Market Analysis

**Introduction**

In today’s analysis, we will examine the recent volatility observed in Bitcoin’s price alongside the prevailing market sentiment. Particular attention will be given to the heightened geopolitical tensions between Israel and Iran, as well as the implications of the latest FOMC meeting. We will explore how these factors are influencing Bitcoin’s technical trends and investor behavior, providing a comprehensive overview of the current market dynamics.

**Analysis**

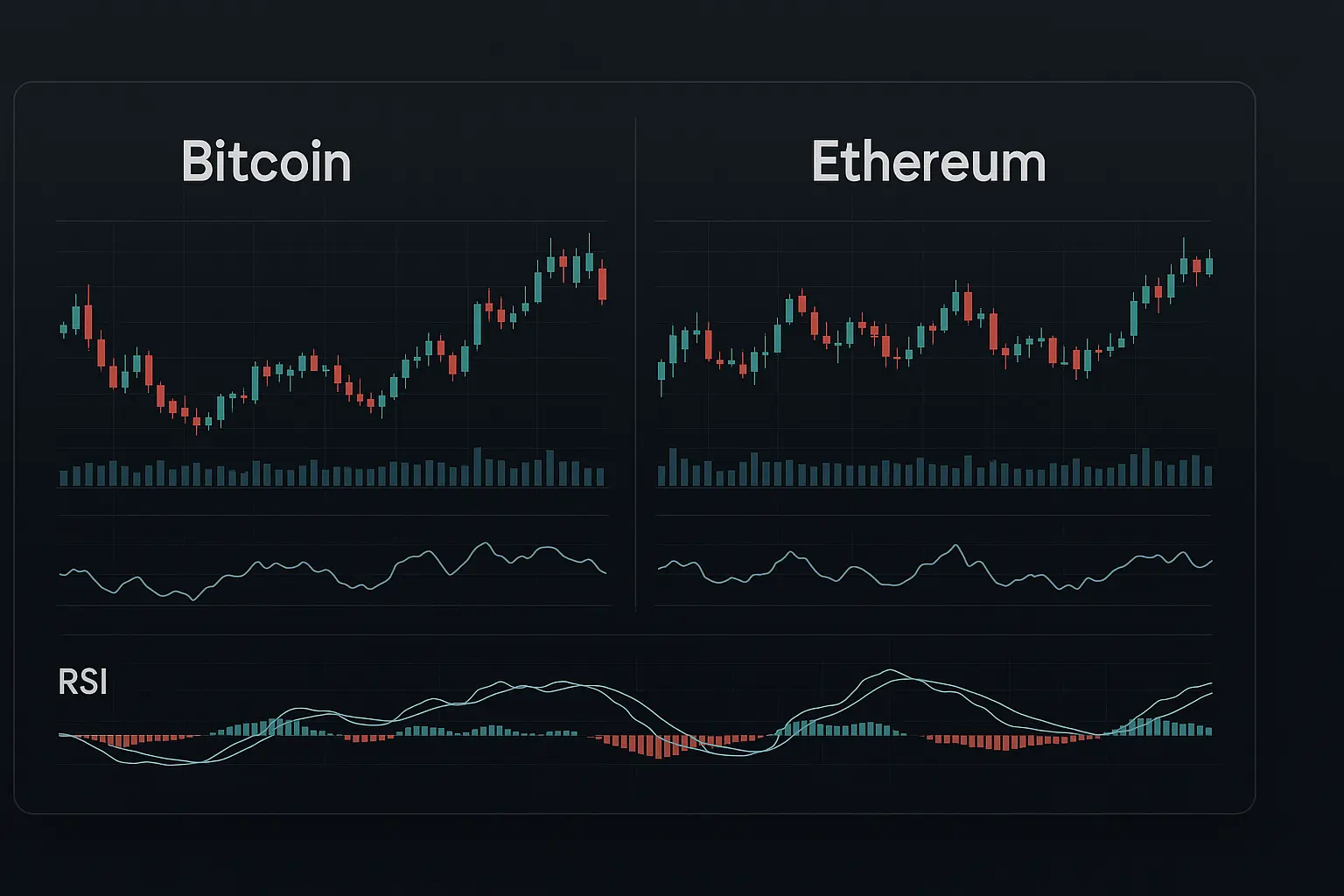

Over the past five days, Bitcoin has experienced notable price fluctuations primarily driven by escalating tensions in the Middle East, particularly between Israel and Iran. On June 13, Bitcoin opened at 105,671 and closed slightly higher at 106,066. Despite intraday volatility, the Relative Strength Index (RSI) remained around a neutral 47.09, and the Money Flow Index (MFI) hovered near 50.52, reflecting an atmosphere of market uncertainty and balance.

