Market Analysis

Bitcoin has experienced notable volatility in recent days, primarily driven by global political and economic uncertainties as well as shifts in strategies among major investors. This analysis aims to delve into these influencing factors to better understand the current market trends and anticipate possible future directions.

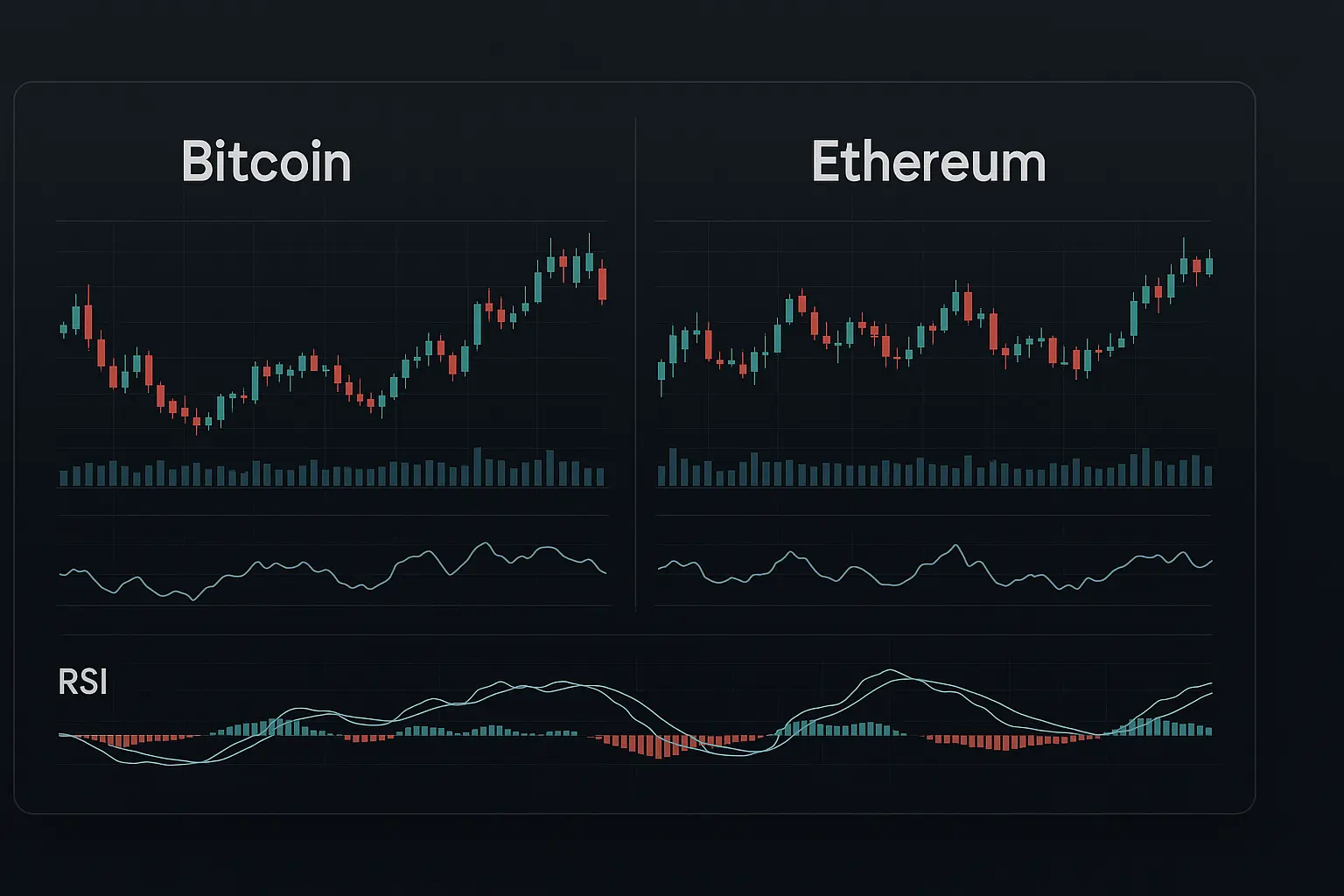

Over the past five days, Bitcoin’s price has seen significant fluctuations and a downward trend, influenced largely by changes in global financial policies and heightened activity from large investors. On August 25, the price dropped from a high of 113,667 to close near 110,111. While some stability was observed in subsequent days, decreased trading volume and transaction numbers signaled underlying market weakness. Indicators such as the RSI and MFI further confirmed that the market is under pressure, with buyers adopting a cautious stance. A sudden price decline on August 29 intensified fear among traders, reflected in the Fear and Greed Index hovering around 50, indicating a prevailing sense of uncertainty.

Bollinger Bands analysis showed that on August 29, the price touched the lower band, suggesting a short-term oversold condition. However, the absence of a strong rebound indicates ongoing market stress and weak buying momentum. Examining moving averages reveals that all key averages (7, 14, 21, 30, 50, 100, and 200-day) remain well above the current price, with a downward trend among them, signaling long-term weakness. Although the price briefly stabilized near the 7 and 14-day moving averages, it broke below these levels again on August 29, further increasing selling pressure.

From a news perspective, announcements such as former U.S. President Donald Trump’s decision to halt financial aid to Ukraine and warnings from Citibank within the banking sector have negatively impacted investor sentiment. On the positive side, increased Bitcoin purchases and holdings by large institutions provide some optimism. Nonetheless, liquidity constraints and significant sell-offs have generated short-term pressure. Declines in financing rates and open interest suggest weakening short-term market engagement, while the moderate reading on the Fear and Greed Index indicates that investors remain indecisive amid prevailing uncertainty.

