Market Analysis

Bitcoin recently approached a significant resistance level near 124,000 but encountered a notable pause, despite the Federal Reserve’s interest rate cuts. Price momentum has yet to demonstrate clear upward movement, signaling potential hesitation in the market. Technical indicators and investor sentiment suggest that the coming days may bring some uncertainty and possible downward pressure on the price.

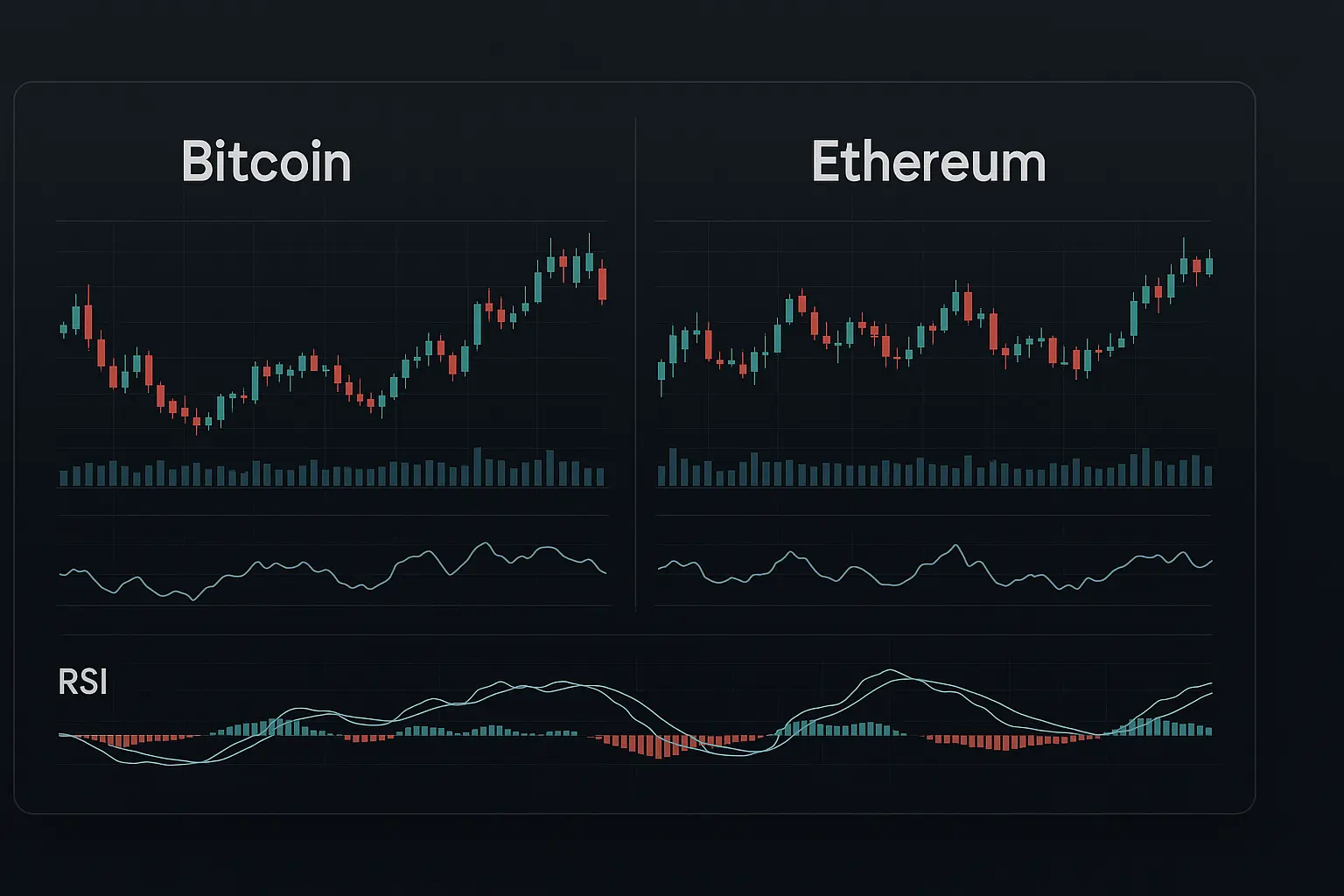

An analysis of Bitcoin’s price action over the past five days reveals a movement from approximately 112,163 to 122,391, characterized by considerable volatility and a marked increase in both trading volume and transaction count. The Relative Strength Index (RSI) over a 7-day period rose sharply from 59.25 to 79.96, nearing overbought territory, which indicates heightened buying pressure. Meanwhile, the Money Flow Index (MFI) climbed from 35.04 to 57.57, settling in the mid-range and reflecting a balanced liquidity environment in the market. Price action touched the upper Bollinger Band, a signal often associated with a potential reversal or weakening of the current upward trend.

