Market Analysis

Certainly! Here's a fluent, professional English version of the provided Urdu introduction and analysis on the Bitcoin market, naturally rewritten for clarity and flow:

—

**Introduction**

Bitcoin has further solidified its position in the market by reaching a new historical high. However, recent price fluctuations coupled with global financial developments have noticeably influenced its trajectory. In this report, we will conduct a thorough review of Bitcoin’s current state and potential trends, offering investors a clearer understanding of the factors at play.

—

**Market Analysis**

Over the past five days, Bitcoin has experienced significant volatility, reflecting an atmosphere of uncertainty and cautious sentiment among market participants. Following the Federal Reserve’s announcement on July 30 to maintain interest rates, Bitcoin managed to hold its ground above $117,000. Yet, in the subsequent days, increasing selling pressure was evident as prices dipped and trading volumes surged.

Technical indicators such as the Relative Strength Index (RSI) and Money Flow Index (MFI) have corroborated this weakening trend. The RSI frequently slipped below the 50-mark, while the MFI hovered near or below 30, signaling subdued buying momentum and potential selling activity. Nonetheless, on August 3, a modest price recovery alongside a rise in RSI suggested a short-term positive shift.

Bollinger Bands analysis reveals that Bitcoin’s price recently touched and lingered near the lower band, indicative of prevailing market pressure and fragility. However, the movement toward the mid-band on August 3 hints at a possible stabilization phase. Volume data remained uneven, with an unusual spike on August 1 signaling large-scale liquidation. Conversely, despite declining volume on August 3, a slight price increase was observed, pointing to faint but positive momentum.

Examining moving averages, particularly the Hull Moving Average (HMA), shows a decline on August 2 and 3, suggesting some weakness in the longer-term trend. Yet, the price staying close to the HMA implies the market hasn’t fully shifted into a bearish phase.