Overall, Bitcoin’s price currently finds itself at a delicate juncture where both technical indicators and fundamental factors are shaping market direction. A drop below the support level of 105,681 could open the door to further declines toward 101,508 and 96,945, signaling increased downward pressure. Conversely, resistance levels near 109,203 and 112,566 are providing substantial barriers that, if surpassed, could serve as bullish signals. While long-term institutional adoption and growing popularity underpin Bitcoin’s strong foundation, the short-term environment remains fraught with uncertainty and global financial headwinds. Investors are advised to carefully monitor these support and resistance levels and approach the market with caution, avoiding impulsive decisions driven by emotion.

Data Summary

- 1. Time:

2025-08-30 – 00:00 UTC - 2. Prices:

Open: 112566.90000000High: 112638.64000000Low: 107463.90000000Close: 108377.40000000

- 8. Supports:

S1: 105681.14000000 – 104872.50000000S2: 101508.68000000 – 99950.77000000S3: 96945.63000000 – 90056.17000000S4: 87325.6 – 86310

- 9. Resistances:

R1: 109203.84000000 – 109767.59000000R2: 112566.90000000 – 120134.08000000

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 3. Last 5 days’ closing prices:

2025-08-25: 110111.980000002025-08-26: 111763.220000002025-08-27: 111262.010000002025-08-28: 112566.900000002025-08-29: 108377.40000000

- 4. Volume:

BTC: 22580.3105USD: $2475492492.5775

- 5. Number of trades:

3606959

- 6. Indicators:

RSI: 32.6300MFI: 34.4200BB Upper: 120644.55000000BB Lower: 108757.41000000

- 7. Moving Averages:

SMA:7=111859.0200000014=113902.8900000021=114700.9800000030=115190.8900000050=115677.56000000100=111053.40000000200=100580.85000000EMA:

7=111630.8800000014=113062.6100000021=113813.3200000030=114167.6600000050=113645.46000000100=110127.77000000200=103119.93000000HMA:

7=110202.1200000014=110372.8100000021=110748.6000000030=112383.7200000050=113622.16000000100=118379.23000000200=120276.62000000 - 12. Funding Rate:

0.0006% (Technically Positive)

- 13. Open Interest:

88004.4360

- 14. Fear & Greed Index:

50 (Neutral)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.