In the following days, a gradual decline in Bitcoin’s price was observed, culminating on June 17 when it dipped to 104,551. Correspondingly, the RSI dropped to 40.5, signaling a weakening trend, while the MFI fell below neutral to 47.7, indicating reduced buying pressure and potential selling pressure. The MACD also showed a consistent downturn, declining from 1,068.95 on June 13 to 535.03 by June 17, suggesting a slowdown in upward momentum.

Trading volumes and the number of transactions also fluctuated during this period. June 13 saw robust activity with volumes near 26,180, marking a strong trading day. However, volume dropped significantly in subsequent days to as low as 7,164, pointing to diminished market interest. A moderate rebound in volume to 17,866 on June 17 indicated renewed, albeit cautious, trading activity. Notably, this uptick in volume coincided with falling prices, which could be interpreted as a bearish signal. The number of trades similarly oscillated, underscoring the prevailing uncertainty among market participants. Bollinger Bands expanded during this time, particularly on June 17 when prices approached the lower band, highlighting short-term downward pressure.

Looking at moving averages, slight declines were evident on June 16 and 17 across the 7-, 14-, and 21-day Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). The Hull Moving Average (HMA), an important indicator of trend strength, settled near 105,478 for the 7-day period—close to the current price level. On June 17, Bitcoin closed below the 7-day HMA at 104,551, signaling weakening short-term momentum. The 14- and 21-day moving averages also trended downward, indicating medium-term pressure.

In terms of support levels, the nearest solid support range lies between 103,985 and 103,105. A breach of this range could see Bitcoin testing lower support between 97,700 and 95,676, which may help limit further declines. On the resistance side, the 105,857 to 106,457 zone presents significant resistance, with further resistance anticipated between 109,434 and 110,797, including the psychologically important 110,000 level.

Market sentiment indicators reveal that the Fear & Greed Index is currently between 61 and 68, reflecting moderate to slightly elevated greed but still far from extreme levels. The funding rate remains very low at 0.000022, and open interest has decreased by 0.8617%, suggesting subdued market enthusiasm. Geopolitical uncertainties, especially concerns about escalation between Israel and Iran and potential U.S. involvement, have made investors cautious. Additionally, expectations that the FOMC will maintain interest rates without cuts amid persistent inflationary pressures add further strain to the market. This environment is driving investors toward traditional safe-haven assets like gold and the U.S. dollar, intensifying bearish pressure on Bitcoin.

Overall, the current downward pressure and market uncertainty point toward a bearish trend in the short to medium term, especially as Bitcoin approaches key support near 103,000. However, a decisive breakout above the liquidity cluster around 113,000 could pave the way for a sustained long-term rally. At present, the market is characterized by a delicate balance between bullish and bearish forces, warranting cautious positioning by investors. Considering both technical and fundamental factors, it is advisable to closely monitor upcoming market developments before making significant trading decisions.

Data Summary

- 1. Time:

2025-06-18 – 00:00 UTC - 2. Prices:

Open: 106794.53000000High: 107771.34000000Low: 103371.02000000Close: 104551.17000000

- 3. Last 5 days’ closing prices:

2025-06-13: 106066.590000002025-06-14: 105414.640000002025-06-15: 105594.010000002025-06-16: 106794.530000002025-06-17: 104551.17000000

- 4. Volume:

BTC: 17866.3303USD: $1883173484.8991

- 5. Number of trades:

3723010

- 6. Indicators:

RSI: 40.5000MFI: 47.7000BB Upper: 109840.81000000BB Lower: 101957.48000000MACD: 535.03000000Signal: 934.98000000Histogram: -399.95000000

- 7. Moving Averages:

SMA:7=106105.4000000014=106075.3800000021=105899.1400000030=106670.1100000050=104060.28000000100=94586.03000000200=95790.47000000EMA:

7=105945.2600000014=106121.4600000021=105920.1600000030=105219.8100000050=102996.39000000100=98752.83000000200=92832.96000000HMA:

7=105478.8700000014=105686.5500000021=106947.3800000030=106404.7200000050=106987.48000000100=111677.65000000200=102200.25000000 - 8. Supports:

S1: 103985.48000000 – 103105.09000000S2: 97700.59000000 – 95676.64000000S3: 94881.47000000 – 92206.02000000S4: 84474.7 – 83949.5

- 9. Resistances:

R1: 105857.99000000 – 106457.44000000R2: 109434.79000000 – 110797.38000000

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 12. Funding Rate:

0.0022% (Technically Positive)

- 13. Open Interest:

77946.8620

- 14. Fear & Greed Index:

68 (Greed)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.