Market Analysis

Certainly! Here is a polished, professional English version of the provided Urdu introduction and analysis for the Bitcoin market:

—

**Introduction**

In today’s analysis, we will closely examine the current price dynamics of Bitcoin and assess the impact of recent news developments. Our goal is to gain a clearer understanding of market trends and potential future directions. The recent price fluctuations within the current range, supported by technical indicators, suggest that no definitive market shift has occurred yet. However, several key factors are influencing price movements and deserve thorough consideration.

—

**Analysis**

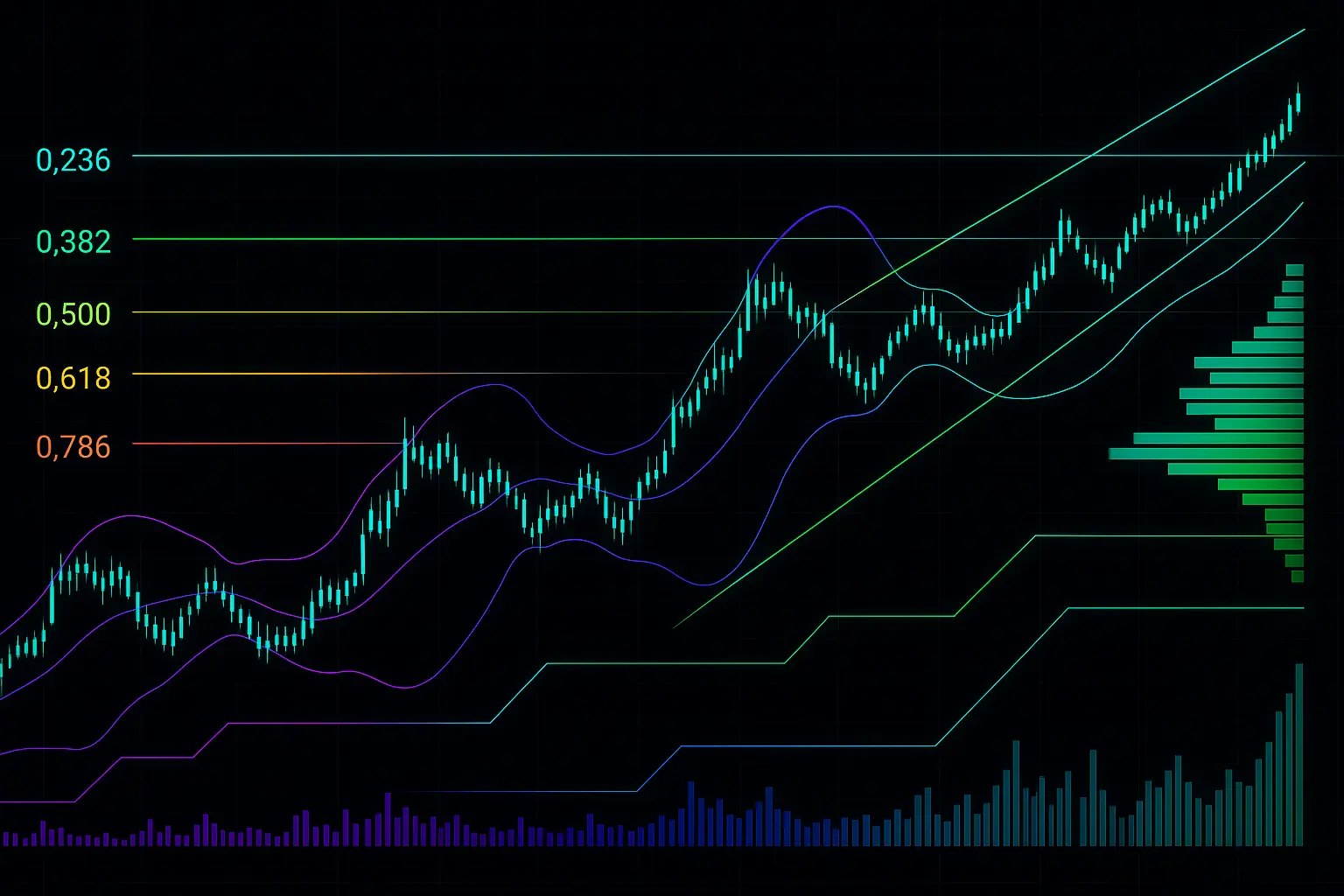

Over the past five days, Bitcoin’s price has been trading within a relatively narrow range between 110,000 and 85,000. Despite multiple attempts to break out of this range, a sustained breakout has not materialized. From June 2 to June 6, a gradual decline in daily prices was observed. Notably, on June 5, the price dropped sharply to 100,372 but partially recovered the following day, closing at 104,288.