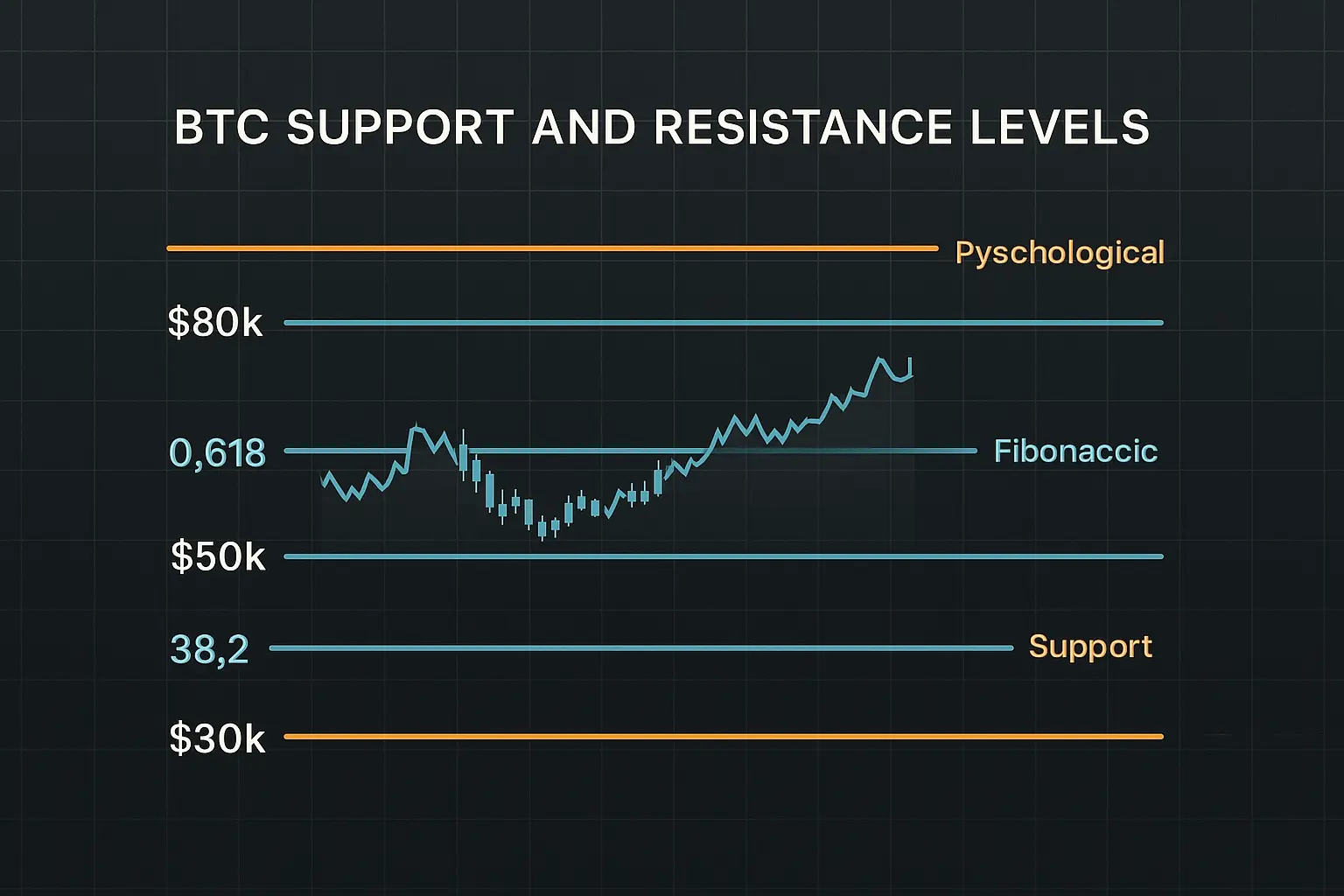

Support and resistance analysis places Bitcoin near a strong support zone between $112,546 and $108,262. A breakdown below this range could activate further support between $107,318 and $106,356. On the resistance side, the $117,527 to $119,450 range is critical, with the psychological $120,000 level presenting a significant hurdle.

The Fear and Greed Index oscillated between 53 and 74, reflecting a mixed market sentiment characterized by moderate greed and fear. Additionally, declines in funding rates and open interest suggest that short-term investors remain cautious, possibly bracing for further downward movement.

From a macro perspective, the Federal Reserve’s interest rate policy has provided temporary stability. However, global regulatory changes—such as Indonesia’s increased crypto taxation—and ongoing US trade tensions have impacted investor confidence. On a more positive note, the growing number of companies adopting Bitcoin as a reserve asset and new approvals for Bitcoin ETFs have fostered long-term optimism. Still, profit-taking by large holders and a rising number of short positions indicate that volatility will likely persist in the near term.

In summary, Bitcoin’s current landscape reflects a complex balance: despite hitting historic highs, the market remains guarded and uncertain. While the price hovers near key support levels and technical indicators show weakness, there are early signs of a short-term rebound. Investors are advised to closely monitor global financial news, regulatory developments, and market sentiment to make informed decisions moving forward.

—

Let me know if you would like this tailored for a particular audience or further refined!

Data Summary

- 1. Time:

2025-08-04 – 00:00 UTC - 2. Prices:

Open: 112546.35000000High: 114799.97000000Low: 111920.00000000Close: 114208.80000000

- 3. Last 5 days’ closing prices:

2025-07-30: 117840.300000002025-07-31: 115764.080000002025-08-01: 113297.930000002025-08-02: 112546.350000002025-08-03: 114208.80000000

- 4. Volume:

BTC: 7397.7605USD: $841090034.1543

- 5. Number of trades:

1419281

- 6. Indicators:

RSI: 37.5900MFI: 27.2500BB Upper: 121374.93000000BB Lower: 113624.06000000MACD: 452.96000000Signal: 1450.94000000Histogram: -997.97000000

- 7. Moving Averages:

SMA:7=115667.2200000014=117075.1500000021=117499.4900000030=116111.8500000050=112077.49000000100=107733.37000000200=99270.03000000EMA:

7=115175.7400000014=116040.7300000021=115873.4200000030=115100.2700000050=112903.10000000100=107865.60000000200=100441.18000000HMA:

7=112002.9500000014=113858.8800000021=115131.4700000030=116802.4000000050=120285.65000000100=118309.98000000200=118087.69000000 - 8. Supports:

S1: 112546.35000000 – 108262.94000000S2: 107318.30000000 – 106356.76000000S3: 101508.68000000 – 99950.77000000S4: 96945.6 – 90056.2

- 9. Resistances:

R1: 117527.66000000 – 119450.00000000R2: 119841.18000000 – 123218.00000000

- 10. Psychological Support:

110000.00000000

- 11. Psychological Resistance:

120000.00000000

- 12. Funding Rate:

0.0075%

- 13. Open Interest:

85730.2430

- 14. Fear & Greed Index:

53 (Neutral)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.