Bitcoin has surged past $99K, bringing fresh optimism to the market, while XRP rallied 40%, signaling renewed interest in altcoins. Regulatory advancements are reshaping the industry, with Coinbase securing a UK VASP license and Kraken expanding into Europe’s derivatives market. Meanwhile, Binance is pushing forward with crypto adoption, forming key partnerships and maintaining confidence despite recent market turbulence. On the innovation front, TON has launched a $100 million fund to accelerate blockchain development. At the same time, Hong Kong is reinforcing its regulatory framework, even as it faces financial challenges.

With shifting global trade policies and new regulatory approvals, the market is experiencing a mix of bullish momentum and cautious optimism. Institutional players are gaining clearer pathways to enter the space, and payment adoption is expanding across Europe. These developments set the stage for greater mainstream adoption, increased market liquidity, and potential price volatility as investors react to changing economic conditions.

1. Bitcoin Surges Above $99K and XRP Rallies 40% as Trade War Tensions Ease

Bitcoin crossed the $99,000 mark after easing trade war tensions between major economies, signaling renewed investor confidence. Alongside Bitcoin, XRP recorded an impressive 40% surge, leading a broader altcoin rally. This price jump comes as global economic uncertainty diminishes, allowing risk assets to thrive.

The trade war between the U.S. and China had previously created market volatility, with Bitcoin acting as a safe-haven asset. However, the recent de-escalation encouraged more investments into traditional and digital assets alike. XRP’s sharp rise suggests that investor interest is shifting back toward altcoins, possibly due to improving sentiment in the crypto market.

If Bitcoin manages to maintain its position above $99K, analysts suggest it could soon reach six figures. However, caution remains as external macroeconomic events still influence price movements. A stable global economy tends to reduce Bitcoin’s appeal as a hedge, but if new tensions arise, crypto could once again see volatility. XRP’s rally is promising, but its history of sharp price swings suggests a high-risk, high-reward scenario for investors.

Market Impact:

- Bullish sentiment for Bitcoin – breaking $99K could push it past the $100K milestone.

- Altcoin market revival – XRP’s rally might inspire renewed interest in alternative cryptocurrencies.

- Global trade stability favors traditional investments, but crypto remains attractive as a long-term store of value.

2. Kraken Expands into Europe with Regulated Crypto Derivatives

Kraken has announced its expansion into Europe with regulated crypto derivatives, positioning itself as a leading exchange in the region. This move is significant as it aligns with increasing demand for compliant trading products, particularly among institutional investors.

Crypto derivatives—such as futures and options—allow traders to hedge risk, speculate on price movements, and increase market liquidity. However, they have been under heavy regulatory scrutiny due to concerns over market manipulation. Kraken securing regulatory approval gives it an advantage over competitors that face restrictions in certain regions.

This move also highlights Europe’s growing role as a crypto-friendly regulatory environment, especially as the U.S. imposes stricter crypto rules. With more U.S. exchanges struggling with compliance, companies like Kraken are looking abroad for growth. If Kraken’s European derivatives market succeeds, it could set a precedent for other exchanges to expand under similar regulatory frameworks.

Market Impact:

- Institutional adoption grows as Kraken brings compliance-focused products.

- Europe solidifies its role as a key crypto hub, attracting more exchanges and investors.

- Derivatives trading expands liquidity, potentially reducing market volatility.

3. US and Mexico Delay Trump Tariffs, Crypto Market Reacts Positively

The U.S. and Mexico agreed to delay tariffs proposed by Donald Trump, bringing relief to both traditional and crypto markets. This news helped Bitcoin and altcoins recover, as economic stability reduces the immediate need for hedging against fiat risks.

Previously, tariff uncertainties led investors to seek safe-haven assets like Bitcoin. With the delay, risk assets—including stocks and cryptocurrencies—saw renewed investor confidence. However, this does not eliminate the possibility of future trade tensions, meaning crypto could remain a key hedge.

If long-term resolutions emerge, crypto might experience lower volatility as economic stability increases. However, if trade disputes resurface, Bitcoin could regain its hedge appeal. For now, the market is responding positively, but traders should watch for further geopolitical developments.

Market Impact:

- Short-term bullish sentiment for Bitcoin and altcoins.

- Decreased hedge demand if economic stability continues.

- Future tariffs could reintroduce volatility, making crypto attractive again as a hedge.