The Relative Strength Index (RSI) fluctuated between 26.43 and 45.64 during this period, initially approaching oversold territory before gradually returning to moderate levels. This indicates short-term weakness with ongoing attempts at recovery. Similarly, the Money Flow Index (MFI) ranged from 28.13 to 36.95, signaling weak buying pressure and reduced cash flow into the market.

The Moving Average Convergence Divergence (MACD) showed consistent decline, dropping from 1788 to 780, reflecting weakening momentum in Bitcoin’s price. Interestingly, on June 5, trading volume and the number of transactions spiked sharply. This surge in activity despite the price dip suggests that investors might be viewing the lower prices as buying opportunities.

The Fear & Greed Index fell from 64 to 45, highlighting rising caution and increased market anxiety among investors. In this environment, support levels become critically important. The first support range (S1) lies between 103,985 and 103,105, close to the current price. If this level fails, the next support zone (S2) ranges from 97,700 to 95,676. On the upside, resistance levels (R1) span from 104,556 to 105,500, presenting a key barrier for any sustained price recovery.

Moving averages, particularly the Hull Moving Average (HMA), also point to a weakening short-term trend. On June 6, the HMA7 hovered around 102,500, with the closing price slightly above it. However, HMA14 and HMA21 values are declining, indicating mid-term weakness. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) give similar signals, as prices remain near or just above these averages but with diminishing upward momentum—signifying a modest or fragile uptrend.

Bollinger Bands show that price movements have been confined between the lower and middle bands recently, suggesting low volatility and diminishing likelihood of an immediate breakout.

From a fundamental perspective, institutional investors continue to accumulate Bitcoin, reflecting long-term confidence. However, mixed signals arise from a decrease in net realized cap positions and sales by long-term holders. Additionally, U.S. financial policies and global economic uncertainties have injected caution into the market, as evidenced by the drop in the Fear & Greed Index. The weakening U.S. dollar and declining yields have somewhat supported Bitcoin prices, but potential interest rate shifts by the Federal Reserve and ongoing volatility in financial markets contribute to directional uncertainty.

In summary, Bitcoin’s price remains within a constrained range, with technical indicators and market sentiment pointing toward a mild or weak upward trend. Support and resistance levels near the current price are crucial in determining the next move. A decisive break above the 104,500 range could signal a stronger recovery, whereas failure to do so might see prices retreat toward the psychological support around 100,000. Given the elevated market anxiety and fluctuating volumes, investors should exercise caution. Close monitoring of major holder activity and global economic developments will be essential to better anticipate Bitcoin’s potential trajectory.

Data Summary

- 1. Time:

2025-06-07 – 00:00 UTC - 2. Prices:

Open: 101508.69000000High: 105333.00000000Low: 101095.80000000Close: 104288.44000000

- 3. Last 5 days’ closing prices:

2025-06-02: 105857.990000002025-06-03: 105376.890000002025-06-04: 104696.860000002025-06-05: 101508.680000002025-06-06: 104288.44000000

- 4. Volume:

BTC: 15839.0739USD: $1642382404.9356

- 5. Number of trades:

2709327

- 6. Indicators:

RSI: 45.6400MFI: 36.9500BB Upper: 111218.26000000BB Lower: 101650.59000000MACD: 780.86000000Signal: 1739.66000000Histogram: -958.81000000

- 7. Moving Averages:

SMA:7=104566.2400000014=106032.8400000021=106434.4200000030=105597.1500000050=100596.83000000100=92412.34000000200=95184.27000000EMA:

7=104479.9800000014=105107.4500000021=104804.8500000030=103723.1300000050=100962.77000000100=96790.29000000200=91214.31000000HMA:

7=102500.8100000014=103438.8000000021=103585.2700000030=105484.0000000050=108920.10000000100=110344.63000000200=97532.43000000 - 8. Supports:

S1: 103985.48000000 – 103105.09000000S2: 97700.59000000 – 95676.64000000S3: 94881.47000000 – 92206.02000000S4: 84474.7 – 83949.5

- 9. Resistances:

R1: 104556.23000000 – 105500.00000000R2: 109434.79000000 – 110797.38000000R3: 111696.21000000 – 111980.00000000

- 10. Psychological Support:

100000.00000000

- 11. Psychological Resistance:

110000.00000000

- 12. Funding Rate:

-0.003% (Technically Positive)

- 13. Open Interest:

82247.5290

- 14. Fear & Greed Index:

45 (Fear)

Disclaimer: This market analysis is generated by AI based on historical BTC data and sentiment indicators. Use it as a reference, not financial advice.