Market Analysis

**Introduction**

Bitcoin’s price recently faced renewed downward pressure near the 103,000 level after failing to break through the critical resistance at 113,000. Against the backdrop of global investment trends and economic developments, today we offer a comprehensive review of this cryptocurrency’s current state and potential future trajectories to better understand the market’s direction.

**Market Analysis**

Over the past five days, Bitcoin’s price has been trading within a tight range between 105,000 and 108,000, showing a slight decline at closing. On June 27, the price opened steadily near 107,000 and reached an intraday high of 108,356, but by July 1, it had retreated to 105,681. The Relative Strength Index (RSI) rose from 60.66 on June 27 to a short-term peak of 67.76 on June 29, signaling positive momentum initially; however, by July 1, it dropped sharply to 45.7, indicating weakening momentum and a shift below neutral territory. Similarly, the Money Flow Index (MFI) declined from 48.65 to 42.32, suggesting a slowdown in capital inflows. These indicators point to temporary price pressure and a cautious stance among investors.

Looking at the Bollinger Bands, the middle band hovers around 105,709, a level around which the price has frequently oscillated. The upper band stands near 109,418 while the lower band is around 102,000. The price’s tendency to remain close to the middle band suggests relative equilibrium in the market, though the move toward the lower band on July 1 signals short-term downside pressure. Volume analysis shows that trading volume was approximately 12,232 on June 27, sharply declined on June 28, and then rose again to 10,505 on July 1, reflecting ongoing market activity despite the price drop. The number of trades has similarly fluctuated, indicating some market turbulence but no clear directional trend.