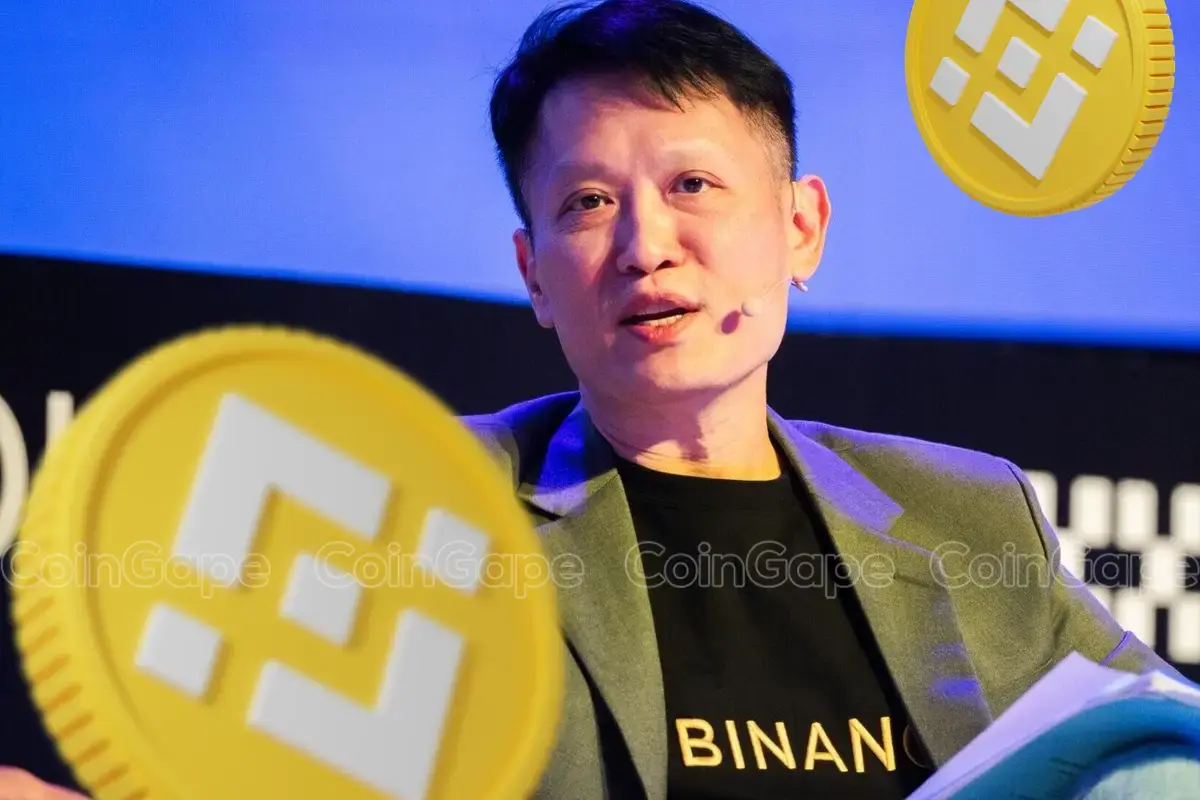

4. Binance CEO Remains Optimistic Despite Market Crash

Binance CEO Changpeng Zhao (CZ) has reassured investors that market downturns are a normal part of crypto’s evolution. He emphasized that historical patterns show recovery after major corrections and urged patience among traders.

CZ’s confidence is backed by ongoing developments within Binance, including regulatory compliance and new product launches. This message appears to have calmed investor fears, especially as Binance continues to expand globally.

While optimism from an industry leader like CZ helps maintain market morale, external factors like regulatory crackdowns and macroeconomic conditions still impact crypto’s long-term stability. If Binance continues innovating and securing regulatory approvals, it could mitigate some of the market’s volatility.

Market Impact:

- Positive sentiment boost for Binance users and the broader market.

- Reinforces long-term investment mindset, despite short-term downturns.

- Regulatory actions remain a key factor in Binance’s future.

5. TON Launches $100M Fund to Boost Blockchain Development

The Open Network (TON) has launched a $100 million fund to support projects built on its blockchain. This move aims to attract developers and enhance adoption within the TON ecosystem, which has been growing due to Telegram integration.

The fund will likely support DeFi projects, dApps, and blockchain infrastructure, making TON a more competitive alternative to platforms like Ethereum and Solana. If executed well, this could position TON as a major player in Web3 development.

However, the success of this initiative depends on developer interest and real-world adoption. If funded projects gain traction, TON’s value and network usage could increase significantly.

Market Impact:

- TON ecosystem expansion through new projects and funding.

- Increased developer activity, making the blockchain more competitive.

- Long-term value potential depends on adoption success.

6. Coinbase Secures UK VASP License for Crypto Services

Coinbase has officially obtained a Virtual Asset Service Provider (VASP) license in the United Kingdom, allowing the exchange to legally offer crypto services in one of Europe’s most significant financial hubs. This regulatory approval marks a major milestone for Coinbase, as it enables the platform to expand its offerings to both retail and institutional investors under the UK’s evolving crypto framework. By securing this license, Coinbase ensures that it operates within a regulated and compliant environment, reinforcing its reputation as a trusted exchange amid increasing global scrutiny of digital asset platforms.