Looking at moving averages, the Hull Moving Averages (HMA) across all time frames display bullish momentum. Notably, the 7- and 14-day HMAs show consistent upward movement, with the most recent closing price positioned above these averages—signifying strong short-term upward momentum. The 200-day HMA, hovering near 118,000, continues to act as a long-term support level. Although the current price remains above this support, its momentum appears somewhat subdued, largely because Bitcoin has yet to break through the 124,000 resistance level decisively.

In terms of support levels, the closest range lies between 117,825 and 118,686, serving as a solid technical floor. Should this area give way, the next support zones are positioned between 115,188 and 117,758, followed further below by a range between 112,380 and 112,872. These support levels are critical in preventing sharp declines in both the short and medium term. On the resistance front, 125,000 stands out as a major psychological barrier that Bitcoin has yet to surpass, and overcoming this level will likely require stronger bullish signals.

Investor sentiment, measured by the Fear & Greed Index, has risen from 50 to 71, moving from a neutral position toward elevated optimism. This suggests growing enthusiasm among investors, albeit with an underlying risk of excessive greed. Increases in financing rates and open interest confirm ongoing market participation, but recent drops in trading volume and fluctuations in transaction numbers advise a cautious approach. Market news remains mixed; while some institutions forecast further price appreciation, concerns about regulatory scrutiny and security risks continue to weigh on sentiment.

From a long-term perspective, Bitcoin’s prospects remain positive, especially given increasing ETF investments and a broader shift among investors toward alternative assets amid global financial uncertainties. However, in the short term, resistance levels and technical signals indicate that price stabilization or a mild correction may occur. Therefore, investors are advised to exercise patience and closely monitor evolving market conditions.

Overall, Bitcoin has demonstrated strong upward momentum in recent days but has encountered resistance near 124,000, revealing some signs of weakening. Both technical indicators and market sentiment suggest adopting a cautious stance, as price declines remain a possibility. Breaching key support levels could open the door to further downside, whereas a break above the 125,000 psychological threshold might ignite a new bullish phase. Careful analysis and disciplined patience are essential when making decisions about entering or exiting the market.

Data Summary

- 1. Time:

2025-10-05 – 00:00 UTC - 2. Prices:

Open: 122232.21000000High: 122800.00000000Low: 121510.00000000Close: 122391.00000000

- 8. Supports:

S1: 118686.00000000 – 117825.50000000S2: 117758.09000000 – 115188.00000000S3: 112872.94000000 – 112380.00000000S4: 101509 – 99950.8

- 9. Resistances:

Only Psychological Resistance

- 10. Psychological Support:

120000.00000000

- 11. Psychological Resistance:

125000.00000000

- 3. Last 5 days’ closing prices:

2025-09-29: 114311.960000002025-10-01: 118594.990000002025-10-02: 120529.350000002025-10-03: 122232.000000002025-10-04: 122391.00000000

- 4. Volume:

BTC: 8208.1668USD: $1002272903.3446

- 5. Number of trades:

1703590

- 6. Indicators:

RSI: 79.9600MFI: 57.5700BB Upper: 122537.89000000BB Lower: 107924.04000000

- 7. Moving Averages:

SMA:7=117122.7300000014=114812.2700000021=115230.9600000030=114388.3400000050=113896.61000000100=113637.08000000200=104449.73000000EMA:

7=118492.0100000014=116410.1600000021=115556.4500000030=115005.8100000050=114345.28000000100=112159.44000000200=106319.05000000HMA:

7=124569.3900000014=120854.1700000021=117026.2400000030=115015.9300000050=115244.01000000100=113063.38000000200=118072.08000000 - 12. Funding Rate:

0.0083%

- 13. Open Interest:

95866.1740

- 14. Fear & Greed Index:

71 (Greed)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.