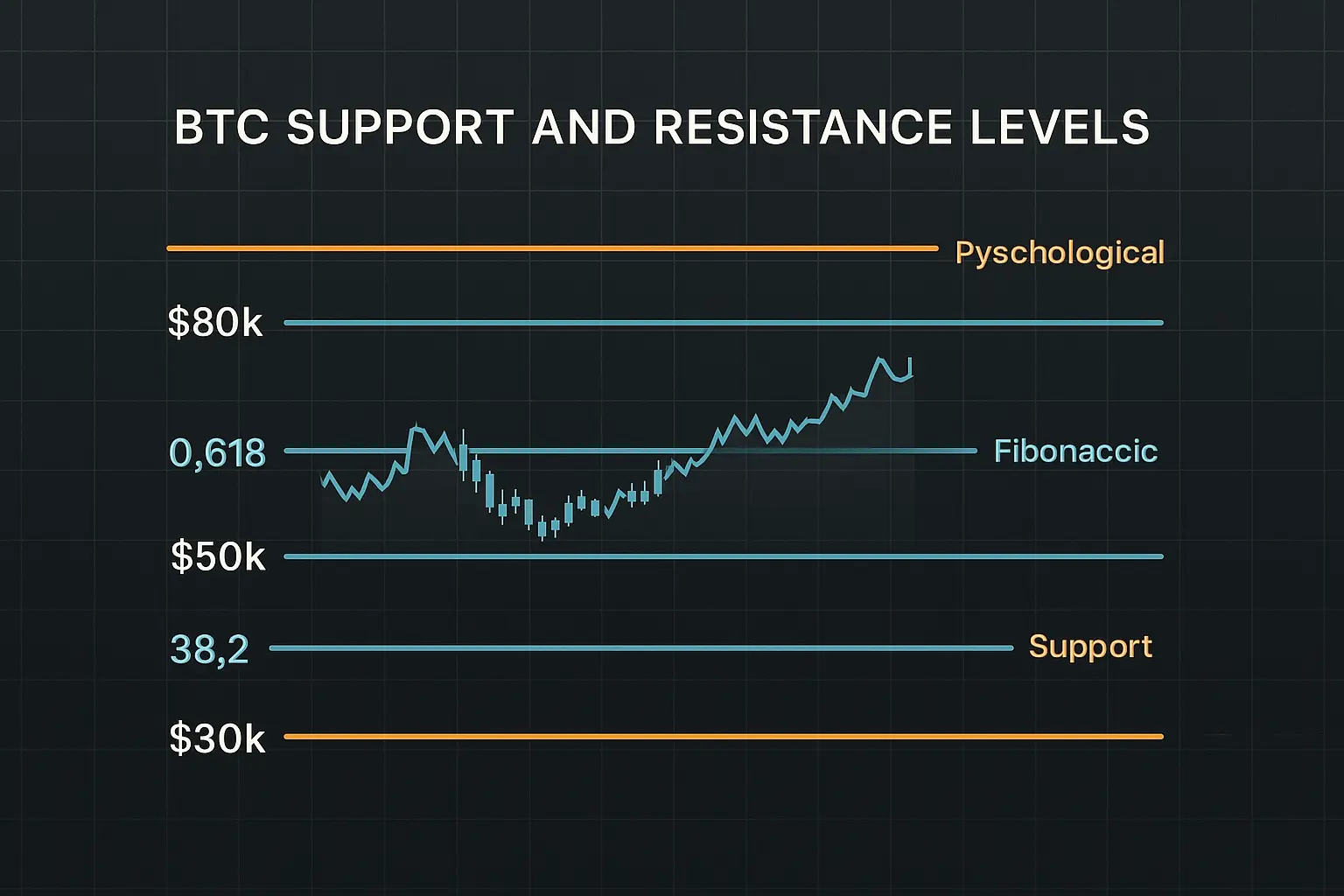

Among moving averages, particular focus falls on the Hull Moving Average (HMA), which was near 107,146 on June 30 but dropped to 106,093 on July 1, reflecting a slight downward drift. The current closing price of 105,681 sits below the HMA, hinting at a weakening or neutral trend. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) display similar patterns, with prices near or just below these levels, signaling market balance or mild selling pressure. Should the key support zone between 103,985 and 103,105 break, the next support lies between 101,508 and 99,950, followed by a broader support range from 96,945 to 90,056. On the resistance side, the range from 105,857 to 106,457 forms the immediate barrier, with a stronger resistance zone between 109,434 and 110,797, and the psychologically significant 110,000 level also important. A close above 105,857 could indicate a move toward these higher resistance levels, whereas failure to hold this mark may intensify downward pressure.

The funding rate currently stands neutral at 0.000011, while open interest has fallen by 1.913%, suggesting mild weakening sentiment in the market. The Fear & Greed Index hovers between 64 and 68, reflecting moderate greed but far from extremes of fear or greed, indicating no imminent sharp reversal in the short term. News flow corroborates that major investors maintain interest in Bitcoin, though some uncertainty persists, particularly as large transfers have decreased and capital is increasingly shifting toward altcoins.

In summary, Bitcoin remains confined within a critical trading range, with significant resistance at 113,000 yet to be breached. Both technical and fundamental factors suggest a prevailing cautious sentiment, keeping the price under pressure near 103,000. A sustained close above 105,857 could pave the way for a recovery, while failure to do so may lead to further declines. Looking ahead, global economic conditions, potential shifts in U.S. monetary policy, and activity among institutional investors will likely influence price direction. Accordingly, investors should closely monitor key support and resistance levels and stay attuned to market news to make informed decisions.

Data Summary

- 1. Time:

2025-07-02 – 00:00 UTC - 2. Prices:

Open: 107146.51000000High: 107540.00000000Low: 105250.85000000Close: 105681.14000000

- 3. Last 5 days’ closing prices:

2025-06-27: 107047.590000002025-06-28: 107296.790000002025-06-29: 108356.930000002025-06-30: 107146.500000002025-07-01: 105681.14000000

- 4. Volume:

BTC: 10505.6244USD: $1117432945.8926

- 5. Number of trades:

2013289

- 6. Indicators:

RSI: 45.7000MFI: 42.3200BB Upper: 109418.53000000BB Lower: 102000.38000000MACD: 485.26000000Signal: 345.38000000Histogram: 139.88000000

- 7. Moving Averages:

SMA:7=107116.6600000014=105511.4800000021=105709.4500000030=105781.7000000050=106033.68000000100=97667.37000000200=96286.66000000EMA:

7=106592.3700000014=106208.2700000021=105988.9000000030=105615.6200000050=104169.31000000100=100430.54000000200=94496.58000000HMA:

7=106746.4800000014=108154.8300000021=107550.0000000030=106093.8700000050=105612.14000000100=109647.69000000200=106566.57000000 - 8. Supports:

S1: 103985.48000000 – 103105.09000000S2: 101508.68000000 – 99950.77000000S3: 96945.63000000 – 90056.17000000S4: 87325.6 – 86310

- 9. Resistances:

R1: 105857.99000000 – 106457.44000000R2: 109434.79000000 – 110797.38000000

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 12. Funding Rate:

0.0011% (Technically Positive)

- 13. Open Interest:

76425.9900

- 14. Fear & Greed Index:

64 (Greed)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.