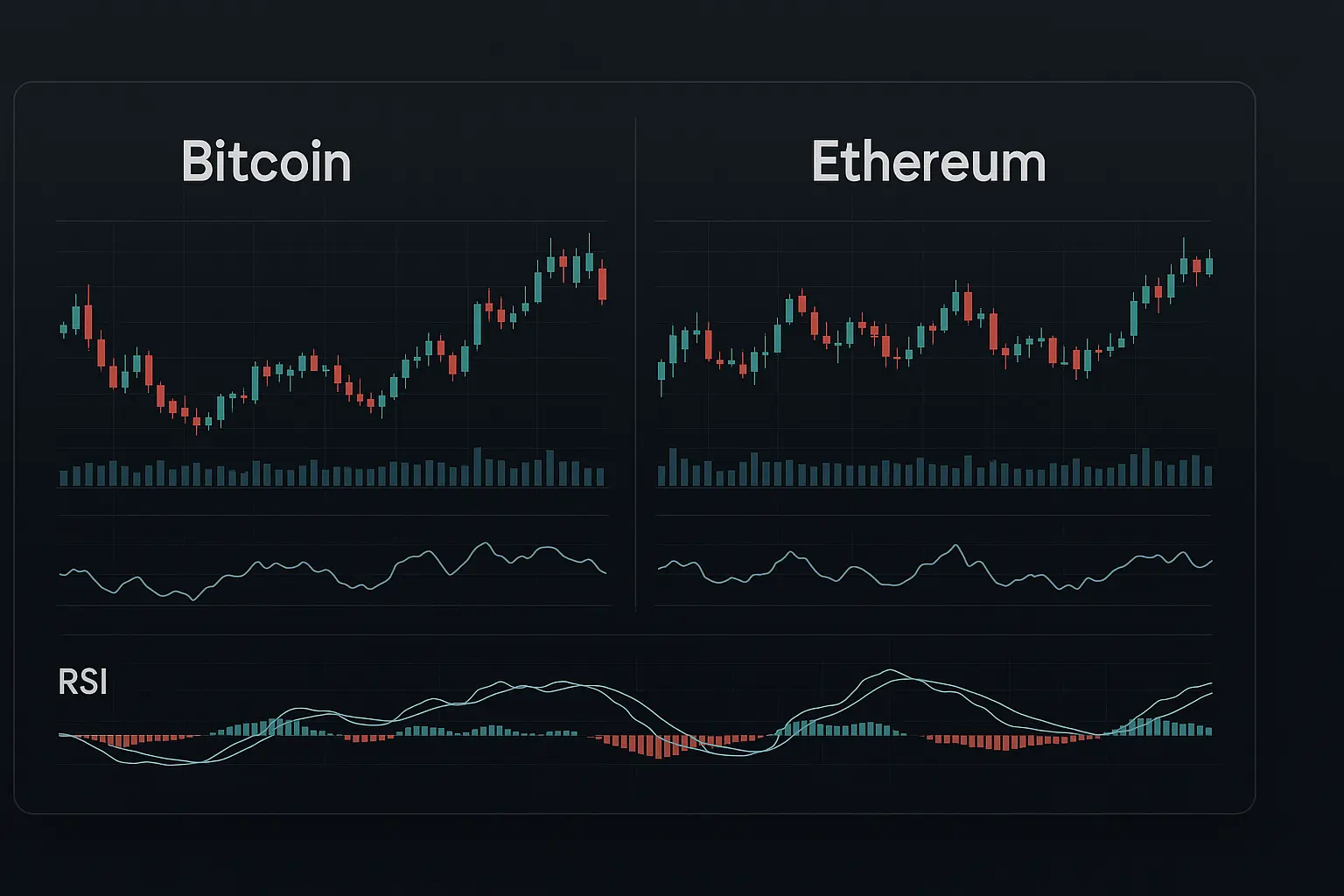

Over the past five days, Bitcoin’s price has experienced significant fluctuations, moving between 118,000 and 126,000. The price opened at 118,594 on October 2nd and closed at 124,658 on October 6th, reflecting a generally positive trend. The Relative Strength Index (RSI) climbed from 76 to 84, entering overbought territory, while the Money Flow Index (MFI) rose from 49 to 68, confirming increased buying pressure. Meanwhile, the Fear and Greed Index fluctuated between 64 and 74, indicating moderately bullish sentiment but stopping short of extreme optimism. This suggests that some short-term price adjustments remain possible.