The UK has been actively working toward establishing clearer crypto regulations, aiming to balance innovation with investor protection. With these regulations taking shape, Coinbase’s proactive approach to compliance gives it a competitive advantage over unlicensed exchanges. Institutional investors, in particular, tend to favor platforms that meet regulatory standards, as compliance reduces risks related to security, fraud, and legal uncertainty. By aligning with the UK’s financial regulations, Coinbase positions itself as a go-to platform for both retail users and large-scale investors seeking regulatory clarity.

Beyond the UK, this move highlights growing global acceptance of cryptocurrency regulations. As more countries introduce VASP licensing frameworks, major exchanges like Coinbase are likely to expand their regulatory footprint in multiple jurisdictions. If other nations follow the UK’s lead in establishing structured compliance models for crypto businesses, we could witness a significant rise in institutional adoption and mainstream integration. By securing licenses in key regions, Coinbase is not only future-proofing its operations but also paving the way for a more regulated and widely accepted crypto market worldwide.

Market Impact:

- Strengthens Coinbase’s European presence.

- Encourages institutional investments in regulated crypto services.

- Potential for other exchanges to seek UK licenses.

7. Binance Pay Partners with xMoney for Crypto Payments in Europe

Binance Pay has partnered with xMoney to accelerate the adoption of cryptocurrency payments across Europe, making it easier for businesses and consumers to use digital currencies for everyday transactions. This collaboration aims to bridge the gap between traditional finance and digital assets, allowing merchants to seamlessly integrate crypto payment solutions into their existing systems. By leveraging Binance Pay’s infrastructure and xMoney’s payment processing capabilities, the partnership could simplify crypto transactions for both businesses and customers.

As regulatory clarity improves across Europe, an increasing number of businesses are exploring crypto payment solutions. Binance Pay’s expansion into the region aligns with this trend, providing a secure and user-friendly method for accepting digital currencies. This initiative could encourage merchants to accept crypto without worrying about volatility, as many crypto payment systems allow for instant conversions to fiat currencies. Additionally, with consumer demand for alternative payment options growing, this partnership could help drive real-world adoption of digital assets beyond just investment and trading use cases.

If successful, the collaboration between Binance Pay and xMoney could contribute to the mainstream acceptance of cryptocurrencies in Europe. Wider merchant adoption could lead to increased transaction volumes, strengthening the utility and legitimacy of digital assets. However, challenges remain, including potential regulatory changes and the willingness of businesses to embrace crypto payments over traditional methods. If European regulators continue to support crypto-friendly policies, Binance Pay and xMoney could play a key role in shaping the future of blockchain-powered financial transactions in the region.

Market Impact:

- Improved adoption of crypto payments in Europe.

- More merchants may accept digital currencies.

- Could challenge traditional payment systems.

8. Hong Kong’s Regulator Faces Budget Deficit Amid Crypto Oversight Expansion

The Hong Kong Securities and Futures Commission (SFC) has projected a budget deficit for the upcoming fiscal year, raising concerns about the financial sustainability of the regulatory body. Despite these challenges, the SFC is pushing forward with plans to expand its regulatory team, particularly in the area of cryptocurrency oversight. This move reflects Hong Kong’s growing commitment to establishing itself as a global hub for digital assets, even as financial constraints pose potential operational difficulties.

The SFC has been actively working to develop a clearer regulatory framework for cryptocurrencies, attracting both institutional investors and major crypto firms looking for regulatory certainty. With a structured licensing regime and increasing enforcement actions against unregistered operators, Hong Kong is attempting to create a balanced environment that encourages innovation while ensuring compliance. The expansion of its regulatory team suggests that the SFC aims to increase its supervision of digital asset firms, ensuring that they adhere to evolving laws and consumer protection measures.

However, while stronger oversight can boost market confidence and attract institutional players, it may also introduce new compliance challenges for crypto businesses. Stricter regulations could lead to higher operational costs for exchanges and blockchain startups, potentially discouraging some firms from setting up in Hong Kong. Additionally, with the SFC operating under a budget deficit, questions remain about how effectively it can implement and enforce these new regulatory measures without additional funding. If Hong Kong successfully balances regulatory clarity with business-friendly policies, it could reinforce its position as a leading digital asset hub in Asia.

Market Impact:

- Regulatory clarity could attract investors.

- Stricter oversight may challenge some firms.

- Hong Kong remains a top crypto-friendly region.

Key Takeaways

✅ Bitcoin breaks past $99K, fueled by easing trade war tensions.

✅ Kraken expands into Europe with regulated derivatives, targeting institutional growth.

✅ Coinbase secures a UK VASP license, strengthening its foothold in Europe.

✅ US-Mexico tariff delay boosts crypto market sentiment, reducing hedge demand.

✅ Binance CEO reassures investors, emphasizing long-term industry growth.

✅ TON launches a $100 million fund, fueling Web3 and dApp development.

✅ Binance Pay partners with xMoney, accelerating crypto payments across Europe.

✅ Hong Kong strengthens regulatory oversight, despite budget deficits.