Looking at the Bollinger Bands, the price is near the upper band, implying that the market is experiencing heightened volatility and an increased likelihood of a reversal. The Hull Moving Averages (HMA) over 7 and 14 days show consistent upward movement, with prices closing above these averages, signaling a strong uptrend. Similarly, the 21- and 30-day moving averages are also trending upward, pointing to positive momentum in the medium term. Key support levels are identified at 117,758, 115,188, and 112,872, which could serve as important cushions if the price dips. On the resistance front, the psychological barrier at 125,000 remains a significant hurdle; breaking this level would be a crucial milestone for further gains.

On the macroeconomic side, the Fed’s rate cut and ongoing uncertainty over a potential government shutdown in the U.S. have provided some support for Bitcoin, as investors seek alternatives to traditional markets. Additionally, growing institutional interest and the potential expansion of Bitcoin Exchange-Traded Funds (ETFs) contribute to a more robust long-term outlook. However, challenges such as fraud and security concerns within the crypto sector—highlighted by recent incidents, including the case involving a former Singapore naval officer—continue to weigh on market confidence and may exert short-term downward pressure on prices.

The Moving Average Convergence Divergence (MACD) indicator remains in positive territory, reinforcing current buying momentum. Nevertheless, the overbought RSI and proximity to the upper Bollinger Band counsel prudence. Trading volume rose notably on October 5th, fueling price advances, whereas lower volumes on October 4th limited price movement. Open interest increased by 2.98%, signaling growing market engagement but also hinting at the potential for increased volatility. The funding rate is slightly positive, confirming bullish sentiment, though the absence of extreme greed increases the risk of sudden corrections.

In summary, Bitcoin’s present situation reflects a delicate balance: the long-term fundamentals remain solid, but a cautious approach is advisable in the short term. Psychological resistance and overbought signals raise the possibility of a retracement, especially if negative news or global financial uncertainties intensify. Conversely, a successful breakthrough above 125,000 could mark the beginning of a new upward phase, supported notably by institutional investments and ETF growth. Investors should therefore closely monitor both technical and fundamental factors and adopt a balanced strategy to navigate potential volatility effectively.

Data Summary

- 1. Time:

2025-10-07 – 00:00 UTC - 2. Prices:

Open: 123482.32000000High: 126199.63000000Low: 123084.00000000Close: 124658.54000000

- 8. Supports:

S1: 117758.09000000 – 115188.00000000S2: 112872.94000000 – 112380.00000000S3: 101509 – 99950.8

- 9. Resistances:

Only Psychological Resistance

- 10. Psychological Support:

120000.00000000

- 11. Psychological Resistance:

125000.00000000

- 3. Last 5 days’ closing prices:

2025-10-02: 120529.350000002025-10-03: 122232.000000002025-10-04: 122391.000000002025-10-05: 123482.310000002025-10-06: 124658.54000000

- 4. Volume:

BTC: 19494.6288USD: $2428828952.2653

- 5. Number of trades:

4206167

- 6. Indicators:

RSI: 84.0300MFI: 68.3300BB Upper: 125015.60000000BB Lower: 107061.05000000

- 7. Moving Averages:

SMA:7=120885.7400000014=116042.4800000021=116038.3200000030=115280.0000000050=114099.83000000100=114087.65000000200=104864.94000000EMA:

7=120969.3200000014=118327.1700000021=117038.9400000030=116140.1500000050=115093.99000000100=112626.73000000200=106670.61000000HMA:

7=125178.0900000014=125097.0300000021=121684.9200000030=117972.6600000050=116842.34000000100=113758.83000000200=118173.73000000 - 12. Funding Rate:

0.0058%

- 13. Open Interest:

99288.6790

- 14. Fear & Greed Index:

71 (Greed)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.